Well, hold onto your wallets, folks! The crypto exchange-traded fund (ETF) panic is spreading like a bad case of the chickenpox at summer camp, with bitcoin, ether, and solana all saying “Hasta la vista, baby!” to their investors’ cash. Meanwhile, XRP is the lone hero in this tragedy, managing to keep its head above water while the rest are taking a deep dive into the pool of despair!

Heavy Redemptions Slam Bitcoin, Ether, Solana; XRP Stands Alone

Midweek trading was about as pleasant as a dentist appointment for crypto ETF investors. The selling pressure was broader than the buffet line at an all-you-can-eat restaurant, dragging total assets lower once again, while only XRP kept waving the flag in this otherwise gloomy session.

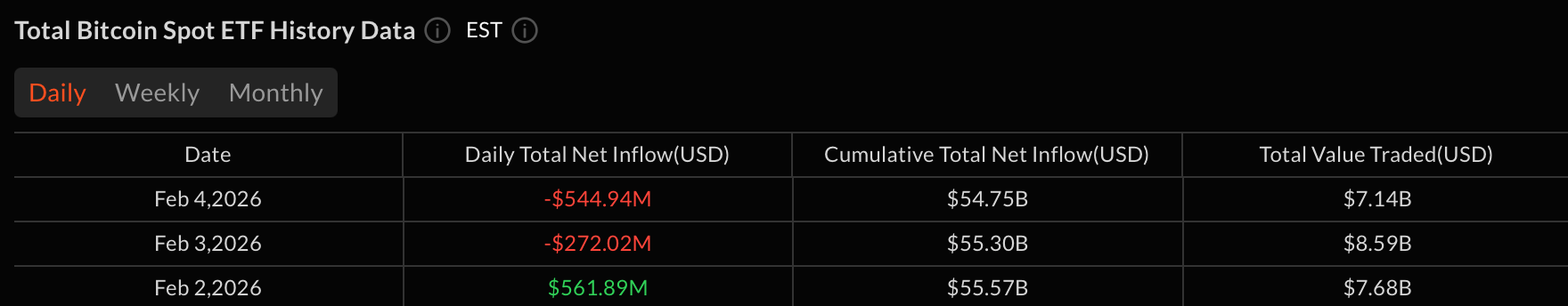

Bitcoin spot ETFs were the biggest drama queens, crying out with a $544.94 million net outflow, spread across six different funds. Blackrock’s IBIT took the biggest hit, losing $373.44 million – I guess it didn’t have a ‘Get Out of Jail Free’ card! Fidelity’s FBTC and Grayscale’s GBTC followed suit, shedding $86.44 million and $41.77 million respectively. Ouch!

And don’t even get me started on the other funds: Ark & 21shares’ ARKB waved goodbye to $31.72 million, Franklin’s EZBC lost $6.38 million, and Vaneck’s HODL said farewell to $5.20 million. With a trading activity of $7.15 billion, it’s like watching a circus where all the clowns are leaving the tent! Total net assets slipped further to $93.51 billion – talk about a party crasher!

Ether spot ETFs weren’t feeling much better, registering a $79.48 million net outflow. Blackrock’s ETHA took most of the blame with $58.95 million fleeing the scene faster than a cat at a dog show. Fidelity’s FETH followed with $20.53 million running for the hills. Trading volumes hit $2.27 billion, but net assets continued to evaporate, closing the day at $12.71 billion. Where’d they go? Off to the Bahamas?

XRP spot ETFs decided to play the role of the underdog, attracting $4.83 million in net inflows. Franklin’s XRPZ led the charge with $2.51 million, followed by Bitwise’s XRP at $1.72 million and 21Shares’ TOXR with $600.36K. Total value traded came in at $42.65 million, while net assets held steady at $1.07 billion – a miracle in a sea of chaos!

Solana spot ETFs couldn’t escape the storm either, recording a $6.71 million net outflow. Grayscale’s GSOL took most of the hits with $5.22 million, while Bitwise’s BSOL saw $1.49 million head for the exit sign. Trading activity was like a rollercoaster ride at $61.67 million, but net assets took a nosedive to $789.47 million, pushing SOL ETFs further from the magical $1 billion mark!

Overall, Wednesday’s session was like a bad horror movie reflected deepening risk aversion across crypto ETFs. Bitcoin and ether continued to bleed cash, solana joined the drama, and XRP stood proudly in the green, showcasing a market that’s as cautious as a cat near a room full of dogs as February unfolds.

FAQ 📉

- Why are Bitcoin ETFs seeing heavy redemptions?

Well, persistent risk-off sentiment and February’s glorious volatility are prompting investors to cut their BTC exposure. Who wouldn’t run when the going gets tough? - How did Ether and Solana ETFs perform this session?

Both ETH and SOL ETFs saw significant outflows, confirming that when it rains, it pours across major crypto assets! - Why did XRP ETFs attract inflows while others fell?

XRP was like that one kid who always gets picked first for dodgeball; investors rotated into it seeking perceived relative strength! - What does this mean for overall crypto market sentiment?

The divergence signals a defensive capital rotation, not a renewed risk appetite-because who wants to jump back into a pool that’s been drained?

Read More

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- 🚨 Senate Drops Crypto Bill: CFTC to the Rescue? 🚨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- Why the Fed’s Decisions Might Make You Rich or Just More Confused! 💰🤔

- 🚀 Memecoins Gone Wild: $DOGE, $PEPE, & $PENGU – Will They Moon or Doom? 🌕

2026-02-05 18:23