PlanB, that ol’ Bitcoin oracle with a knack for Stock-to-Flow mumbo jumbo, done took a jab at Ethereum just as ETH’s price and clout started slippin’ faster than a greased pig at the county fair.

His rant’s all about how Ethereum, the second fiddle in this crypto hoedown, ain’t exactly the virtuoso it claims to be—blaming its switch from the good ol’ Proof of Work to that newfangled Proof of Stake.

Why PlanB Calls Ethereum “Centralized” and “Pre-Mined” (Fancy Words for “This Here’s a Fixer-Upper”)

PlanB dug up some dusty words from Vitalik Buterin back in ’22, where Vitalik warned against trusting the Stock-to-Flow gospel like it was gospel indeed. Seeing his chance, PlanB poked sharp fun at Ethereum, pointing out that the ETH/BTC pair hit rock bottom like a lead balloon. The feller called Ethereum a “shitcoin”—yep, that’s the polite term—blaming it for being centralized, cooked up ahead of time (“pre-mined”), and swapping the sweat-and-toil Proof of Work for that fancy Proof of Stake. Oh, and its supply? As “flexible” as a circus contortionist.

“I reckon it ain’t proper to gloat, but coins like ETH—centralized, premined, PoS instead of PoW, and flipping supply rules like a politician flip-flops—well, they’re just asking for a heap of mockery,” PlanB grinned.

And he ain’t alone in this circus act. Ethereum’s big switcheroo, “The Merge,” chopped its energy use by over 99%, but some brainiacs say it also gummed up the network’s worth in the long haul.

Meltem Demirors, a suit from Crucible Capital, waved her finger and called it a trillion-dollar blunder, complainin’ it mucked up innovation in GPU gear.

PlanB also pointed finger at Ethereum’s pre-mine shenanigans.

Turns out, the early Ethereum whizzes mined up more than 72 million ETH before the public even got a whiff—60% of all ETH flyin’ ’round. That’s like lettin’ a small bunch run the county fair, then complainin’ when they hog all the prizes. Especially under PoS, where the big fish get to call the shots.

“Premining is the biggest red flag waving in the breeze, but some folks just shrug and say ‘meh,’” PlanB quipped.

These bickering words came as Ethereum’s market swagger sank to a five-year low and ETH lost nearly 60% of its shine since last year.

Despite the Hecklers, Ethereum’s Still Dancing at the Big Party

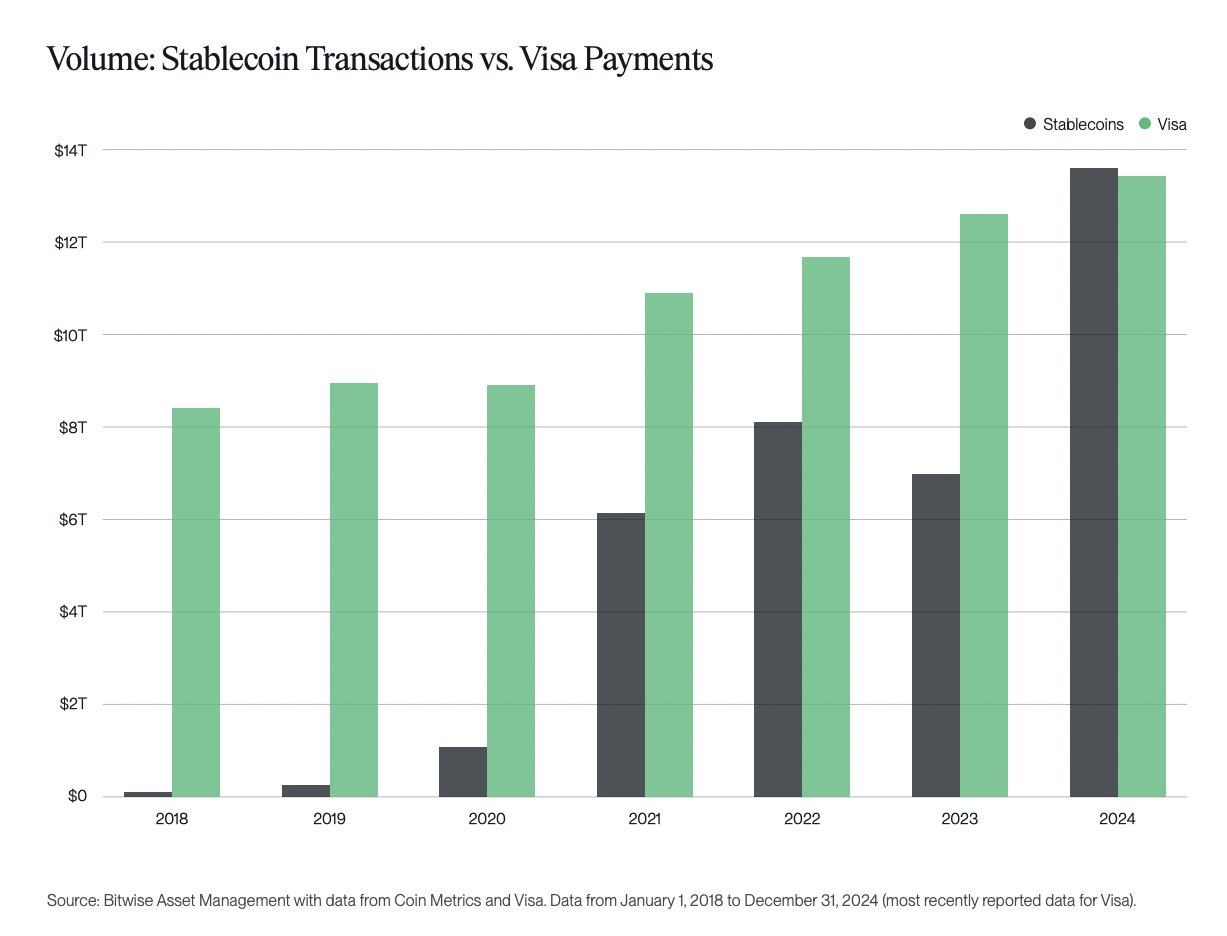

On the flip side, analyst Danny Marques piped up to remind folks that Ethereum’s got punch—it processed more stablecoin transactions this year than Visa, clearing nearly $14 trillion, while Visa lagged at $13 trillion. Over half of the stablecoins twirling in that digital dance hall run on Ethereum.

Investor Wise chimed in, sayin’ Ethereum’s sittin’ pretty with 56% of all real-world asset value, stablecoins and all.

Investor AllThingsEVM.eth reckons Ethereum’s shed some centralization over the years, while Bitcoin’s got the opposite problem—more and more nation-states and big-shot institutions hoardin’ BTC like squirrels with acorns.

“Tell me, what’s gonna happen when Uncle Sam and the Middle Kingdom run most of the Bitcoin miners? Will the network be more decentralized or just another country club? Or maybe BlackRock will get uppity and fork the thing on a whim?”

While the critics yap away, Ethereum’s been hustlin’, plotin’ upgrades like swappin’ out its Ethereum Virtual Machine for a spiffy RISC-V processor—promisin’ faster smart contracts and better scaling, all while keepin’ the old contracts happy.

Well, ain’t crypto a wild rodeo? 🤠💸

Read More

- EUR ZAR PREDICTION

- CNY RUB PREDICTION

- Gold Rate Forecast

- USD INR PREDICTION

- ETH Collapses?! You Won’t Believe What Happens Next 🤯

- Mine BTC at Home? 🏡💰 LOL!

- ETH Does What Now?! 😱

- Shocking News: IREN’s $450M Debt Offering Will Leave You Speechless! 💰😱

- How TRON’s Recent Stunt Could Turn a Meme to a Million: The Epic Tale of $1 Billion and Soon $1.20?

- USD IDR PREDICTION

2025-04-21 15:16