Ah, Ethereum, the digital gold of our time! 💎 With its price soaring to $3,229, it seems like everyone wants a piece of the pie. And guess what? The demand for staking is back on the rise, like a phoenix from the ashes! 🔥

Speaking of phoenixes, we’ve got Tom Lee’s BitMine Technologies (NASDAQ: BMNR) strutting around like it owns the place, boosting ETH staking like there’s no tomorrow! Market analysts are buzzing, as this could mean less pressure to sell off that precious ETH in the near term. Who wouldn’t want that? 😏

The Great Exodus of Validators: Where Did They Go?

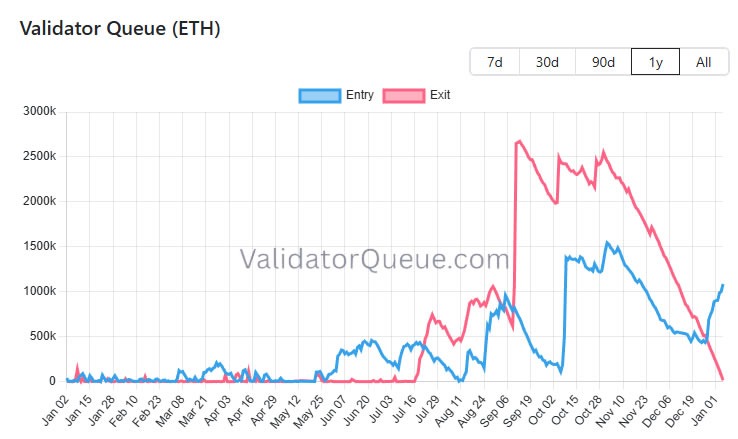

According to the wise sages at beaconcha.in, our little validator exit queue is now just a mere 32 ETH long, with a wait time that could only be described as ‘virtually instantaneous’-about one minute! 🕒 Can you believe it? That’s a staggering drop of 99.9% since the chaotic days of mid-September 2025 when over 2.67 million ETH were stuck in limbo!

Ethereum Validator Exit Queue | Source: Validator Queue

Meanwhile, the entry queue for staking is getting cozy at about 1.3 million ETH. It looks like participants are lining up like kids for candy after a long diet-this is the highest since mid-November 2025! 🍬

Rostyk, the tech wizard at Asymetrix, remarked that the exit queue is “basically empty.” Looks like hardly anyone wants to withdraw their precious ETH! Perhaps they’re all enjoying the sweet taste of staking rewards? 🤑

Experts are whispering sweet nothings about how this revival of staking demand could ease selling pressure, which might just send ETH prices skyrocketing. Who doesn’t love a good supply shock? 🤔

$ETH Exchange reserves are at 10-year lows. Selling pressure is drying up, and now we see the validator entry queue far outpacing the exit queues, driven by $BMNR and ETFs staking their ETH for yields.

Is a supply shock induced squeeze on the horizon? 🧐

– Tevis (@FunOfInvesting) January 5, 2026

BitMine: The Staking Juggernaut! 💪

Our favorite ETH treasury titan, BitMine (BMNR), has kicked its staking activity into high gear! 🚀 Institutional demand is rising faster than a cat meme going viral, tightening the overall ETH supply in the market.

They began staking Ether on December 26 and added another whopping 82,560 ETH, worth nearly $260 million. And if that wasn’t enough, they staked an additional 186,336 ETH-worth a jaw-dropping $605 million-in just the last 12 hours! Talk about a power move! 💰💥

Tom Lee (@fundstrat)’s #Bitmine staked another 186,336 $ETH ($604.5M) in the past 4 hours.

In total, #Bitmine has now staked 779,488 $ETH ($2.51B).

– Lookonchain (@lookonchain) January 6, 2026

This latest power play brings BitMine’s total staked Ether to about 779,488 ETH-more than $2.5 billion locked away in the Ethereum vault. That’s a lot of money taking a nice vacation from trading, earning staking yield instead! 🌴

The tighter ETH liquidity could push prices higher, making all our wallets a little heavier! As we speak, ETH is trading up by 1.59% at $3,219, with daily trading volumes surging by 50% to over $25 billion. Can I get a “cha-ching”? 🎉💵

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Brent Oil Forecast

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- XRP: The Calm Before the Storm?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- Ethereum’s ETH: The New Global GDP? 🌍💰

- This Will Break the Internet: Is Bitcoin About to Explode Past Its All-Time High?

2026-01-06 13:55