If one peers over the gilded monocle of modern finance, one might discern, buried among the cigar smoke and mutual funds, a rather impertinent chart waved by one Rajat Soni, CFA. Whisper it, but should you stand at the tender age of 45 (that sweet spot between youth’s folly and regret’s heyday), you need only clutch a mere 4.28 Bitcoin to stride into 2030 and spend a hundred thousand dollars a year in gloriously idle luxury. At today’s rates, that’s about $400,000—a sum which, in the context of high society, will buy you either a palatial retirement or roughly three chairs at a Sotheby’s auction. All this, of course, presupposes that Bitcoin continues its habit of ascending like a social climber at a Victorian dinner party. 🥂

“This is your doomsday scenario,” quoth Soni (via tweet, that most literary of modern missives), while lamenting that even those blessed with such capital prefer to tie their fortunes to the anxieties of traditional financial advisors, who regard cryptocurrency with the suspicion normally reserved for illicit liaisons at Ascot.

BTC Required: By Age, By Year, By Amount of Champagne Consumed

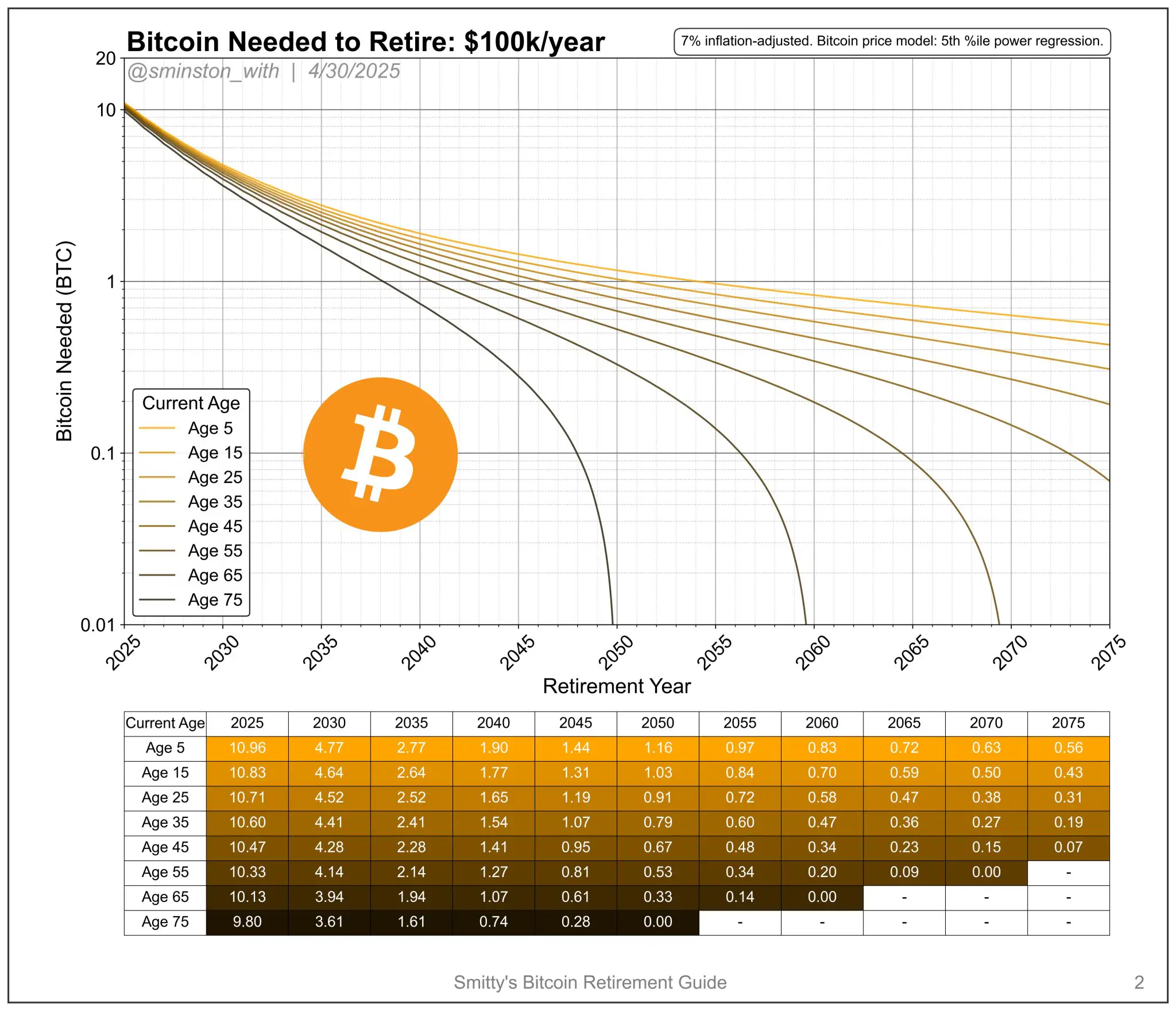

Fortunately, the ever-diligent @sminston_with has rendered the figures into a chart—because if one cannot understand something, one may as well make it into art. Assuming Bitcoin grows at an inflation-adjusted 7% (or the expected increase in the price of fine port), here’s how much you’d need to enjoy $100,000 in expenses per annum:

- 25-year-olds: ~4.52 BTC, because you still dream of yachts 👶

- 45-year-olds: ~4.28 BTC, perfect for midlife crises and silk dressing gowns 🦚

- 65-year-olds: ~3.94 BTC, handy for sherry and crossword puzzles 🧓

- 5-year-olds: ~0.63 BTC—for the visionaries still perfecting finger painting 🎨

Why Bother? Musings on Scarcity, Speculation & Other Delights

While Bitcoin is hailed by some as the tulip of our times, its ever-reducing supply and tenacious price performance nudge it into a more respectable place at the retirement planning table. Early devotion to this digital deity has its perks—a single sliver of a coin now could fund your twilight years (or at least keep you in bespoke loafers).

Yet heed the warning from our dear Soni: shun Bitcoin at your peril, lest you find yourself clutching stock certificates while the great train of fortune whistles past, chauffeurs and all. “They’ll cling to real estate and equities,” Soni sighs, as if referring to last season’s waistcoats, “until the waltz is over.” 💃🚀

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Silver Rate Forecast

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Wall Street Whales Abandon Bitcoin for FARTCOIN—You Won’t Believe Their Reason 🤯💨

- Whale of a Time! BTC Bags Billions!

2025-05-04 16:02