One morning, after a five-minute stretch that felt like a snooze in a drowsy backwater town, who would have guessed that Bitcoin’s spot inflows had ballooned by a merry 1,671%! The whole affair was so dramatic, even the crickets stopped chirping in disbelief. While CoinGlass might get the numbers right or goblin them up, it’s the signals sneaking out like midnight mischief that captivate the whispers of the market.

Why the Giant Bitcoin Is Stomping Around

Spot flows, dear reader, are not those show-off leveraged bets you might see at the market gates. No, these are the profitable sleazebags – actual sly purchases and sales of the underlying good, Bitcoin. When spot inflow spikes outrun the drummer boy at the parade, you can bet your last chocolate bar that sizeable transactions are thundering into spot venues, weaving an aggressively widespread market move. Contrary to those flaky futures-driven squirrels jumping around causing venues to close, this is a whole other fanciful tale.

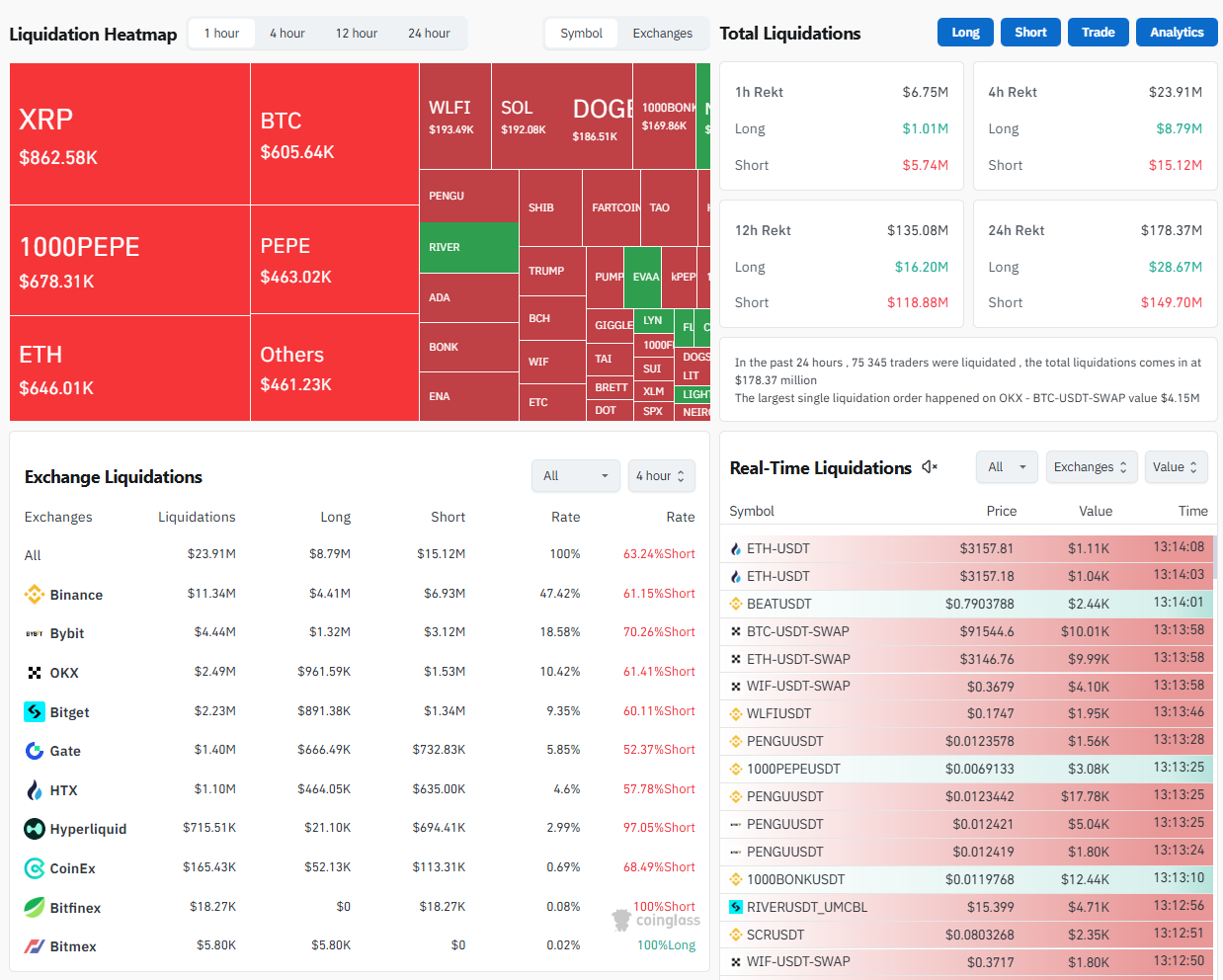

After being harshly chided like a naughty child for peaking too broadly, following a dive from the six-figure heights to the somewhat gnarled $90,000 territory, Bitcoin found itself getting hauled upright. The liquidation data painted a picture of longs scampering away, while the open interest reduced to mere flickering candles. Ah, the rewarding simplicity of a market reset! In the grand scheme of market health, it’s far more admirable when the spot demand sidles up after all the leverage has had its last tantrum than when prices are galloped during those unruly, euphoric hours.

Playing Catch-Up with the Sneaky Market

Meanwhile, like the aftermath of a skirmish in a pixie gang, futures flows sprawl out haphazardly to a more negative count. Their divergence is the gold-star project one hopes will happen. While those crafty derivatives traders shy away like pop-eyed toads under a rainy sky, hedge spot buyers saunter about filling the void. Historically, such patterns don’t rush to the skies in an explosive vertical stunt but rather favor a grumbling, grinding climb. Fear of missing out doesn’t hold a candle to the pressure of accumulation. Technically speaking, after resting on its laurels, the price is hungrily attempting to rebuff its shy, sidelined short- and mid-term moving averages.

The momentum indicators are rising from their no-muss-no-fuss neutral territory, an impressive show rather than a kitchen fire! This suggests that should spot demand remain unrelenting, continuation of the march is a gleeful possibility. Between the teeth-gritting mid-$90,000 realms and the lofty, untouchable $100,000 kingdom, resistance lies as firmly as a stubborn candy bar sticking to a rug. And plenty of wicked supply is dangling there from previous misadventures! Could $100,000 merely be lurking just over the next hill?

It’s a notion worth spreading like a mischievous rumor, but certainly not a certainty. A neat spot-flow surge can hardly trample over those macroscopic barriers by itself. Repeated waves of spot inflows, trickling exchange balances, and a leash on those frenetic futures cannot be overstated! Bitcoin could frolic higher and make those short players scurry, shoving them into the light if spot manages to drink deeply of its supply while leverage takes a decorous raincheck.

Should that spike be a fleeting transfer or just a lesson in short-term mischief? Certainty is not friend, dear readers – wield this as a curious whisper of confirmation. Resumes shuffling interlaced with mindless arbitrage may result in a price halt, meandering towards old, familiar terrains. Thus, one should dance to the tune of confirmation and not merely to an on-off | finger-snapping signal! 🕺🎶

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- XRP: The Calm Before the Storm?

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Brent Oil Forecast

- Ethereum’s ETH: The New Global GDP? 🌍💰

- Is XRP on the Verge of a Market Shake-Up? Find Out Before the Rest! 🚀🔮

2026-01-04 18:52