So Arbitrum (ARB) thought it could cozy up to Nvidia’s Ignition AI Accelerator program — spoiler alert: Nvidia said, “Thanks, but no thanks.” Apparently, driving a shiny AI Ferrari means avoiding crypto potholes, at least according to Nvidia’s risk-control GPS.

In case you missed it, Arbitrum, the L2 network that’s been riding the struggle bus after an 85% price nosedive, figured rebranding as the “cool AI kid” might help. Turns out, the cool kids’ table was already full.

Nvidia’s “Thanks, But We’re Good” Moment

Word on the blockchain is that Arbitrum was lined up to be Nvidia’s Ethereum wingman in their AI accelerator squad—until, bam, last-minute rejection.

Nvidia’s official stance? Crypto projects don’t get a hall pass because, well, risk. I guess AI and crypto don’t mix, like oil and water or pineapple on pizza. 🍍🍕

“Nvidia recently explicitly excluded cryptocurrency-related projects from its Inception program,” Wu Blockchain spilled the tea.

They even had it in the fine print when the program launched:

“No consulting, no crypto companies, no cloud providers, no resellers, no public companies.” Translation: If you’re crypto, take a hike.

This move protects Nvidia’s AI street cred, but it’s like saying, “Sure, AI and blockchain *could* be the future, but let’s just not get our hands dirty.” Revolutionary? Meh. Cautious? Absolutely.

On X (formerly Twitter), a user summed it up:

“Nvidia’s crypto snub makes you wonder if old-school tech and blockchain will ever really be friends.”

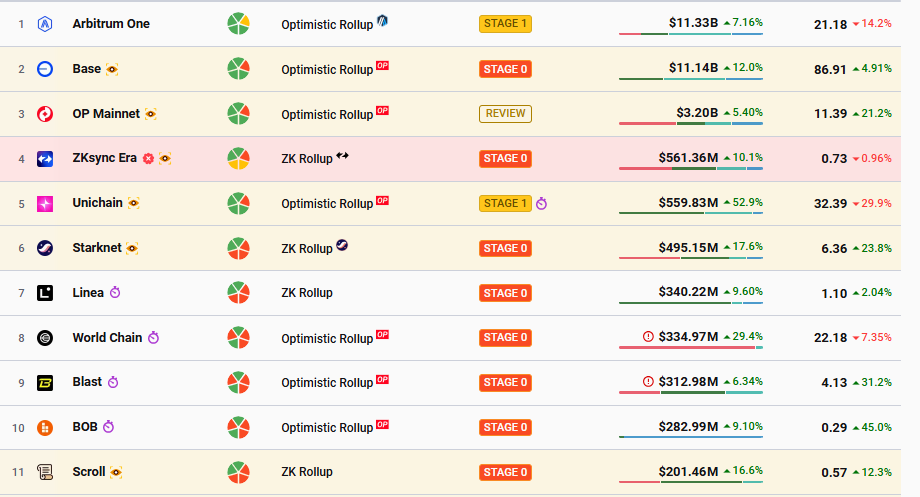

Meanwhile, Arbitrum is still wearing the crown as Ethereum’s biggest Layer-2 scaling solution, trailed by Optimism (OP) and friends. According to L2Beats, Arbitrum One still flexes its muscles leading all L2s in TVL (Total Value Locked).

But if you peek over its shoulder, Arbitrum’s looking wistfully at December 6, 2024—the day it hit $1.2384, before the heartbreak. Since then, it’s been clawing back from the abyss.

Among its survival tactics: a token buyback program launched in March designed to suck up supply sloshing around after a massive token unlock event. For a minute, prices bounced up 36% like a caffeinated kangaroo… then decided to nap again, bottoming out at $0.2420 on April 7.

But experts aren’t popping champagne just yet. Yogi, a wallet maxi with a crystal ball (or just good instincts), warned that buybacks are like putting a Band-Aid on a sinking ship—they might keep the water out temporarily, but they don’t fix the hole.

And Patryk from Messari? He says Arbitrum’s got to stay nimble, deploying funds like a chess player instead of going all-in on a buyback bet.

“I think projects will do this eventually. It’s just tough to say exactly where the money’s going up front. Being flexible is the winning move,” Patryk opined.

So what’s next for Arbitrum now that Nvidia slammed the door? Apparently, they’re cooking up ARB airdrops to keep the early believers happy. Because nothing says “We’re still in this” like free tokens falling from the sky.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Silver Rate Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Crypto Chaos: Hackers Make a Killing While CEOs Insist “Nothing’s Changed” 😒

2025-04-25 12:16