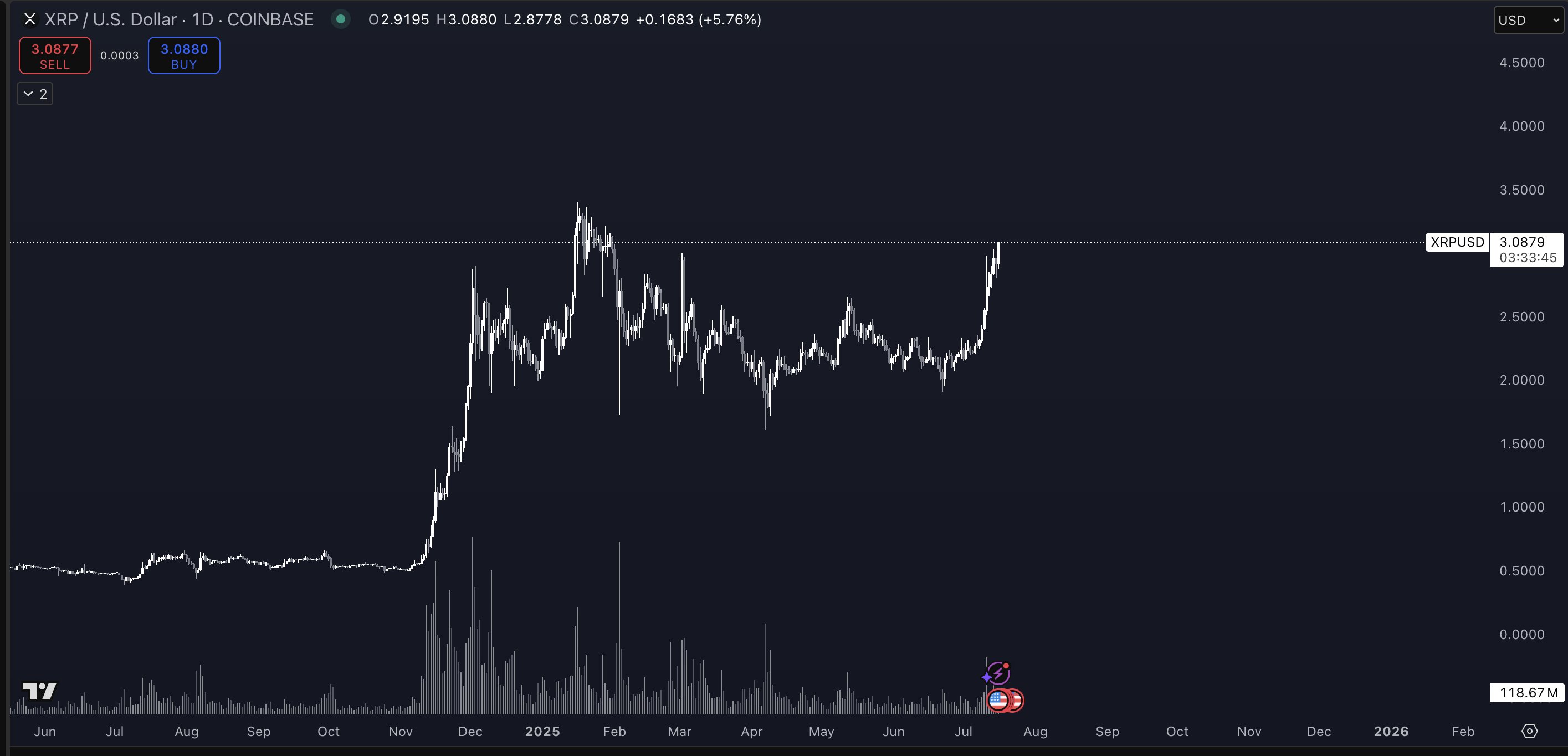

Crypto strategist Pentoshi stirred up the market with a late-Tuesday post, claiming that XRP has been holding up for the past 7 months while most of the market crashed. He added that there is little resistance from here because it never spent time trading in this price range, and the cluster of regulatory and corporate tailwinds is a pretty good setup for some decent tailwinds. XRP has been trading very cleanly so far.

By Wednesday afternoon, XRP was trading at $3.08, up roughly 27% on the week and just below its highest close since the 2021 cycle high. Daily volumes have topped $8.5 billion, and momentum indicators on major venues show relative-strength indexes back in “buy” territory, supporting Pentoshi’s claim that overhead supply is thin.

Upcoming XRP Price Catalysts

The first fundamental catalyst is Washington’s sudden enthusiasm for federal stablecoin rules. The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act sailed through the Senate in June and secured the votes it needs in the House this week after an eleventh-hour whip by President Donald Trump. House Majority Leader Steve Scalise told reporters, “We’re back on track… all three bills will be encompassed in the work we do today,” referring also to the CLARITY and Anti-CBDC acts.

Ripple, which launched its dollar-backed RLUSD last December, is already positioning for that environment. On 2nd July, the company filed for a US national bank charter and a Federal Reserve master account that would let it custody RLUSD reserves directly at the Fed. Two weeks later, it confirmed plans to secure an EU electronic-money-institution licence under MiCA; a company spokesperson said Ripple aims “to become MiCA-compliant” because it sees “significant opportunity in the European market.”

The second driver is the near-resolution of Ripple’s grinding courtroom saga. On 26th June, when US District Judge Analisa Torres rebuffed a joint motion by Ripple and the SEC that would have vacated her permanent injunction and sliced the civil penalty from $125 million to $50 million, ruling the parties had “not come close” to establishing the “exceptional circumstances” required to alter a final judgment.

The next day, CEO Brad Garlinghouse announced on X that Ripple will drop its own cross-appeal and “close this chapter once and for all,” adding that he expects the SEC to withdraw its appeal as well. For now, however, Torres’s injunction and the full $125 million penalty remain in force, leaving any definitive resolution, however, the end has never been closer.

With the litigation roadblock largely cleared, exchange-traded-fund issuers have accelerated filings. ProShares on 15th July rolled out 2× leveraged futures funds tied to Solana and XRP, noting that spot-based products remain in the SEC queue. Only a week earlier, the agency issued new disclosure guidance meant to streamline crypto-ETF approvals. Trump Media & Technology Group has even asked the SEC to sign off on a “blue-chip” basket ETF that would hold bitcoin, ether, solana, and xrp, signalling bipartisan pressure to open the ETF spigot further.

Ripple is also arming itself for a buying spree. “Our M&A people are very busy,” chief technology officer David Schwartz told DL News in late June, revealing “multiple potential acquisitions in various different stages.” The firm has already paid $1.25 billion for prime broker Hidden Road this year and is building an on-ledger lending protocol slated for Q3, moves that could deepen XRP liquidity and justify higher valuations.

Each strand—the GENIUS Act, the bank charter and MiCA licences, the SEC’s retreat, the ETF pipeline, and Ripple’s war-chest for acquisitions—converges on the same conclusion: regulatory opacity is fading just as institutional distribution channels open. Whether that is enough to propel XRP through the previous all-time high at $3.84 from January 2018 remains to be seen, but the technical setup is also looking quite strong, as Pentoshi concludes.

At press time, XRP traded at $3.14.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- Gold Rate Forecast

- Unlocking the Secrets of Token Launches: A Hilarious Journey into Crypto Madness!

- Brent Oil Forecast

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Bitcoin’s Next Move Will SHOCK You! $85K or $83K?

- Gary Gensler Throws Shade at Altcoins but Gives Bitcoin a Wink 🚀💼

- These Two Binance Coins Are Playing Hard to Get — But You’ll Want In!

2025-07-17 13:23