Well, I do declare, if Bitcoin ETFs didn’t just haul in a bountiful $675 million this week, and all of it thanks to Blackrock’s IBIT. Yes, sir, every shiny digital dime. Ether ETFs weren’t exactly sleeping on the job either—they rustled up a modest $20 million, riding on ETHA’s coattails.

Blackrock’s IBIT: The Only Gold Rush in Town for Bitcoin ETFs

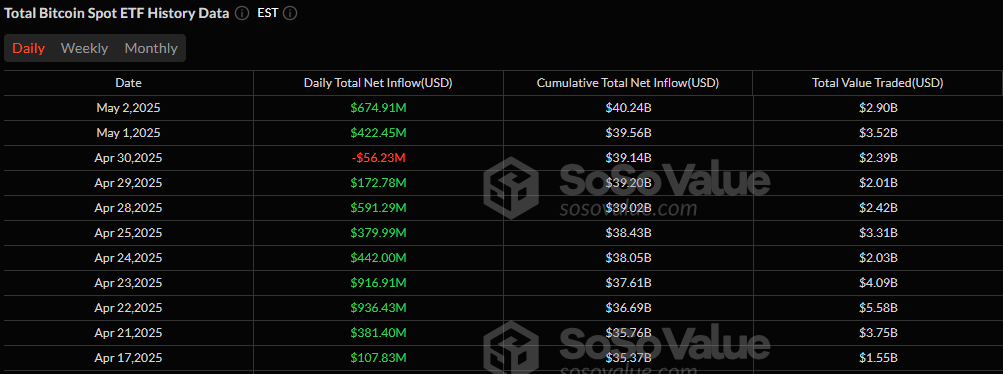

As Friday, May 2, moseyed on by, Blackrock strutted onto the market floor like it owned the place (hint: it practically does). The ishares Bitcoin Trust (IBIT) lassoed an eye-popping $674.91 million all by its lonesome—other bitcoin ETFs couldn’t so much as find a penny under their couch cushions. Yet, that solo act tipped the whole wagon, ringing the day’s total net inflow for bitcoin ETFs at, you guessed it, $674.91 million.

Now, you ever see a sweep that clean? Me neither. Not a drop flowing out, nor a challenger in sight—IBIT’s the only gunslinger in this deserted ETF town. Money changing hands like cards in a riverboat casino: $2.90 billion worth, if anyone’s counting. Net assets swaggered up to a hardy $113.15 billion. I do reckon that’s a heap of zeroes for something you can’t hold in your hand.

Ether ETFs wanted a piece of the pie, but showed up like a catfish at a lobster boil. Blackrock’s ETHA pulled in $20.10 million, bless its heart. Other ether ETFs didn’t bother waving—they just sat there, neither giving nor taking. If silence had a sound, that’s what you’d hear: just the lonely click of ETHA’s abacus.

Total trading volume for ether ETFs was $153 million, net assets crooned up to $6.40 billion, and even the tumbleweeds were impressed.

All told, the Blackrock juggernaut is hogging the limelight like a hog on the slop, leaving the rest of the herd gawking from the fence. This week: IBIT and ETHA wrote the tune, and the rest just whistled along. 🎩🐂💰

Read More

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Dogecoin’s Wild Ride: Will It Bark or Bite? 🐶💰

- Crypto Investors Laughing All the Way to the Bank, But They’re Not Selling Yet!

- Crypto Cowboy Fights Back: CZ Tells WSJ to Take a Hike! 🚀😏

2025-05-05 19:57