In brief – or rather, as brief as the affairs of men and markets can be:

- The enigmatic SUI flutters near its modest summit of $3.83, having ascended a mere 7%, daring to test the old, creaking resistance of a downtrend channel.

- Its creators, those mysterious alchemists at Mysten Labs, with the stout backing of Google’s titanic grasp, continue their quiet maneuverings, consolidating above foundations that seem sturdy enough to bear the weight of hope.

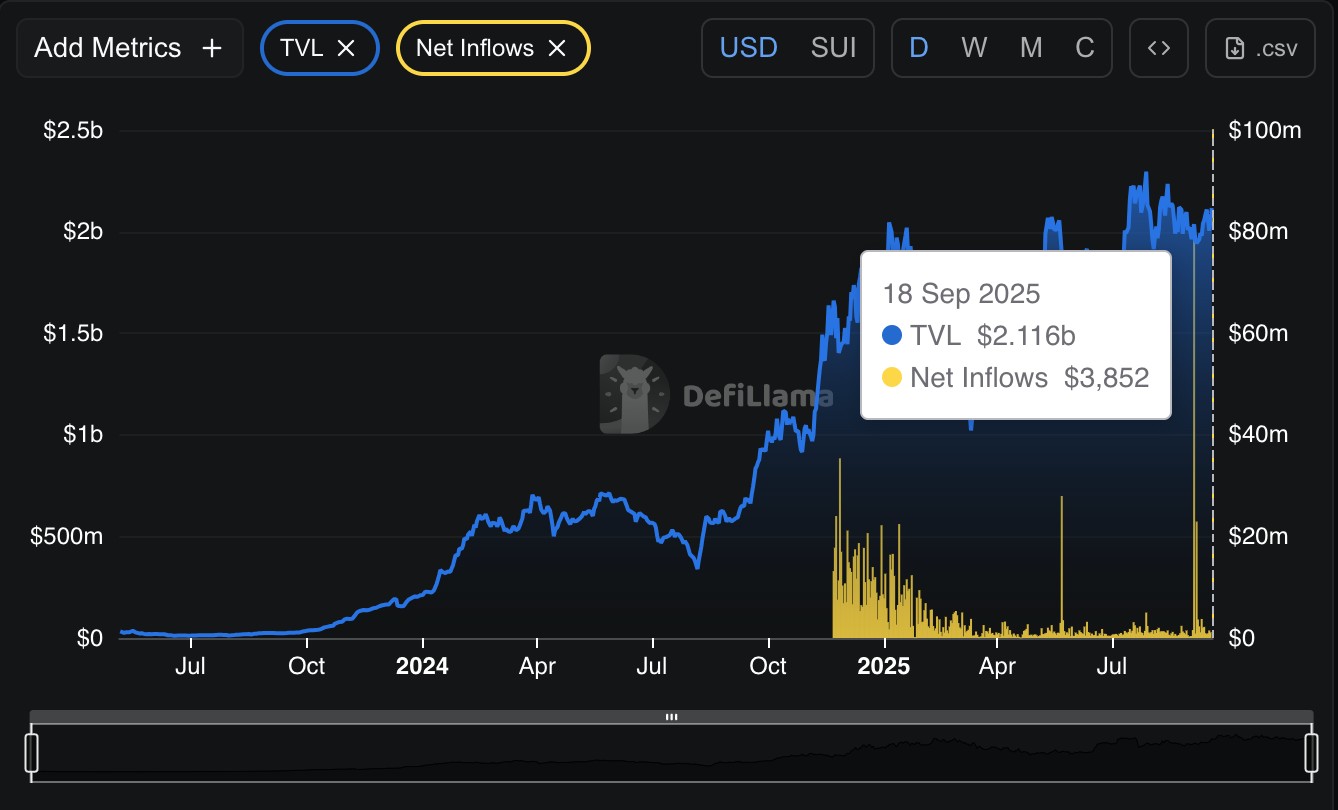

- The total treasure locked within SUI’s vaults remains impressively lofty at over $2.1 billion, attracting hopeful gazes and the cautious optimism of learned analysts, who speak in whispers of bullish tidings.

As the Price Approaches the Weighty Threshold

One might say SUI increased its value by a humble 7% in the span of a single day, reaching $3.83 with a clamorous trading volume exceeding $1.7 billion-enough to make even the most stoic broker raise an eyebrow. Over the past week, it has inched upward by about 5%, like a contemplative horse pulling a cart up a gentle hill.

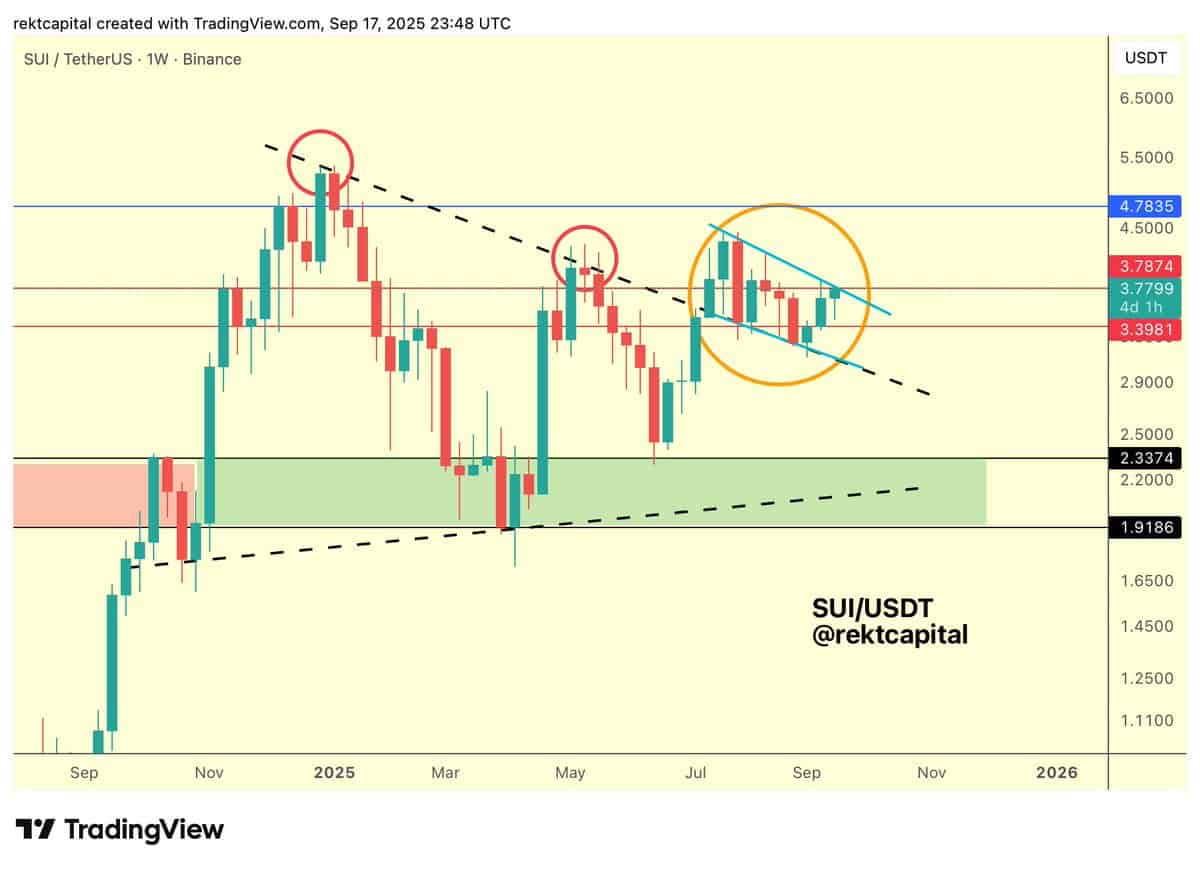

The charts, those cryptic runes of our age, reveal SUI approaching the top of a channel that has confined its errant spirit since the early days of the year.

In the manner of a soothsayer, the analyst known as Rekt Capital proclaims:

“SUI teeters at the edge, poised to break free from this downtrend cage (painted in blue, as if sorrow itself). Should it succeed, it may well revisit the elusive old summit of glory.”

That summit rests near the storied figure of $5.35-an Everest not yet conquered, but whose base camps grow ever more crowded with buyers climbing in hope. The phrase “higher lows” is whispered reverently, as if each small rise were a step toward destiny.

Should this tender hope falter, the price may retreat, like a bashful lover, back to the comforting arms of support near $3.40, or even descend further into the valley between $2.33 and $2.00-an ancient, timeweathered refuge from past storms.

Google’s Hand: Blessing or Mischief?

In this grand drama, Google, that omnipresent titan, has lent its mighty name to the Agents Payments Protocol-erected by the venerable Mysten Labs, the progenitors of SUI.

Analyst Michaël van de Poppe, much like an intrigued observer at a family gathering, notes:

“A colossal partnership, incoming! Google embraces $SUI and its companion $WAL, as if bestowing divine favor upon this humble ecosystem.”

“The stage is set, the players ready, and perhaps the plot will thicken.”

– Michaël van de Poppe (@CryptoMichNL) September 17, 2025

And so it stands, the price consolidating, neither fleeing nor storming forward, but rather gathering strength like a bear waking from hibernation.

The Strength of the Platform Amidst This Courtship

The capital locked within SUI’s domain, referred to in the sacred tongues as TVL, remains steadfast above $2.1 billion-a figure as solid as the Russian winter ice, still holding firm as summer fades into memory.

Daily inflows approach a modest $3,852, a mere drop in the ocean of this sprawling market, yet each drop counts when billions flow. The prognosticator Kaleo assures us:

“It is but a matter of time before SUI shakes off this quiet slumber and charges toward those historic peaks-especially when measured against the venerable BTC.”

One can only watch and wonder, much like witnessing a grand Russian novel unfold, where every character’s fate hangs delicately in the balance-except here, the characters are tokens, and their fate, a dramatic price surge.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- AVAX Soars Again! Is the Crypto World Turning Tides? 🚀

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

2025-09-18 15:30