Cryptonews

Woori Bank’s Crypto Obsession: Bitcoin Prices Now in Trading Room! 🚀

The trading room is a meeting place for market makers, where frontline trading of foreign exchange, bonds, and derivatives takes place. An official of the bank noted that the initiative is in response to the growing prominence of crypto. One wonders if they’ve finally realized that ignoring Bitcoin is as effective as pretending the internet doesn’t exist. 🤯

AlphaTON’s Big $420M Jump: Is this the Bitcoin of the Blockchain? 🤔💰

So, AlphaTON is tiny, like “I just learned to walk” tiny, but guess what? They’re aiming to raise more than $420 million. Yeah, that’s more than most mid-cap tech giants pull in. It’s like the neighbor kid saying he’s going to build Elon Musk’s spaceship. Just because the law says “baby-shelf” is off doesn’t mean the money’s falling from the sky, but they’re hopeful. And if they pull it off, they’re gonna pour that cash into beefing up Telegram’s AI infrastructure and buying more TON tokens. Because who doesn’t want to buy more tokens, right? 🚀

Kraken’s New VIP Crypto Club: For Millionaires Who Think They’re Special 🐙💸

Kraken, in their infinite wisdom, has decided to cater to people who think their crypto portfolio gives them a special parking spot in heaven. The “elite” program launched on December 4, 2025 (because who wasn’t waiting for that?), requires you to either have $10 million just lying around or trade $80 million a year (because who doesn’t have that in their spare change?). Now you can brag about your “dedicated relationship manager,” which is just a fancy term for someone who will probably forget your name by Tuesday. Also, enjoy “global experiences” like Formula 1 events-nothing says “exclusive” like elbowing other rich people in a stadium while yelling at a car race. 🏎️🙄

🚀 XRP’s Doom & Gloom: The Bull’s Secret Sauce? 🤑

History, that wily old fox, whispers: such despair often precedes the dawn. 🦊🌅 Might this be the hour before the storm breaks, the silence before the symphony?

Wall Street Wizards Invest in Digital Chocolate Factory 🍫💸

Digital Asset, the wizard behind the curtain of Canton Network (CC), announced this week that four Wall Street titans have decided blockchain is the new black. Or perhaps the new gold? 🤔

CNBC Teams Up With Prediction Market… But Will They Predict Their Own Success?

Starting in 2026, CNBC will have real-time forecasts on “Squawk Box”-because nothing says “financial expertise” like predicting the future with a ticker that’s probably wrong. 🕒💸

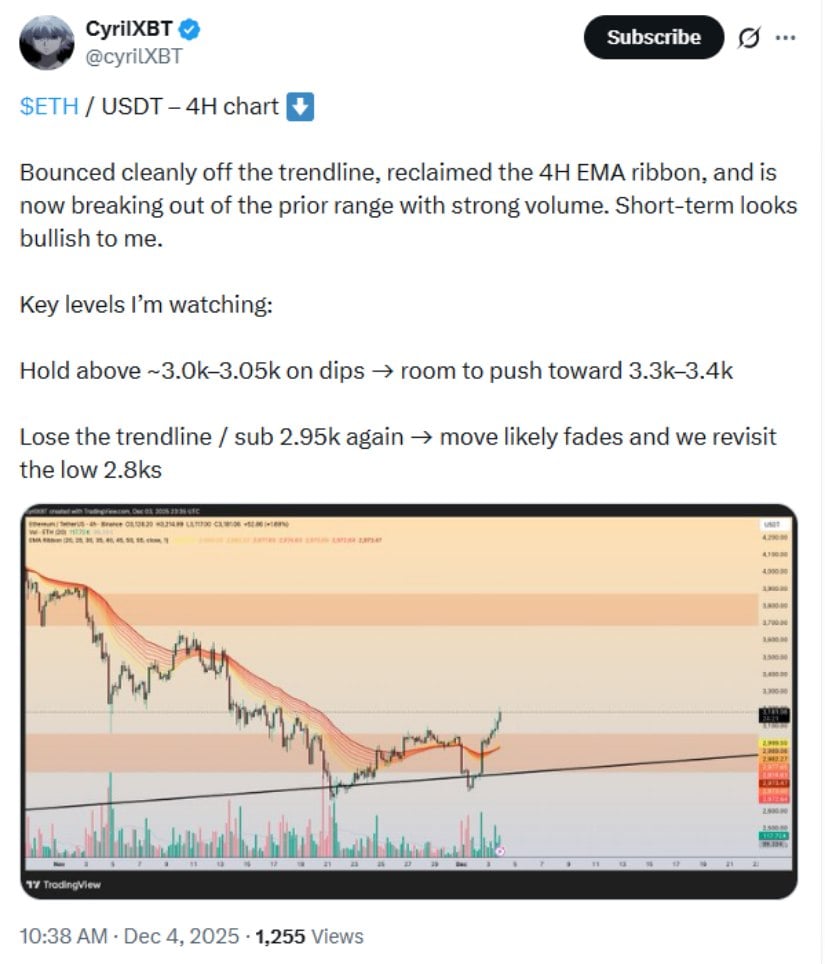

Ethereum Price Prediction: ETH Eyes $3,400-$3,500 as $3,050 Support Holds

Ethereum (ETH/USD) has been gradually decreasing in value, as shown on its daily price chart. The price is now nearing a “supply zone” between $3,500 and $3,700 – an area where there’s typically more selling than buying, potentially leading to a price pause or drop. A key support level – a price point where the value is likely to bounce back – sits between $2,400 and $2,550, a level that previously helped fuel Ethereum’s price increase.

CFTC Unleashes Crypto Chaos (But at Least It’s Regulated! 😅)

Under this new regulatory wonderland, companies with a DCM license or DCO designation can now legally offer spot crypto trading. Because why trust anyone without a fancy acronym, right? 🤷♂️