Well, folks, it seems the world’s most famous digital gold has turned into a bit of a jester lately. The data shows that those wise guys betting against Bitcoin—or short sellers—are getting their hats handed to them in a heap more often than the long-eyed bulls. Now, whether this means a rally is just around the corner or we’re riding straight into a top as hot as a June barnyard is a question only fortune-tellers and card readers can answer. 🤔💸

Bitcoin Liquidation Oscillator Is In Negative Territory Right Now

Over on X (that’s Twitter for landlubbers), a fellow by the name of Axel Adler Jr has laid out the state of our coin in a neat little report. Turns out, the “liquidation” — which is fancy talk for when folks get scared stiff and close up shop—has been happening more to the short side than the long lately. Imagine that, the bets against Bitcoin are getting knocked out like gnat swatting on a summer’s day.

Sometimes, these liquidations come after the price dips for the bullish chickens (the folks betting it will go up), while they surge when the bears (those betting against it) get caught with their fingers in the cookie jar. The more leverage folks use, the more likely they are to be sent packing—kind of like trying to hold onto a greased pig.

The oscillator (that’s a fancy gadget that measures short and long liquidation tussles) swings around the 0% mark, like a weather vane in a tornado. See this here chart—this chart tells us whether the shorts or longs are throwing the most tantrums lately:

As you might notice, the 30-day average of this oscillator lately has slid into negative territory, meaning the short-sellers are getting a good old-fashioned spanking. And what do you know, just as Bitcoin hit a new record or so at an all-time high, these very same short busters were getting liquidated left and right—it’s like removing soldiers from the battleground makes the victory sweeter.

In fact, when short liquidations run wild, it sure does give a boost to the price of Bitcoin. But, my dear reader, if this dominance becomes too extreme, it might just be a sign the ship’s about to run aground, overcooked and overheated — everyone wanted to jump in, but forgot the boat needs a bit of a cool breeze to stay afloat.

Right now, the indicator’s sitting at about -11.5%, which ain’t quite as savage as the -16.5% it hit late last year when Bitcoin was launching its rocket. In April it dipped to -19% and in January a hefty -24%. That’s enough to make even the most hardened traders sweat through their suspenders.

As the wise analyst adds, “Despite the recent pullback, the bull still has his horns—no sign yet of overheating that could send the whole thing crashing like a china shop on a Tuesday.”

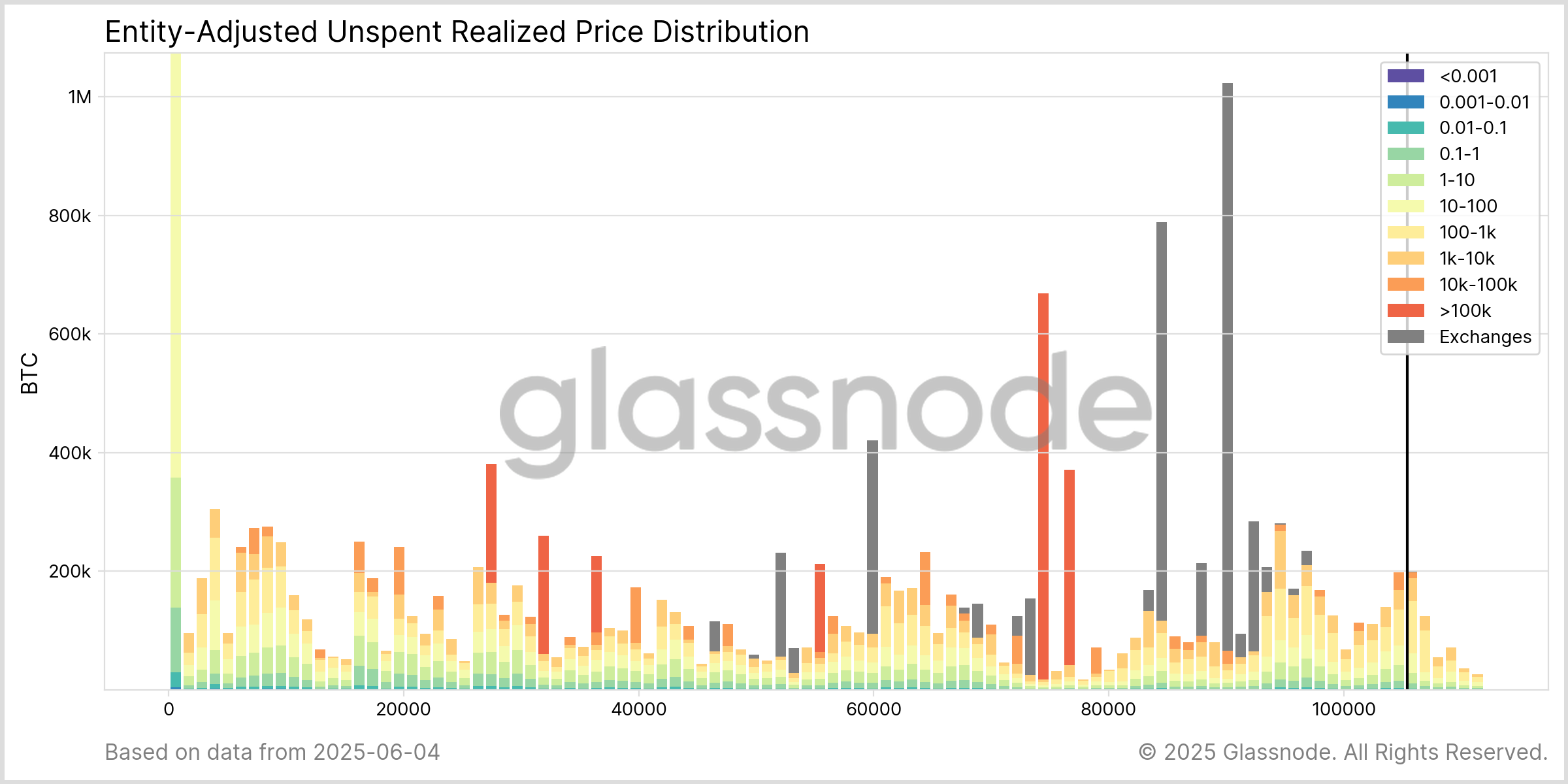

Meanwhile, some sharp-eyed folks at Glassnode report that Bitcoin’s big sharks—those with a hundred thousand or more coins—are playing a bigger role lately. They’ve got a fancy chart showing where these whales last bought, and it looks like a map of high seas treasure—above $90,000, these big fish are busy, while their smaller friends are scatterin’ about at different levels.

Based on Glassnode’s words, the whales huddle mostly around the $74k–$76k mark, with others hanging out at $78k–$79k and near the current levels—making it clear they aren’t in any big rush to part with their loot.

Bitcoin Price

As for the current price of this digital gold, it’s been sittin’ around the $104,800 mark like a lazy cow in a field—nothing too exciting, but it sure ain’t falling off the wagon either.

So there you have it, folks. The Bitcoin rodeo continues, with short sellers getting kicked in the shins and whales lurking beneath the surface, all while the price drifts along like a lazy river—waiting for the next big splash, or maybe a big blunder. Hold onto your hats, because the show’s far from over! 🤠🚀

Read More

- Silver Rate Forecast

- SPEC PREDICTION. SPEC cryptocurrency

- ETHFI PREDICTION. ETHFI cryptocurrency

- USD PHP PREDICTION

- INR RUB PREDICTION

- OM PREDICTION. OM cryptocurrency

- RUNE PREDICTION. RUNE cryptocurrency

- ADA GBP PREDICTION. ADA cryptocurrency

- GBP CNY PREDICTION

- MNDE PREDICTION. MNDE cryptocurrency

2025-06-05 11:13