Oh, look! Bitcoin price has soared by a whopping 12% last week, hitting a glorious $96,500, all while the “short-term whales”—those big crypto sharks who bought within the last six months—are grinning ear to ear. They’re officially in the green! 🤑

According to CryptoQuant’s expert JA Maartunn, these whales have hit their break-even level at $90,890. Translation? They’re raking in profits now, which means they’re less likely to flood the market with sales anytime soon. What a shocker, right? Stability in the crypto world? Who would’ve thought? 😜

The Short-Term Bitcoin Whales Are Back in the Game!

So, what does a “short-term whale” even mean? Well, these are the folks who’ve only been holding Bitcoin for less than six months. And guess what? They’re all swimming in profits now that the price of BTC is cruising ahead of their purchase price. 🍾

History tells us that when these whales start raking in the cash, they tend to ease off the “sell” button. Could this be a sign that the sell-in-May panic is overrated? 🤔

CryptoQuant’s chart (look at the bright orange line!) shows that the short-term whale cost basis is catching up to the white market price curve. Translation? Most short-term holders could cash out with a profit if they decided to sell now. But who knows? They’re probably too busy popping champagne. 🍾

And don’t even get me started on the on-chain data. Funding rates on perpetual swaps are staying deep in negative territory. That means there are a lot of short positions out there that could get squeezed faster than a lemon at a crypto lemonade stand. 🥤

Meanwhile, the long-term holders are still holding steady, and let’s not forget the miners. Oh, and by the way, the network hash rate just hit a record 1.04 ZH/s this month. So, yeah, miners are confident. Confidence is always reassuring, right? 😏

All these stats and numbers point to one thing: whales are making money, and Bitcoin’s rally looks like it might just stick around for the long haul. But don’t get too comfy, my friend, there’s always a twist in this crypto tale. 📉

Is the “Sell in May” Myth Real? Or Just Another Bear Tale?

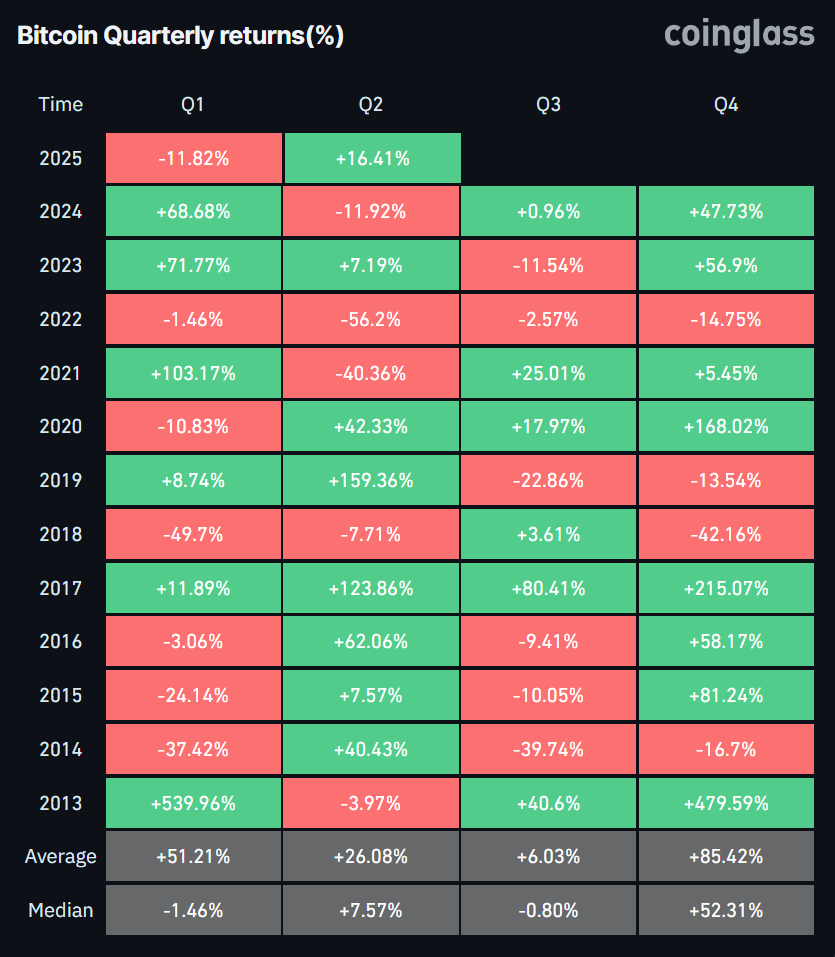

Here comes the fun part: seasonal trends. As summer approaches, Bitcoin’s gains often slow down. Sure, Bitcoin usually gains 26% in Q2, but let’s be real—the median has only been 7.6% since 2013. That’s not exactly setting the world on fire, is it? 🔥

And Q3? Oh boy, it’s usually even worse, with an average of just 6% returns. So, brace yourself for a bumpy ride. The “sell in May” effect is real for equities—just ask the S&P 500, which has only returned a measly 1.8% from May to October since 1950. 📉

But hey, there’s good news: macro factors are giving Bitcoin a nice boost. US inflation is down to 2.4%, and the markets are betting on some Fed rate cuts later this year. Plus, a weaker dollar is making assets like Bitcoin look a lot more appealing. 💸

Institutional investors are clearly still in the game, too. In late April, spot Bitcoin ETFs saw a massive $3 billion in net inflows. So yeah, the big money is watching closely, and they seem pretty confident. 😎

In conclusion, whale profits, strong on-chain signals, and favorable macro trends are keeping Bitcoin’s rally afloat. But remember, seasonal trends and those pesky derivative imbalances could always come back to bite. Traders, it’s time to set those risk limits and keep an eye on funding rates and economic news this summer. Let’s hope the market doesn’t pull another “surprise dip”! 😆

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Bitcoin’s Wild Ride: Is It a Rally or Just a Bunch of Greedy Investors? 🤔💰

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- XRP: The Calm Before the Storm?

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- BitMine’s 4M ETH Hoard: Stock Valuation Shenanigans 💰💸

- Silver Rate Forecast

- Crypto Riches or Fool’s Gold? 🤑

2025-05-02 07:06