The market’s capricious whims are once again at play, with XRP caught between the twin specters of ETF enthusiasm and speculative frenzy. 🎭 A dance of liquidity and lunacy, where institutional inflows whisper promises of scarcity, while short-term pullbacks scream, “Not so fast, darling!” 🕵️♂️

XRP Shows Recovery Amid ETF Activity

After a volatile November, XRP has stabilized in early December, with liquidity conditions improving and ETF-related activity becoming more visible. The current XRP price has recovered above $2 following a notable drawdown last month, indicating that long-term accumulation may be occurring despite broader market risk-off conditions. 🤯 A miracle? Or just a well-timed rally? Only the market knows-and it’s not talking. 🤐

According to aggregated data from crypto ETF trackers, institutional exposure to XRP has increased since mid-November. Some reports suggest that cumulative net inflows for XRP-linked ETFs may have surpassed $660 million, reflecting growing interest from professional investors. 📈 A sea of money, but will it wash ashore? 🏖️

New investment products from firms such as Grayscale have helped integrate XRP into regulated market structures, signaling cautious optimism among institutional participants following years of legal uncertainty surrounding the asset. 🧠 A phoenix rising from the ashes of litigation? Or just a well-dressed charlatan? 🦅

XRP Recovers After November Sell-Off

During November, XRP experienced a significant sell-off, with estimates suggesting the market lost nearly half of its value at its peak downturn. This movement coincided with tightening liquidity, crypto-specific risk events, and temporary disruptions in derivatives positioning. 🌪️ A perfect storm of chaos and confusion. 🌀

On-chain analytics platforms report that XRP briefly dipped below $2 before rebounding. This recovery accelerated during the last week of November, as longer-term accumulation patterns appeared to support key structural levels. Bitcoin and Ethereum also stabilized during this period following coordinated liquidations linked to Yearn. finance pool incident. 🧮 A tale of two cryptocurrencies, both dancing to the same chaotic tune. 🎭

Technical analysts following XRP note that the rebound above $2 after a steep correction may indicate ongoing strategic accumulation, though this remains speculative and should not be interpreted as confirmed institutional intent. 🤷♂️ A guess, a hope, and a prayer. 🙏

Key Technical Levels Provide Context

XRP remains supported by its 20-month Simple Moving Average (SMA), a long-term average often used to identify macro trend floors. Holding this zone may reduce short-term downside risk. 🛡️ A shield against the sword of despair. ⚔️

Resistance is observed near $2.30, a level that has repeatedly capped advances since September. A higher resistance zone exists around $2.77, historically associated with increased selling pressure. 🚧 “Beware the $2.77 barrier-where dreams go to die.” 🎭

Failure to reclaim the 50-day SMA leaves the market exposed to potential retests of $2.00 or deeper supports near $1.50. Analysts highlight that momentum confirmation is currently absent on higher intraday timeframes, underscoring continued uncertainty. 🌀 “The market is a riddle wrapped in an enigma, and the answer is ‘I don’t know.’” 🤯

ETF Developments and Institutional Signals

ETF expansion has become a significant narrative in XRP’s 2025 outlook. The launch of XRP-linked funds across U.S. exchanges may alter capital access for the asset. 🚀 “A new dawn for XRP, or just another bubble waiting to burst?” 🌅

Bloomberg ETF analyst Eric Balchunas noted that early ETF trading volumes in alternative crypto funds have rivaled some major commodity ETFs at launch, and this trend now appears to extend to spot XRP products. 📈 “The market’s appetite for crypto is insatiable… or at least, that’s what they say.” 🤭

Industry reports indicate that the 21Shares TOXR product-under review by the U.S. Securities and Exchange Commission-has received notable pre-launch interest. Marketing materials suggest the fund intends to custody physical XRP through regulated providers such as Anchorage and BitGo, which could temporarily reduce publicly circulating supply. Some observers estimate that ETF inflows could approach $1 billion in assets under management within the initial 30 days, echoing early Bitcoin ETF growth patterns. 📊 “A gold rush, but with fewer pickaxes and more lawyers.” 🧱

Constructive Outlook-Conditional Scenarios

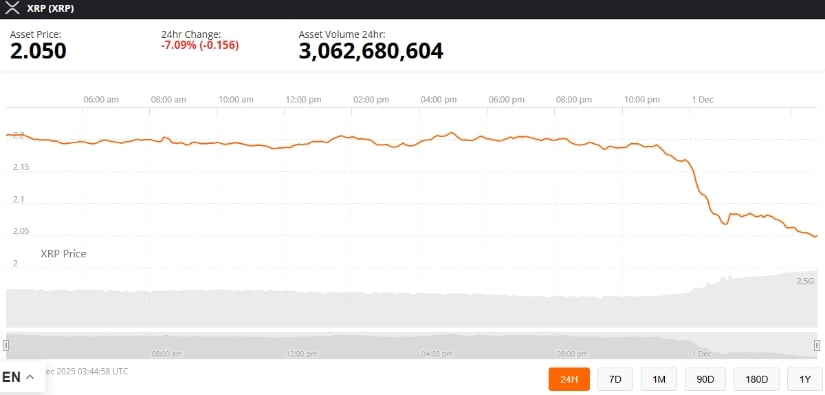

Despite ETF-related activity, near-term volatility remains elevated. On December 1, XRP declined more than 5% to roughly $2.08. A crypto market commentator on X suggested that this drop may reflect short-term positioning ahead of the TOXR ETF launch. Some in the community have speculated that such movements resemble previous patterns before major regulatory or product events; however, correlation does not imply intentional market manipulation. 🤔 “The market’s a magician-always hiding the ball.” 🎩

Analysts suggest that if bulls reclaim $2.30, the next resistance levels could come into view around $2.50-$3.00. Whether buyers can trigger a sustained breakout remains uncertain, and price dynamics are expected to remain influenced by both accumulation trends and external market events. 🧭 “The future is a mystery, but the past is a warning.” 🧭

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Brent Oil Forecast

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

- Silver Rate Forecast

2025-12-01 17:43