Somewhere on the Discworld of economics, Bitcoin—yes, that gleaming, imaginary coin you can’t use to tip the milkman—has hit the sort of numbers that would frighten insurance salesmen and delight any Hedge Wizard with a sufficiently fireproof robe.

Bitcoin Derivatives: Now With More Unreality!

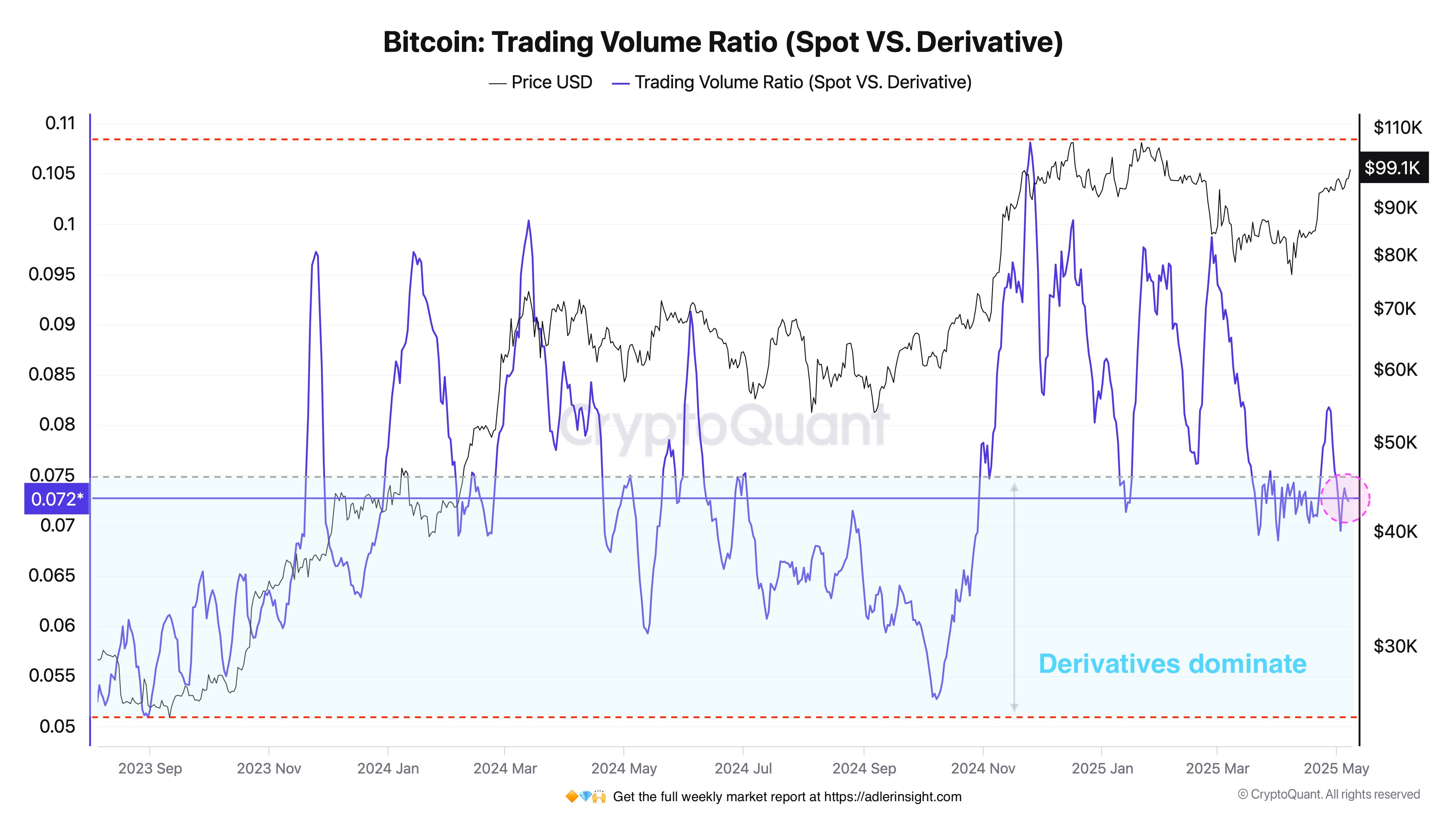

According to the latest missive (presumably delivered by a small, panicked owl) from CryptoQuant, that esteemed coven of market soothsayers, something called the Trading Volume Ratio is currently doing a passable impression of a stunned hedgehog—namely, lying well below 1.0. If this is starting to sound like mathematics, don’t worry. It’s mostly just wizards arguing about whose numbers are more numerically impressive.

The Trading Volume Ratio is, in short, a competition between spot exchanges (the mosh pit of the trading universe where you buy actual stuff) and derivatives (arcane contracts that allow you to bet on whether something will go up, down, or spontaneously combust). When the ratio is above 1, it’s the spot traders in charge; below 1, derivatives traders are running around making prophecies.

As you can see from the above squiggly lines—astonishingly, produced by sober adults—the volume on the derivatives exchanges is positively out-marching spot like an Ankh-Morpork parade of over-caffeinated accountants. Meanwhile, the price is apparently surfing its way past $100,000, which is presumably the upper limit before the gods step in and ask everyone to calm down.

Contrast this with last month, when the spot markets had their brief moment in the sun, and the Trading Volume Ratio soared, presumably flapping its wings and shouting “Look at me!” This, the old sages say, is the sort of rally that lasts longer than a politician’s promise. Because speculation—especially the high-octane kind that occurs on the derivatives markets—tends to pop and fizzle like an amateur wizard’s potion.

So will this rally last? Will it collapse under the weight of its own expectation, like a souffle removed from the oven at the wrong existential moment? Stay tuned. Or, better yet, invest in something less volatile, like Luggage futures or octarine-backed bonds.

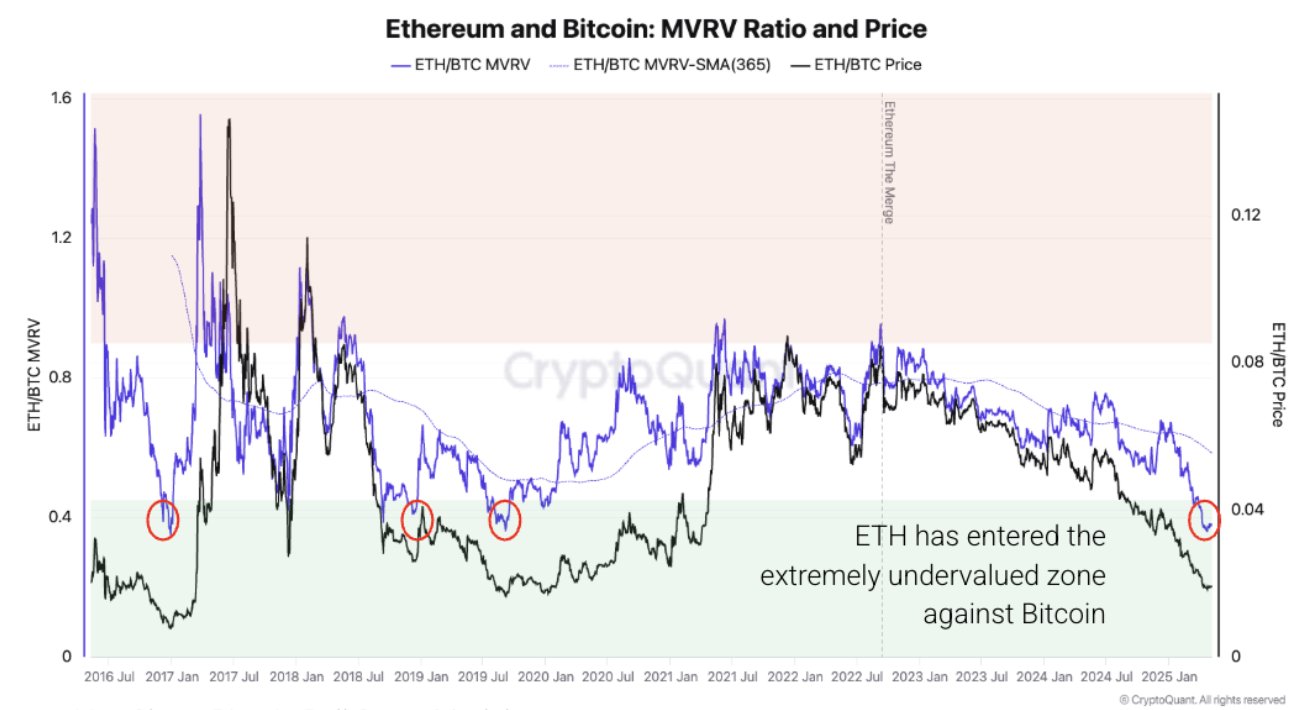

Meanwhile, over in Ethereum’s corner, the poor thing is looking undervalued in comparison, which on Discworld practically guarantees it’s about to be discovered by a herd of speculators or lost under a pile of Unseen University grant applications. Analytics firms are waving their MVRV Ratios around (which, for the uninitiated, is supposed to reveal how many people are crying into their coffee vs. cackling in their sleep).

According to CryptoQuant, Ethereum is ready to outperform if only it can muster enough enthusiasm—or at least shift out of its pyjamas and face the day. Naturally, this is assuming the usual supply pressure and weak demand don’t trip it up on the stairs.

BTC Price: Wizards Rolling Dice

With a surge of nearly 3% in the last twenty-four hours, Bitcoin has teetered over $101,000, sparking joy or existential dread depending on your position and the alignment of your stars. 🔮📈🍿

In conclusion: People are making money, people are losing money, wizards are suspicious, and the only thing that’s certain is that everyone still talks about it anyway. Probably at great length, and with charts.

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- Mysterious Moves: Crypto Titans’ Bold Bet or Folly? 🤔

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- Doge Doomed?! 😱🐳

- Traders Rush Back to XRP: The Silent Storm Brewing in the Crypto World! 😱🚀

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Ethereum’s Fee Fiasco: When Blockchains Play Hard to Get! 🤡

- Brent Oil Forecast

- PLUME: 60% Down?! 😱

2025-05-09 13:44