Once upon a time, in a not-so-distant financial realm, Bitcoin gallantly attempted to penetrate the mythical barrier of $115,000, only to be repelled by the sinister forces of market volatility as they ominously pave the path for the much-whispered-about “Uptober,” that enchanted month where crypto prices have historically sprung to enchantment.

Not so long ago, Bitcoin saw itself tumbling from the grand heights of $124,457 to a piteous $108,000, succumbing to a 13% tumble, much to the shock and sober disbelief of those monitoring CoinMarketCap. The rumblings speak of a decline peak, yet Bitcoin, ever the tenacious twilight soldier, has managed to claw its way up to $113,940, whilst trading volume buzzes through the air at a lively $61 billion.

The grand ensemble of the global crypto market played its part by rising a modest 1.9% to $3.91 trillion, and flung its total market volume into the stratosphere by 41.88% to $177.4 billion. Behold, the numbers dance!

Boon or Bane: The Technomancy of Bitcoin

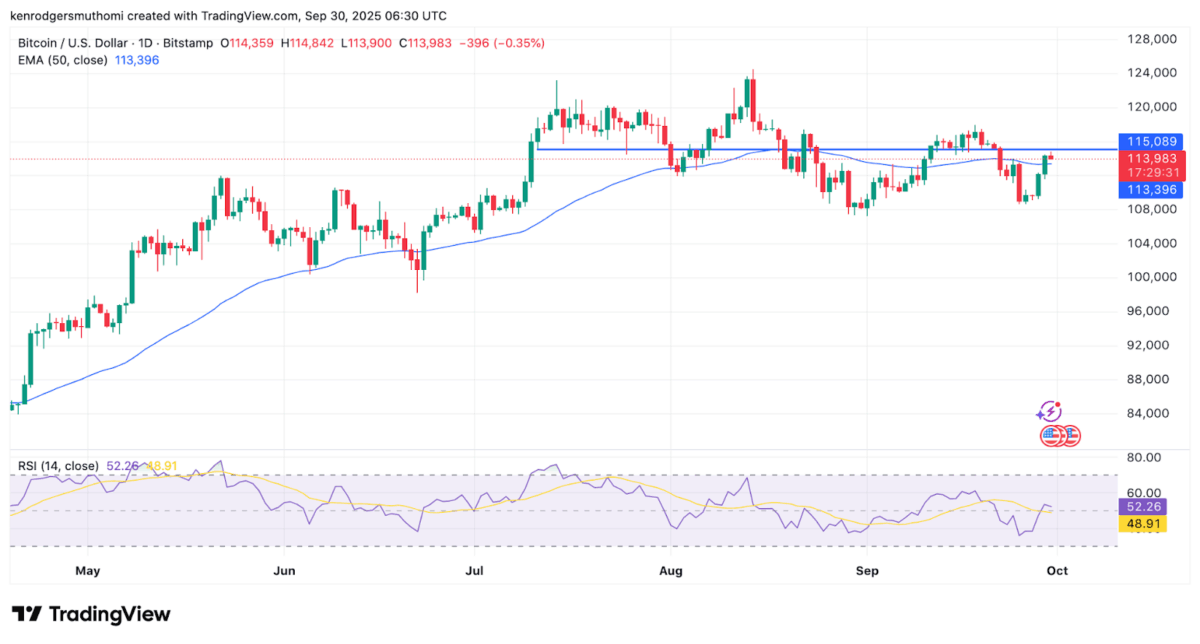

With a flair of alchemical retrofitting, Bitcoin trades ever-so-daintily above its 50-day Exponential Moving Average (EMA) of $113,396, as viewed from the technomantic oracles of TradingView. This suggests the whims of a looming short-term bullish surge-or another grand illusion, depending on one’s faith.

The Relative Strength Index (RSI) tantalizingly hovers at 52.26, hinting at a story of enthralling neutrality.

Crypt0pus, a modern-day soothsayer, declared past week on X, “Bitcoin emerges from its slumber around the horizontal demand zone, enmeshed within the great Charybdis of the descending triangle, hinting at an undercurrent of buying charm.” And yet, he cautions, “The mighty Ichimoku Cloud stands daunting as a gyre of spiritual miscellanea-a decisive breakout, however, portends a surge of bullish fervor.”

On-line Oracles Whisper of Opportunity

The most sagacious of analysts, Rekt Fencer, noticed Bitcoin’s Short-Term Holder MVRV sink to the dungeons of oversold negativity-a harbinger of market disruptions, according to historical scrolls. Plunges at $24K, $49K, $74K, and $109K have each been followed by glorious ascents, much to the potential delight of crypto enthusiasts.

As October’s threshold looms, such readings converge to predict another updraft for Bitcoin. – Rekt Fencer (@rektfencer) September 30, 2025

Dan Tapiero, wise and wary, however, murmurs, “Woke up on the right side of your crypto pillow? A bull market in Bitcoin has not yet risen from its apricot dawn.” He places his bets on macro tailwinds-jailed dollar strength and burgeoning ETF winds-to one day herald the true bull season.

At present, Bitcoin wrestles with the daunting resistance at $115,000, cradled amidst a myriad of signs that taunt with both opportunity and mystification as Uptober beckons. Will this grand tale be one of triumph or sorcery misplaced?

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Polygon’s Rise: A Most Curious Affair! 🧐

- Bitcoin’s Droll Dance: Profits Plummet While Prices Prance! 💃🕺

- Corporate Giants Dive into Bitcoin with $458 Million Bet: Is This the End of Fiat?

- Bitcoin to Moon? Tom Lee’s Wild Predictions and a Universe of Imbalance 🚀

- Ethereum Whales Are Hoarding Like It’s the Apocalypse 🤑

2025-09-30 11:02