Please gather ’round for today’s thoroughly perplexing cosmic drama: Crypto markets, teetering on the brink of comedic disaster, are valiantly flailing against mood swings in global finance. Meanwhile, everyone wonders if the Federal Reserve (Fed), that most enthusiastic of monetary magicians, will wave its wand for Quantitative Easing (QE) once again. 🪄😲

Legend has it that this rumored QE could echo those dashing episodes of 2008 and 2020, when money was printed with the same gusto one might reserve for storing cheese in a fridge about to explode. Naturally, crypto enthusiasts foresee meteoric rises (or possibly a conga line of dancing digits) if our dear Fed chooses to sprinkle its magic liquidity dust again.

Analysts Share Signals Why the FED Could Act

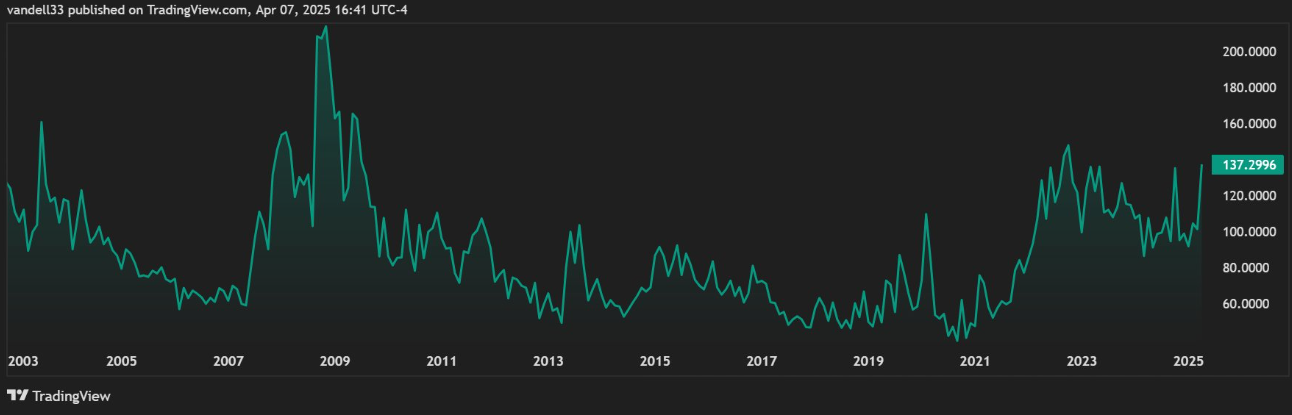

A legion of analysts is frantically scribbling possible reasons on pub napkins, including one particularly enamored with the MOVE Index—Wall Street’s bond-market bogeyman. Currently at 137.30 (which is suspiciously close to 137.31, if you squint), it lurks in the 130–160 range where the Fed typically brandishes its monetary ray guns.

“Right now, it’s at 137.30. If the Fed does nothing, they’ll still cut rates soon—lest the entire financial hamster wheel stops spinning and the so-called Ponzi scheme keels over,” wrote Vandell, co-founder of Black Swan Capitalist, presumably while wearing slippers.

That reading fits elegantly (er—chaotically) with those other ominous financial signals that typically make everyone nervous. It even led the Fed to hold a mysterious closed-door shindig on April 3, quite possibly involving secret incantations, sufficiently brewed coffee, and maybe the occasional interpretive dance number.

This is supposedly no coincidence, with tension building like leftover stinky cheese in the fridge—inevitably someone’s going to open the door. And rumor has it that someone might be President Trump.

“If the Fed starts blowing more currency confetti into the air, everything changes. The risk:reward ratio will be torn to bits, then glued back together for a potential rally,” explained Aaron Dishner. “Mind you, it’s easier to trade a roller-coaster market than enjoy a seatbelt-free ride.”

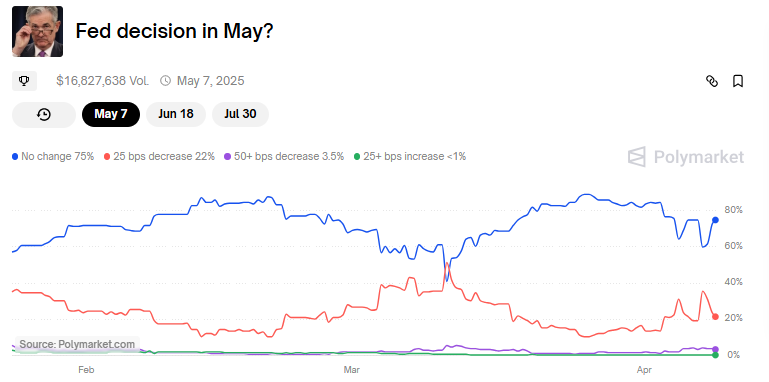

Some interpret these hints as the Fed’s subtle wink and nudge—though official pronouncements won’t be made until May 6–7. Meanwhile, JPMorgan turned up the doomsday dial by forecasting a recession amidst looming Trump tariffs, making the entire fiasco even more comedic if you have the right sense of humor.

This bank, presumably not content with mere spreadsheets, suggests that the Fed may panic-cut rates or plop QE on the table even before the Formal Monetary Cookie-Bake (FOMC) meeting. On that note, crypto investor Eliz, never short on conspiracies, had this to say:

“I suspect Trump is orchestrating these shenanigans to hurry the Fed along so rates drop like lead balloons. Then—cha-ching!—QE incoming.”

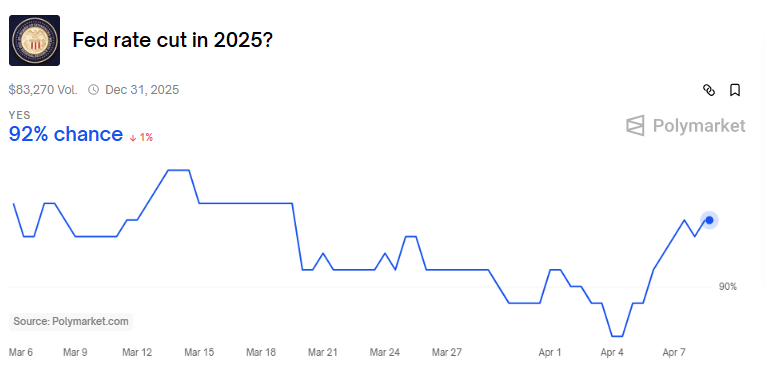

It might not be so outlandish, considering the Fed also has to wrangle with $34 trillion in old-fashioned federal debt, which is as easy to service at high interest rates as carrying a walrus upstairs. Polymarket adds extra spice by claiming there’s a 92% chance the Fed cuts rates in 2025, so the waiting game continues.

Why Crypto Could Benefit From QE

History repeats itself like a dreadful karaoke chorus, so if QE revs up, crypto might break out the champagne. In fact, ex-BitMEX CEO Arthur Hayes reckons that the Fed’s gargantuan injection could reach $3.24 trillion—only slightly less than the coin avalanche unleashed by stimulus in 2020.

“Once upon a time, Bitcoin soared 24x from its COVID-19 bottom. If we see a few more trillion dollars waltzing into the system, it might just rocket toward that $1 million price tag. No big deal, right?” he mused.

Yes, it pairs nicely with his bold stance that Bitcoin could settle at $250,000 by the end of the year, presumably if the Fed whips out those liquidity piñatas early enough.

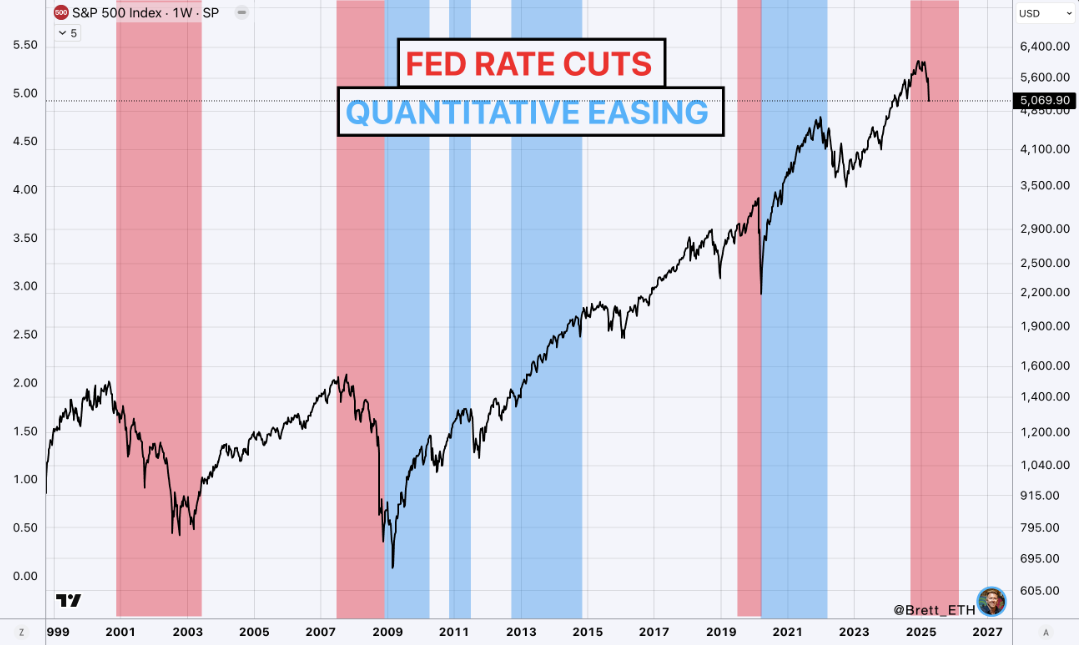

Analyst Brett, however, politely rubs a bit of realism on that wide-eyed optimism. He asserts QE typically ambles in after rate cuts, a bit like the side dish that never arrives until the main course is half-eaten.

“We’re more likely to see rate cuts continuing through mid-2026. Powell, in his infinite monotone wisdom, has said QE doesn’t pop up until rate cuts are done,” Brett intoned.

Armed with that prophecy, Brett plans to buy selectively—though he remains unconvinced that the market will spontaneously leap to the stars unless something grand changes. And that “something” might indeed be tariffs reversing, the Fed preemptively banishing recession, or the entire galaxy deciding it’s had enough of a dull economy.

Altseason on the Horizon?

In this wild scenario, a certain Our Crypto Talk predicts a merry altcoin season if QE appears in May (which might be the most comedic move since goldfish took up line dancing). The pattern from 2020 remains fresh in everyone’s mind, when altcoins (and lots of them) soared by 100X, presumably to the consternation of rational mathematicians everywhere.

As speculators await the next possible wave of liquidity, folks are passing the time placing bets that the Fed will do nothing. Or maybe something. In either case, altcoins might bounce around like caffeinated bunnies once the printing press roars to life. Joy! 😆

Meanwhile, some traders brace themselves for more wiggly price action in the short term, while others are secretly hoarding rocket emojis for the next mega bull run.

“If QE cranks up in May, consider the current sideways slog to be the comedic warm-up act before the big cosmic pump,” typed MrBrondorDeFi with a flourish.

But even if the money printer remains shy in May, there’s growing certainty that it’ll make a cameo this year—good news for those who enjoy breathless cycles of joyous mania. Our Crypto Talk echoed the sentiment that May might be a red herring, but 2025 might still see a lot of zeroes on the digital price boards. 🤭

“If not May, then sometime soon. The Fed can’t resist a cameo performance forever, and that’s a cue for crypto euphoria,” Our Crypto Talk teased.

So keep your wits about you and your emoticons at the ready. If the Fed unshackles a fresh tidal wave of liquidity, we might witness a new cosmic event: Bitcoin and friends skyrocketing beyond the heights of the 2020–2021 bull run. Stay weird and carry a towel—it’s bound to be an intergalactic ride. 🤖🤯

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Square Bets on Bitcoin: A Tiny Shop’s Grand Wallet Scheme

- Scandal and Speculation! Trump’s Blue Chip Folly Sends Cronos Tumbling and Tumultuous

- XRP PREDICTION. XRP cryptocurrency

- 🚀 Barry Silbert’s Crypto-AI Love Child: Yuma is Here! 🌪️

- U.S. Justice Dept.’s Cryptocurrency Heist: $12 Billion in Bitcoin Gone Wild 🕵️♂️💸

- US and UK Team Up to Blow Up Southeast Asian Crypto Scams: The Crypto Crime Comedy

- Zeta Network Bets $231M on Bitcoin: Will It Moon or Doom? 🚀💰

2025-04-08 13:29