Imagine, if you will, a spirited crowd gathered at a rustic Russian market, whispering tales of a certain coin called BNB, whose fate teeters just shy of a lofty $600 summit. The mood, once gloomy as a Siberian winter, now warms with a peculiar cheer: buyers, like cunning foxes, seem prepared to outwit hesitation and vault that stubborn fence. The great holders—those oligarchs of crypto—quietly amass their treasures during this brief downturn, fueling the silent pulse of on-chain omens that hold the promise of a stirring revival.

The Curious Case of BNB’s Open Interest Rising While the Funding Rate Takes a Nap

While other altcoins have fallen from grace as dramatically as a balalaika string snapping mid-song—some by as much as 98%—our dear BNB stands resilient, showing the stoicism of a Russian winter fir tree. This steadfastness has made it the darling of accumulators, even as the market weeps. According to the chronicles of Coinglass, a total liquidation of $97,300 has taken place: buyers claimed a modest $37,000 slice, while sellers fiddled away with about $60,000.

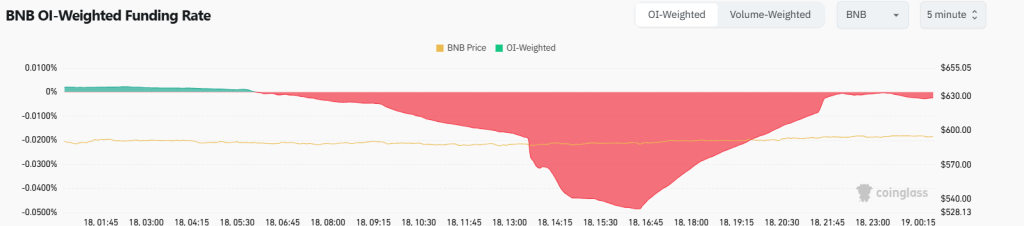

Despite the tempest tossing the market’s main deck, BNB’s open interest swells with gusto—up 3.3%, now cresting over $760 million. This bullish surge might well be the sturdy ice bridge over a thawing river, preventing a sudden plunge into despair. Yet, as with any good Russian novel, there is a shadow: funding rates turned negative at -0.485%, reminding even the most optimistic that caution must dance alongside hope.

The saga continues with the recent quarterly token burn, a fiery ritual performed on April 16, when precisely 1.57 million BNB tokens were sent to their digital purgatory, a sacrifice valued over $1 billion. This act of deletion, measured by price and block production, is designed to tighten supply as one might knuckle the ice off a thickened river, revealing clearer passage beneath.

Indeed, these burns form the plot’s backbone, steadily ushering the supply from a generous 140 million tokens down to a stricter count of 100 million. Like a simmering stew, this patience may well breed richer rewards.

And what of the brave traders? Their long-to-short ratio now proudly struts at 2.1133—meaning some 68% wager the price will ascend. In other words, most are betting on a dance higher, and such majority confidence may well be the gust of wind needed to finally topple the $600 barrier.

The Drama Unfolds: To Break or Not to Break $600?

Here stands BNB at the $610 gates, presently lingering near $595 with a modest 0.66% swagger over the last day. Sellers, ever vigilant, toil to keep the price hemmed under $600, maintaining an obstinate downtrend like a jealous village elder.

Yet, even as the bears snarl, large holders accumulate—the HODLers with all the cunning of a fox stealing geese. This steady collection undergirds a tentative recovery; the Relative Strength Index (RSI) perches around 60, a hopeful beacon suggesting buyers have not yet lost their grip on momentum.

If this buying fervor keeps its fire, we might witness BNB’s triumphant breach of the $610 threshold, potentially eyeing the more ambitious heights of $644. But beware—should sellers muster strength and knock BNB below the 20-day EMA support, a slide to the critical $557 awaits, like an icy plunge into the cold Volga.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- XRP: The Calm Before the Storm?

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- Silver Rate Forecast

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Bitcoin’s Dramatic Dive: A Comedy of Errors and Accumulation! 💸😂

2025-04-18 22:52