Oh, joy. The financial world is melting down again – not because of climate change or war or anything reasonable, but because CME, that posh country club for bankers who’ve never touched a crypto wallet, is finally getting with the program. 😅

XRP and SOL Futures? CME Joins the Meme Lords 🙃

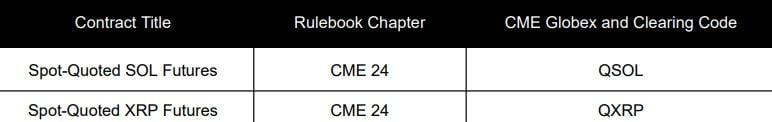

So. CME Group – yes, that CME, the one that treats Bitcoin like it’s their embarrassing cousin who showed up to the gala in Crocs – has dropped a “Special Executive Report” (fancy name for “we saw the money and panicked”). 🔥 They’re launching Spot-Quoted XRP and Spot-Quoted SOL futures. Officially. On December 15. Because nothing says “trust us, we’re regulated” like launching a futures contract two days after Christmas. 🎄⚰️

Let’s unpack this like a very confused toddler with a robotic dog: these futures are cash-settled, meaning no one actually hands over the XRP or SOL like a human would. Nope. We’re all too fancy for that. Instead, there’s a “daily financing adjustment” – which honestly sounds like a euphemism for “we’re making this up as we go.” 🤪 It’s all pegged to CME’s fancy-schmancy CF Reference Rates, because nothing says “trustworthy” like three letters and a hyphen.

Each contract kicks off with one lonely maturity: June 2026. The XRP one is code-named QXRP – which, let’s be honest, sounds like a rejected James Bond gadget (“QXRP, pass me the cloaking XRP, stat!”). The SOL one is QSOL, probably pronounced “cue-soul” by guys who wear socks with sandals and call blockchain “the future.” 🌉 Each trades on CME Globex (the crypto version of a private lounge you need a suit and a spreadsheet to enter) and clears through CME ClearPort (the financial equivalent of whispering secrets into a briefcase).

Oh, and trading ends on the second Friday of the month at 4 p.m. ET. Unless there’s a holiday. Then they’ll do… something else. Flexible! Very institutional! 🎩

And the fees? Cute. Quarterly maintenance: $0.15. Yes. Fifteen. Cents. Probably less than your Spotify ad-free subscription. 🎧 But the transaction fees? $0.10 to $0.20. So, like, a gumball machine, but for high-frequency traders who haven’t smiled since 2008.

Are people excited? Sure. Market strategists (aka people who say “tailwinds” unironically) think this is a “broadening of institutional hedging options.” 🥱 Sceptics, meanwhile, are over here like, “Cool, more volatility, more regulation drama, more paperwork for lawyers who don’t even know what a blockchain is.” But hey – supporters say this means more transparency, better price discovery, and safer playgrounds for pension funds to gamble on altcoins. 🎢

FAQ ⏰ (Because You’re Obviously Confused)

- What are the key features of the new Spot-Quoted XRP and SOL futures?

Cash-settled, baby! With daily financing adjustments (fancy!) and June 2026 expiry. And yes, they trade on CME Globex – so bring your dad’s tie. - How do the contract sizes differ between XRP and SOL?

XRP: 250 tokens. SOL: 5 tokens. Why? Because one’s cheap and one’s not. Also, possibly astrology. The tick values are both $0.10, so at least someone’s trying to be fair. 🎯 - What fees apply to the new altcoin futures?

$0.15 per quarter. Seriously. That’s less than a mint. But transaction fees are $0.10-$0.20, which adds up if you’re typing fast and crying quietly into your Bloomberg terminal. - Why are institutions into regulated XRP and SOL futures?

Because they can now short or long these without touching an exchange. It’s like betting on a horse race without going to the racetrack. Or knowing what a horse is. 🐎💼

So there you have it. CME’s finally jumped on the altcoin bandwagon. Not because they believe. Not because they get it. But because the money’s too loud to ignore. And honestly? Same, CME. Same. 💸

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- USD GEL PREDICTION

- You Won’t Believe What Binance Coin Did Next! 🤯💰

- Doge Doomed?! 😱🐳

- Ethereum’s Fee Fiasco: When Blockchains Play Hard to Get! 🤡

- Crypto Chaos: Hackers Make a Killing While CEOs Insist “Nothing’s Changed” 😒

- Frog Frenzy: You Won’t Believe What PEPE Just Did! 🚀

2025-11-20 04:59