Oh, darling, dust off your top hats and polish those monocles—Bitcoin (BTC) has just waltzed back across the $99,000 ballroom floor for the first time in over two months. The cryptographic chatterati are fainting with excitement and quietly betting the mansion that we’ll soon see a number with six delicious zeroes.

Our dashing crypto protagonist is enjoying quite the renaissance. Up 31.8% in just one month, Bitcoin has positively flounced its way out of the early April doldrums. The comeback is less “slow recovery” and more “springtime musical number.”

Bitcoin: To $100,000 and Beyond (Champagne Optional?)

In those glittering first moments of Asian trading, BTC graced $99,388—a level unseen since February 21, 2025. Yes, that long ago. By the time anyone had located their smelling salts, it was back down at $98,874. (A minor 0.3% dip, or as we say at the club, “barely an eyebrow raise, darling.”)

Still, the pitter-patter of traders’ hearts on X (née Twitter) is deafening: the air practically reeks of optimism.

“Bitcoin is knocking on the door of $100,000 again. Tick, tock…,” cooed Anthony Pompliano, perhaps while seated on a velvet settee, checking his pocket watch.

Rumour has it—the Bitfinex soothsayers themselves predicted that as long as our hero holds court above $95,000, a return to those fabled all-time highs is distinctly possible. And here we are, hobnobbing comfortably above that threshold.

Our cast of market indicators enters stage right, each more bullish than a Mayfair party crasher. A clever analyst remarked that Bitcoin has now sashayed past the clusters of over-leveraged shorts, leaving naysayers clutching their pearls.

“There is no significant resistance until around $100,000,” came the analyst’s pronouncement, ending with a theatrical wink.

The weekly Glassnode telegram (read aloud, no doubt, by a butler in white gloves) noted BTC’s realized cap has hit a sparkling $889 billion—a 2.1% moonwalk, for those counting. This signals capital flowing in at a rate that could make Scrooge McDuck green with envy. 💸

ETFs, those reliable old aunts of finance, have welcomed back more than $4.6 billion this fortnight. Their trunks are now bursting with 1.171 million BTC—just 11,000 BTC shy of the all-time high, or as we say, “more than enough to fill the punch bowl.”

“Strong ETF inflows, alongside improved investor confidence, helps to paint a picture of stronger tailwinds supporting the Bitcoin market,” opined Glassnode, before inquiring politely about the hors d’oeuvres.

Meanwhile, over at Chez Binance, a torrent of stablecoins—nearly $1 billion on May 6—has swept in over the past three days. Largest deposit since April, don’t you know. The mood suggests an imminent shopping spree. 🛒

“Stablecoin inflows typically reflect investor readiness to enter the market, as these assets are often sent to exchanges in anticipation of buy-side activity,” pronounced one observer, sounding very much like a fortune teller at a garden party.

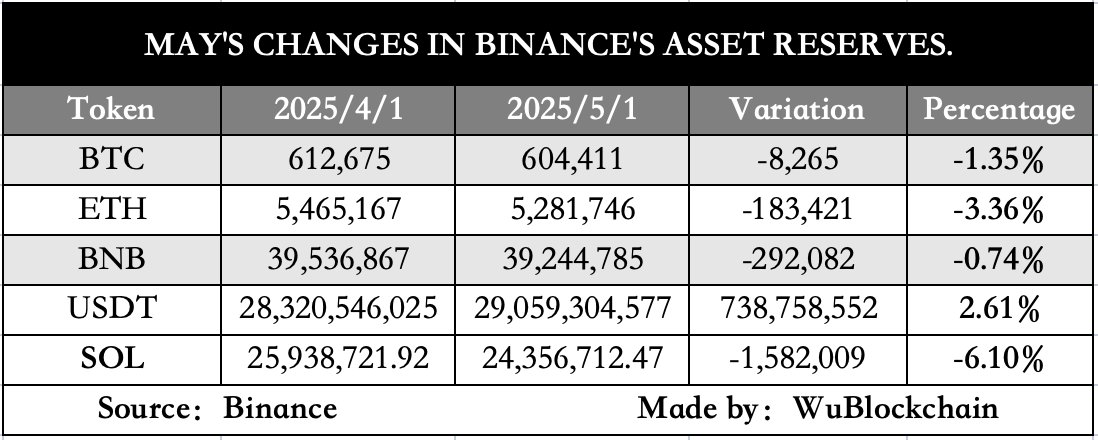

Binance’s latest “peek behind the curtain” revealed that major crypto reserves such as Bitcoin, Ethereum, and Solana are being depleted, though Tether (USDT) has fancied a little 2.6% uptick. One can only assume the sherry was flowing that day.

All this liquidity swirling about is like free cocktails—impossible to ignore and frequently a prelude to excess. Traders are clearly limbering up for some lively transactions.

Meanwhile, Tether’s dominance has dipped, typically meaning funds are fleeing the safety of umbrellas and diving, champagne glass in hand, into more risk-on assets. The rally’s appetite is impressive—one imagines Gatsby himself would approve. 🍾

Adding a rare governmental rose to this already flamboyant bouquet, two Bitcoin-reserve bills have recently made the law books, with more striding confidently through legislative halls. Even the institutions are dusting off their ledgers in anticipation.

As Bitcoin pirouettes ever closer to the $100,000 mark, all eyes are glued to the ticker, breath bated, wondering: Will the show go on? Or will the curtain fall on this bullish performance? Either way, darlings, it’s fabulously entertaining to watch.

Read More

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- Binance’s CZ Predicts Bitcoin Will Go So High Even Molière Would Write a Satire

- MSCI’s Exclusion Plan Sparks Crypto Chaos! 🚨📉

- Bitcoin’s Last Stand: The Wild Ride Before the Big Move! 🚀💥

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Shocking! Dogecoin Poised for a 110% Leap—Is the Moon Too Tame?

2025-05-08 10:57