What to know:

- Despite numerous stablecoin announcements in Q2, the market remains dominated by a few major players, with Tether leading the pack.

- Mini apps are transforming DeFi by embedding complex financial tools into user-friendly mobile interfaces.

- The line between traditional finance and crypto continues to blur as both sectors integrate and evolve together.

Everyone’s rushing into stablecoins, but the numbers look… the same.

In Q2, there seemed to be a continuous stream of significant announcements regarding stablecoins. For instance, JPMorgan introduced their USD Deposit Token on Base, while Coinbase unveiled their stablecoin payment system following their partnership with Shopify. Anchorage Digital purchased Mountain Protocol, a USDM issuer. Ubyx managed to secure $10 million for its stablecoin clearing infrastructure. Bitcoin-based Plasma swiftly reached its $1 billion deposit limit in just 30 minutes. All of these events happened quite successively within a short period.

Although there’s a lot of action in the stablecoin market, it remains heavily dominated by a few key players. Out of the approximately $250 billion in circulation, Tether controls around $158 billion (which is about twice as much as Circle’s $62 billion), while USDC significantly outweighs the third-largest dollar-backed asset, USDe ($5.3 billion), by an elevenfold margin.

As an analyst, I observe that yield-bearing stablecoins like USDe, sUSDS, BUIDL, M0, and others are introducing fresh competitive dimensions. Yet, it’s essential to remember that distribution remains crucial in this landscape. The most triumphant stablecoin won’t be the one offering the highest yield through an innovative mechanism, but rather the one that is effortlessly integrated, trustworthy, and universally accepted. Ultimately, the value of a stablecoin lies in its widespread use and acceptance.

It’s clear that there will likely be an ongoing influx of funds into stablecoins, which are essentially digital dollars on a blockchain and have become one of the most significant markets in the crypto sphere. However, what intrigues me is finding solutions to assist users in effectively utilizing their stablecoins once they acquire them.

Mini Apps: Mobile-First Crypto Finally Arrives

Over time, the intricacy of Decentralized Finance (DeFi) has been a significant hindrance for its widespread acceptance. However, Q2 signified a shift in trend, as the sector united around a fresh access method – mini applications.

- Coinbase Wallet (building on the Farcaster Frames framework) invested in revamping Coinbase Wallet into a Mini App platform.

- World’s mini-app ecosystem exploded and caught builder attention.

- Opera launched its standalone MiniPay app for iOS and Android.

The strategy is clear: embed DeFi’s power within familiar, user-friendly interfaces.

In a significant shift, mini-apps are now propelling Decentralized Finance (DeFi) into the mobile era. Unlike past iterations, user experience (UX) is no longer a secondary consideration—it’s the primary focus, making UX the very essence of these products. Today, platforms that boast wide distribution aim to transform into multi-functional structures reminiscent of superapps, where developers compete to access built-in user communities, similar to WeChat in China.

These applications simplify on-chain finance by hiding technical aspects like transaction fees, recovery phrases, and hexadecimal addresses, allowing users to access these services easily, even if they’re not required to grasp the complexities beneath.

Sophisticated Capital Structures Return (Without the Baggage)

One of Q2’s most interesting developments has been the quiet return of structured products to DeFi.

These protocols, such as Resolv, Aave’s Umbrella project, and infinifi.xyz, are developing tools that TradFi experts would find recognizable. By incorporating features akin to tranching and focusing on yield enhancement, they offer distinct risk profiles tailored to institutional investors’ unique requirements, including pension funds, corporations, and DeFi treasuries, thus accommodating their specific investment mandates.

This shift is from basic, high-stakes yield farming to a financial setup capable of evaluating and distributing risk more intelligently. It’s the foundation necessary for effectively managing large amounts of capital.

A Blurring of Financial Worlds

The distinction between “crypto” and “TradFi” is further dissolved.

Superstate’s Opening Bell platform marked the initial on-chain release of SEC-registered public shares, while Kraken introduced a commission-free stock trading service as an addition to their existing cryptocurrency services.

As a researcher, I find that when conventional assets seamlessly transition on unified platforms, and users can effortlessly navigate between both systems through a harmonious interface, the distinction between “crypto” and “fintech” products becomes increasingly blurred. Instead, these innovations might be more aptly characterized as integrated financial solutions that transcend traditional categorizations.

As a researcher, I can certainly attest that the examples provided demonstrate the transition of cryptocurrencies into traditional stock markets. Yet, it’s equally important to note that this trend is reciprocal, with most significant financial technology (fintech) applications incorporating cryptocurrency in some form. The market landscape has significantly evolved, shifting from an experimental phase to one where crypto integration has become indispensable.

Looking Forward: A Different Kind of Bull Market

2025’s Q2 is shaping up to be the quarter that DeFi solidified its position, shifting from an emphasis on reinventing finance to enhancing it significantly. The robust stablecoin infrastructure being established by traditional institutions, the user-friendly experiences offered through mini-apps on mobile devices, and the advanced products being developed by seasoned protocols all suggest a common trend: DeFi has found its footing and is now making strides in its evolution.

The process of acquiring businesses provides a narrative: it demonstrates that significant transactions such as Privy’s sale to Stripe and Mountain Protocol’s purchase by Anchorage are part of a pattern where larger entities are valuing and purchasing cryptocurrency infrastructure companies.

As a crypto investor, I can confidently say that this current cycle isn’t just another speculative frenzy. Instead, it represents an unprecedented level of accessibility, efficiency, and global scale in financial services.

In its early days, the frenzied gold-seeking attitude typical of cryptocurrency is being replaced by a focus on constructing infrastructure, similar to the shift from gold rushes to railroad building in history. Notably, it’s often the companies that lay the tracks (build the infrastructure) rather than those who merely dig for gold (focus solely on the crypto market) that survive longer term.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

BTCS Joins Russell Microcap Index as Ether Treasury Firms Continue to Post Big Gains

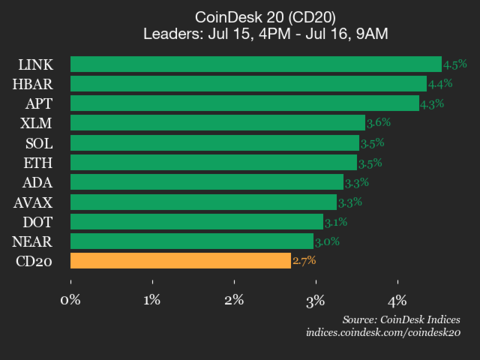

CoinDesk 20 Performance Update: Chainlink (LINK) gains 4.5% as Index Trades Higher

XRP Prints Bullish Reversal, Volume Confirms Recovery Toward $3

PayPal Blockchain Lead José Fernández da Ponte Joins Stellar

Crypto Trading Technology Firm Talos to Buy Data Platform Coin Metrics for Over $100M: Source

Arbitrum’s ARB Surges After Appearing Among Supported Chains for PayPal’s $850M PYUSD Stablecoin

Ether Races 6% Against Bitcoin as GENIUS Act Puts Spotlight on Yield-Bearing Stablecoins: Analyst

Crypto Is Going Mainstream and ‘You Can’t Put the Genie Back in the Bottle,’ Bitwise Says

Polymarket Odds on Jerome Powell’s Ouster Jumps as Congresswoman Says It’s ‘Imminent’

Crypto Exchange BigONE Confirms $27M Hack, Vows Full User Compensation

Read More

- Gold Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Crypto Riches or Fool’s Gold? 🤑

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Silver Rate Forecast

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

2025-07-16 18:12