Will Bitcoin Keep Growing or Is It Just a Cosmic Joke? 🚀🤣

In the minds of many folks chasing shiny digital coins, Bitcoin (BTC) is like that crazy uncle’s tall tale—promising riches that shoot to the heavens and make you believe you’ve got a ticket to the moon. It’s a kind of modern miracle, a magic bean in the world of finance, growing faster than a weed on a summer day.

Analyst Willy Woo says the good times might be fading. Or maybe he’s just forgotten what hope looks like. But don’t worry—others aren’t so quick to pack up their bags.

Willy Woo Predicts Bitcoin’s Growth Will Decline To Something We Can All Yawn At

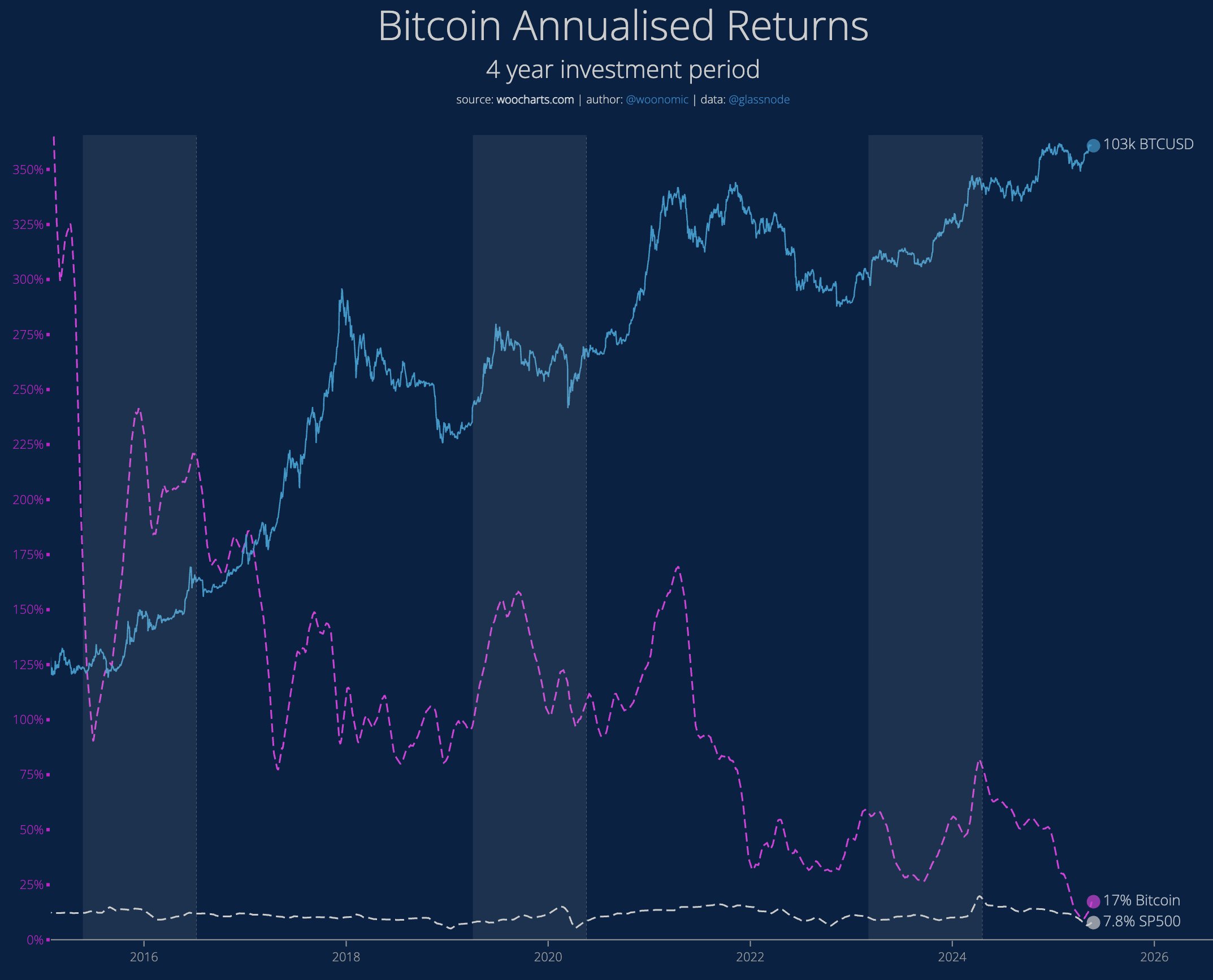

Woo flapped his gums about a chart showing that Bitcoin’s annual return—think of it as how fast your money is growing—has plummeted from the 100%+ days of 2017 to a more modest 30–40% after 2020. Yep, major banks, governments, and the local pizza shop started hoarding BTC then, probably dreaming of a gold rush.

“People think BTC is like a unicorn that prances to infinity on moonbeams. Here’s the actual CAGR chart. We’re long past the days of triple-digit returns,” Willy Woo said. Because nothing screams stability like that rollercoaster.

He reckons that in the next twenty years, Bitcoin will settle into a slow, predictable pace—around 8% growth—a rate that’s about as exciting as watching paint dry, but hey, it beats most stocks, right? It lines up with the slow crawl of money printing and economic growth—boring but steady as she goes.

But Fred Krueger (no, not the nightmare guy, just a fellow with some hope) disagrees. He points out Bitcoin has already rocketed 7 times from its low in December 2022, now trading near $103,000 as of May 2025. Well, that’s enough to make even a skeptic smirk.

And then there’s Arthur Hayes, who predicts Bitcoin hitting a million dollars before Trump’s current term ends. Yep, a million—and he expects a quarter-million by then. Just four more years of sitting back and waiting for that jackpot. Easy peasy, right?

Giant GIs of the Economy and Liquidity—Bitcoin’s New Best Friends

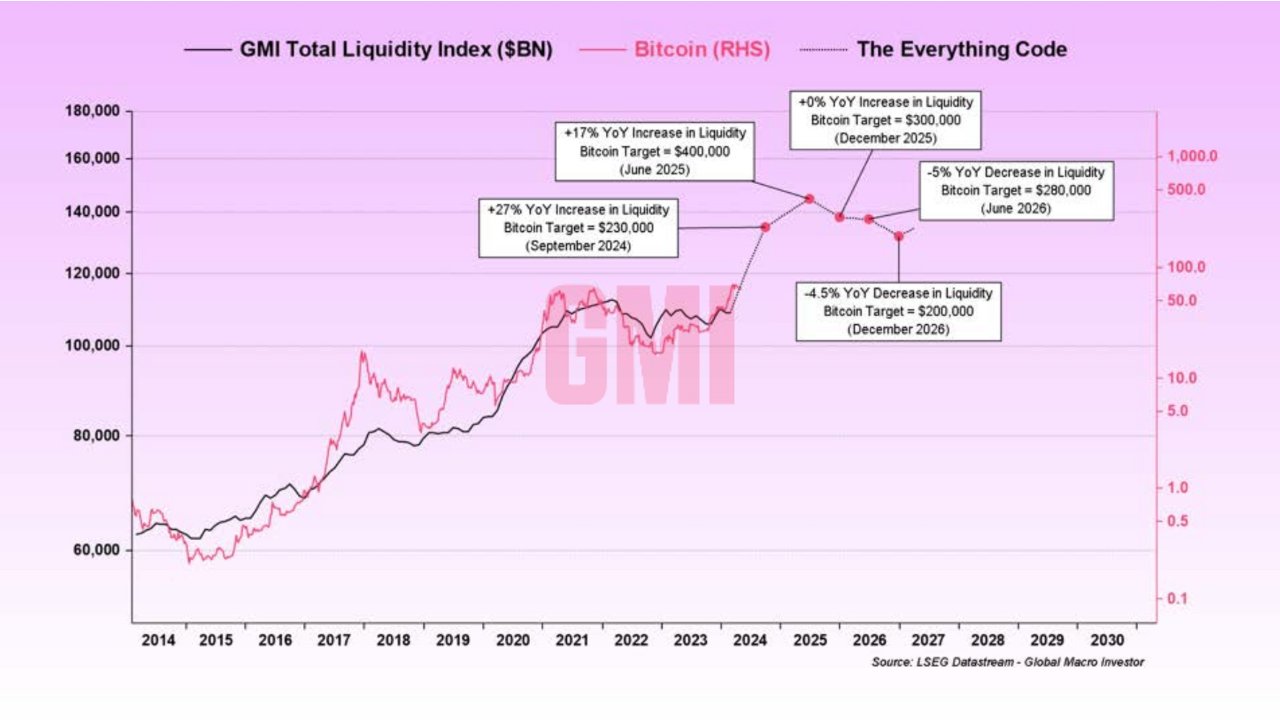

Woo’s crystal ball sees GDP and money printing as the driving force behind Bitcoin’s future. Meanwhile, Paul Guerra from RealVision makes it sound even more dramatic—liquidity is the puppet master pulling all the strings. Essentially, the key to all market madness is how much money is swirling around, like a faucet left dripping.

Paul explains that GDP (that’s the total size of the economy, if you’re curious) grows only when populations expand, productivity gets better, and debt balloons. But since today populations are shrinking, productivity is flattish, and debts are soaring faster than a kite in a hurricane, governments are just pumping money into the system—like trying to fill a bathtub with a teaspoon.

“Populations are aging, productivity flat on its back, and debts are exploding. To keep the GDP from crashing, all governments have left is to just pump liquidity—like trying to water a cactus with a firehose,” Paul said.

That means liquidity might speed up even more. Paul sees Bitcoin hitting $300,000 by the end of 2025—what he calls the “Banana Zone,” a place where assets grow so fast you’d think they’re on steroids. Remember Bitcoin’s 19,900% surge between 2013 and 2017? Or Ethereum’s monstrous 699,900% jump? Yeah, those were the days of “blink and you miss it.”

But hold your horses! While these predictions may sound like a straightforward fairy tale, there are whispers of doom—like quantum computers that might one day crack Bitcoin’s code and leave us all holding empty digital bags. Because if it’s one thing markets love, it’s a little chaos, served with a side of paranoia.

Read More

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Gold Rate Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Bouncy Castle? 🚀

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

- Bitcoin’s Bumpy Ride: Will it Sink or Swim? Find Out Before Your Coffee Gets Cold! 🚀💸

- Shocking! Dogecoin Poised for a 110% Leap—Is the Moon Too Tame?

2025-05-19 21:14