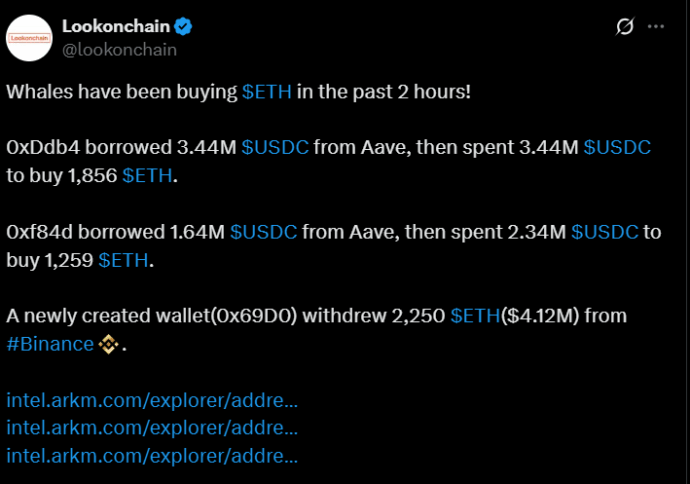

How remarkable — upon the muddy banks of that great digital river, Ethereum, the whales have surfaced again. Yes, those enigmatic behemoths, those bourgeois oligarchs of code and candlestick, have been quietly gorging themselves while the world, distracted, sips its tepid tea. According to the respected chroniclers of our epoch — Lookonchain, mind you, not some retired uncle with opinions — three whales have amassed not dreams, but 5,362 ETH in just hours. Over $7.2 million! One can only wonder if that money will buy joy, or merely smarter refrigerators.

Permit me to introduce the latest participant in this financial spectacle: a nondescript newborn, ‘0x69D0’. This infant wallet, unjaded and hungry, reached into Binance, plucking out 2,250 ETH — a sum so large it would make even a provincial governor blush (or at least switch banks). What wonder, what innocence! What a blockchain-enabled appetite.

Immediately after this dramatic raid on the digital larder, Ethereum’s price, ever sensitive to rumor and grand gestures, leapt over $1,862.16 on that chilly Thursday, May 1. Up over 5% since yesterday’s misfortune at $1,767, the coin strutted across its $224.82 billion market cap like a peacock among sparrows. Volume? A paltry $15.65 billion changed hands, the sort of loose change one finds between the cushions if one’s family is large enough. All this excitement because ETH nuzzled a so-called “strong support” at $1,500, bouncing back with all the resilience of a Russian serf who’s smelled fresh bread.

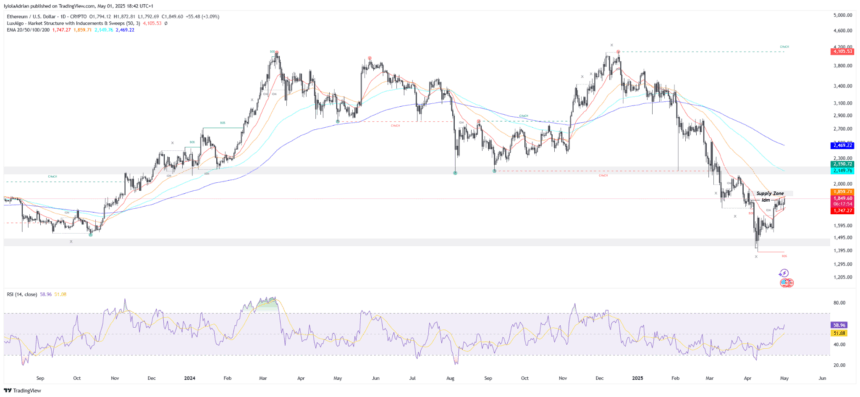

Turning to the charts, on the daily, one can see ETH pirouetting from the $1,500 depths up towards a mysterious “order block” near $1,800, where traders galore sharpen their swords in expectation of spoils. Should the coin maintain its tenuous grip on this ledge, there is talk, almost blasphemous, of a push to $2,200 — the heights where the 100-day moving average dwells, lonely and unbothered like an old landowner reminiscing over his harvests.

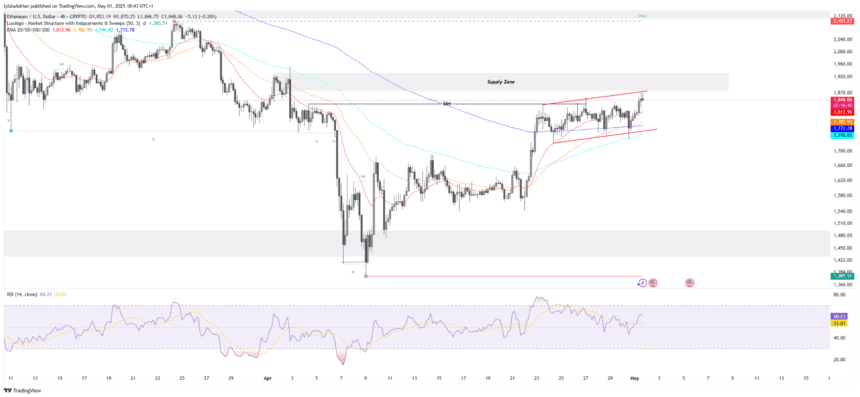

Meanwhile, in the somewhat less poetic realm of the 4-hour chart, Ethereum seems to loiter, forming what the experts call a ‘bearish flag pattern’. Such patterns give analysts the jitters — will there be a drop, or will the market, like Turgenev’s Nikolai Petrovich after a stiff drink, surprise everyone with a sudden burst of energy?

To end, the so-called Relative Strength Index is at 53, which as everyone knows, means absolutely nothing. 😏 Buyers and sellers glare across the void, uncertain whether to attack or retreat. Somewhere in the background, Ethereum futures’ open interest soars to $23 billion — which may fuel a rally into glory, or, with the grace of a drunken bear, end in a heap on the floor. The whole market sits on edge. It is Russia, it is May, and the wolves of speculation prowl the moonlit steppe, wondering who will blink first.

Read More

- ZEREBRO PREDICTION. ZEREBRO cryptocurrency

- INJ PREDICTION. INJ cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

- Cardano Bulls Unleash Secret Weapon to Spark Price Surge!

- DOT PREDICTION. DOT cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SEI PREDICTION. SEI cryptocurrency

- AXS PREDICTION. AXS cryptocurrency

- LAT PREDICTION. LAT cryptocurrency

- Why Consensus 2025 Could Make or Break Pi Network: The Scoop You Can’t Miss!

2025-05-01 21:41