Oh, the irony! The recent surge in gold and bitcoin prices isn’t just a market blip—it’s a rebellion against the centuries-old con of fiat money. 🤑

The Great Fiat Fraud: How Inflation Became the Ultimate Heist

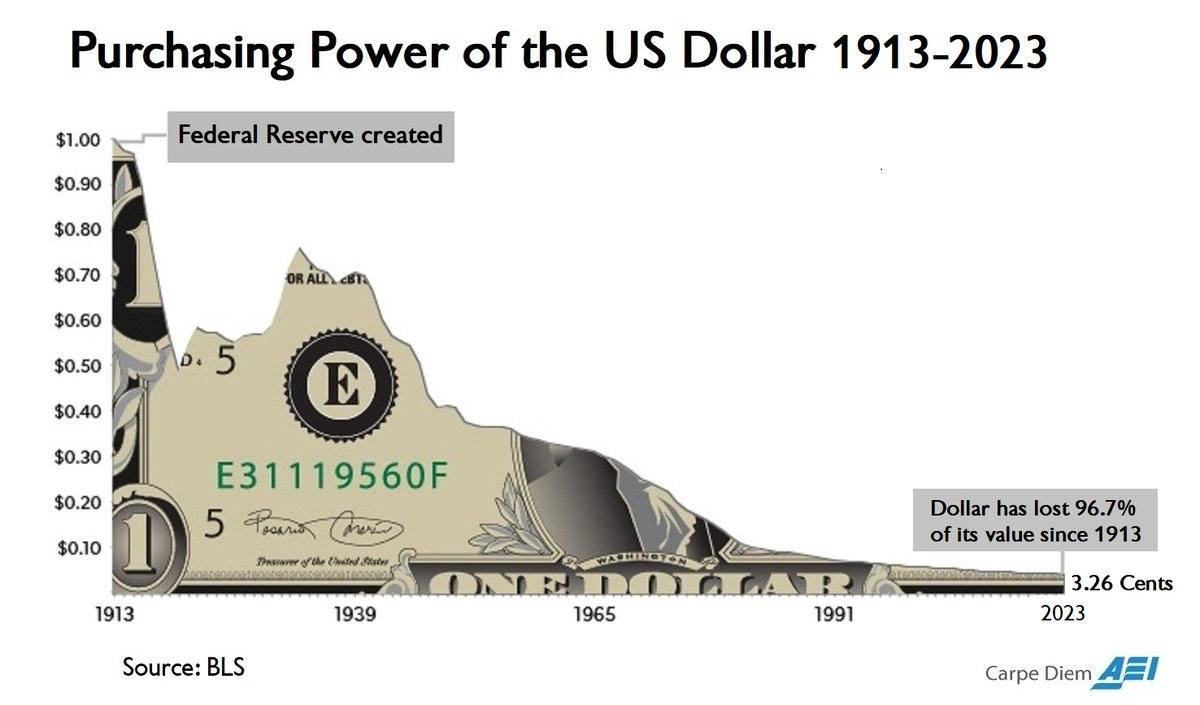

Ever noticed how people wax nostalgic about the good old days, when a candy bar cost 50 cents? 🍬 They talk about it like it’s some kind of natural phenomenon, as if prices rising over time is as inevitable as the tides. But let’s be real, folks, it’s not nature’s doing—it’s a calculated con that’s been fooling us for generations.

Inflation is not an accident. It’s not some mysterious force beyond our control. It’s a deliberate act of diluting the value of money by printing more of it than we actually produce. That’s the only definition of inflation, and it’s the only cause. Meanwhile, technology has made production faster, cheaper, and more efficient than ever before. So why are prices still rising? Because someone is tampering with the money, duh! 🤦♀️

So why should prices rise, if not because someone is tampering with the money?

And yet, we accept this ongoing theft with a shrug. We repeat “back in my day” like a lullaby, blind to the fact that we’ve been robbed. Robbed by the very political and banking institutions we were taught to trust. The government has drained our wealth slowly, silently, and with cold precision. The central bank has engineered this betrayal in plain sight, not just once, but over generations. 🕵️♂️

This is the moral context in which we must understand the gravitation toward gold, now priced at $3,356 per ounce, and bitcoin, trading over $109,000 per coin at 10 a.m. Eastern time on Friday. These aren’t just commodities—they’re acts of defiance. They represent a growing recognition of what hard money truly means: money that can’t be conjured out of thin air or manipulated by central planners.

Money backed by scarcity, rooted in objective value, and immune to manipulation.

Gold and bitcoin aren’t relics of the past or speculative whims of the future; they’re the direct consequence of a moral rebellion. They reflect a refusal to be enslaved by a dishonest monetary regime. People aren’t just seeking safety—they’re seeking justice. 🚀

Both gold and bitcoin possess a rare and powerful attribute in a world dominated by centralized authority: they are fundamentally resistant to censorship and manipulation. Gold, by its very nature, is a physical asset beyond the reach of political decree. It can’t be printed, duplicated, or forged into existence. It requires effort—mining, refining, and safeguarding.

No bureaucrat can simply will more gold into circulation with a signature.

Bitcoin, though digital, is governed by the same principle of incorruptibility. Its code is public, its supply is fixed, and its network is decentralized—run by thousands of independent nodes and miners across the globe. No single government, institution, or cartel can alter its issuance schedule or freeze a transaction without consensus from a global community. In Bitcoin, the main consensus rules are transparent and immutable; they apply equally to all.

that the only way to fix the world is to fix the money. 🌍💰

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Whale of a Time! BTC Bags Billions!

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- Crypto Riches or Fool’s Gold? 🤑

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

2025-05-24 08:58