In the vast and unpredictable sea of markets, the price of XRP finds itself hovering near $2.83, having taken a modest tumble of 2.67% in the past day, extending its weekly sorrow to about 7.5%. Yet, like a stubborn old soldier battered but unbowed, Ripple‘s token clings to a gain exceeding 30% over the last three months-a testament that beneath these dark clouds, the sun yet strives to break through.

And lo, amid this tempest, strange signals arise, much like whispers from the mighty whales themselves. On-chain and technical apparitions flicker with hints of recovery-as if some unseen hand urges the price toward redemption. The grand question thus emerges: shall the price of XRP dare to dream once more of surpassing the elusive $3?

Exchange Inflow Value Bands Reveal the Patient Whale’s Comedy

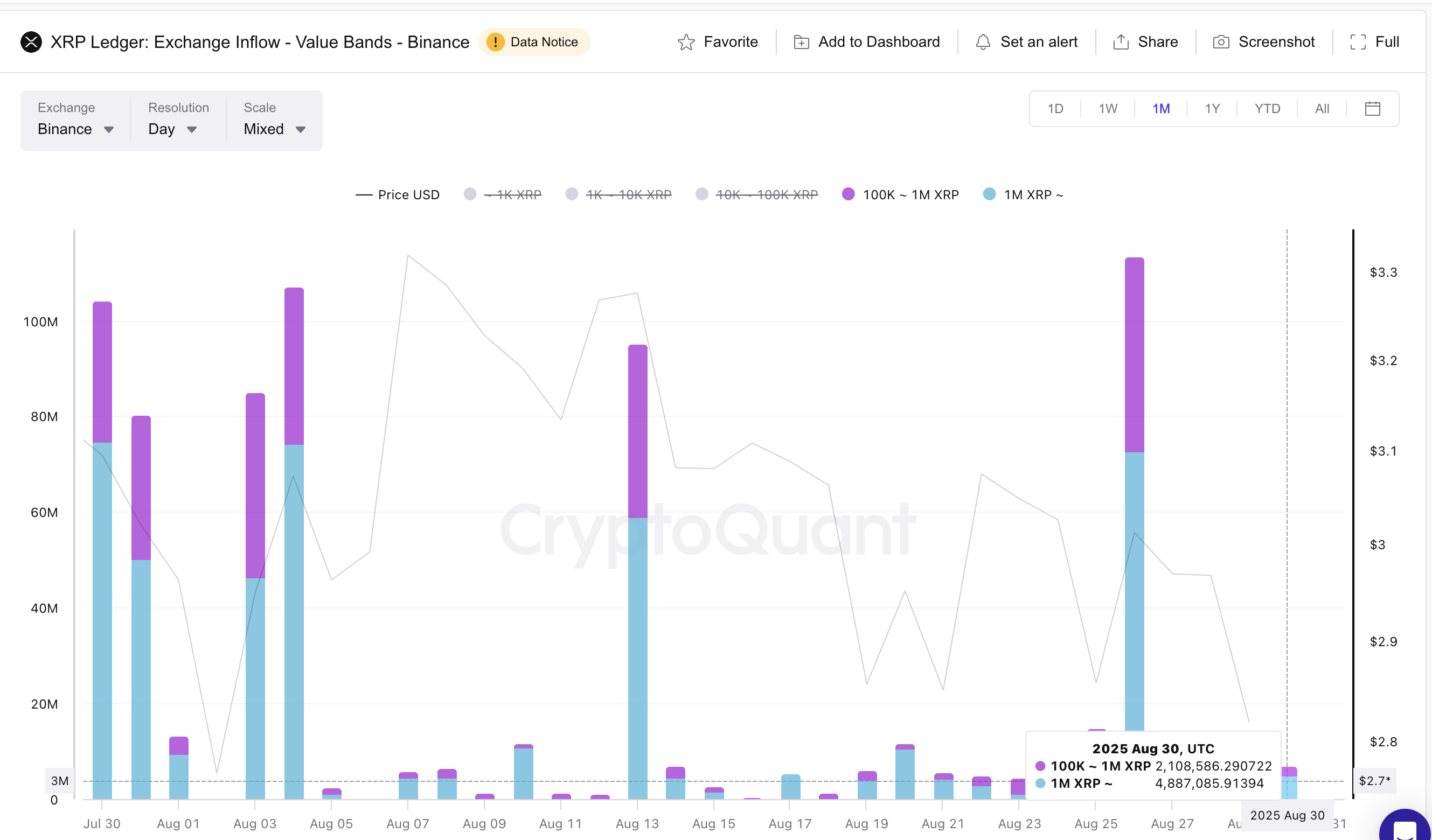

First comes a spectacle from the enigmatic exchange inflow value bands-those mystical measures of XRP migrating in varying sizes into the kingdom of exchange wallets.

Customarily, vast inflows spell the imminent feast of whales selling their spoils, while a sudden decline betrays a rare patience, a pause in their voracious appetites.

Since the twenty-sixth day of August, a dramatic retreat has been witnessed. Binance‘s largest value band inflows, those transactions between 100,000 and a staggering 1 million XRP, have plummeted nearly 95%-from a swelling 45.6 million down to a meek 2.1 million by the thirtieth. Transactions beyond a million XRP have also had their own tragedy, shrinking by some 93% within these fleeting days.

This sharp decrescendo proclaims loudly that the great whales have ceased their previous frenzy of exchange infiltration. They linger now, not to sell but to muse and perhaps plot their next move. “Patience is a virtue,” one hears them say, “especially when smaller fish panic and scuttle for the lifeboats.”

Craving more such sardonic market musings? Enlist in Editor Harsh Notariya’s Daily Crypto Newsletter and bask in the glorious theater of tokens.

With these leviathans holding fast, the XRP price’s foundations find fresh strength. While the common traders, swift and nervy, sell without a second glance, the great holders sit idle, a sign-if ever there was one-that resurgence might yet dawn.

Taker Buy-Sell Ratio: The Market’s Mischievous Jester

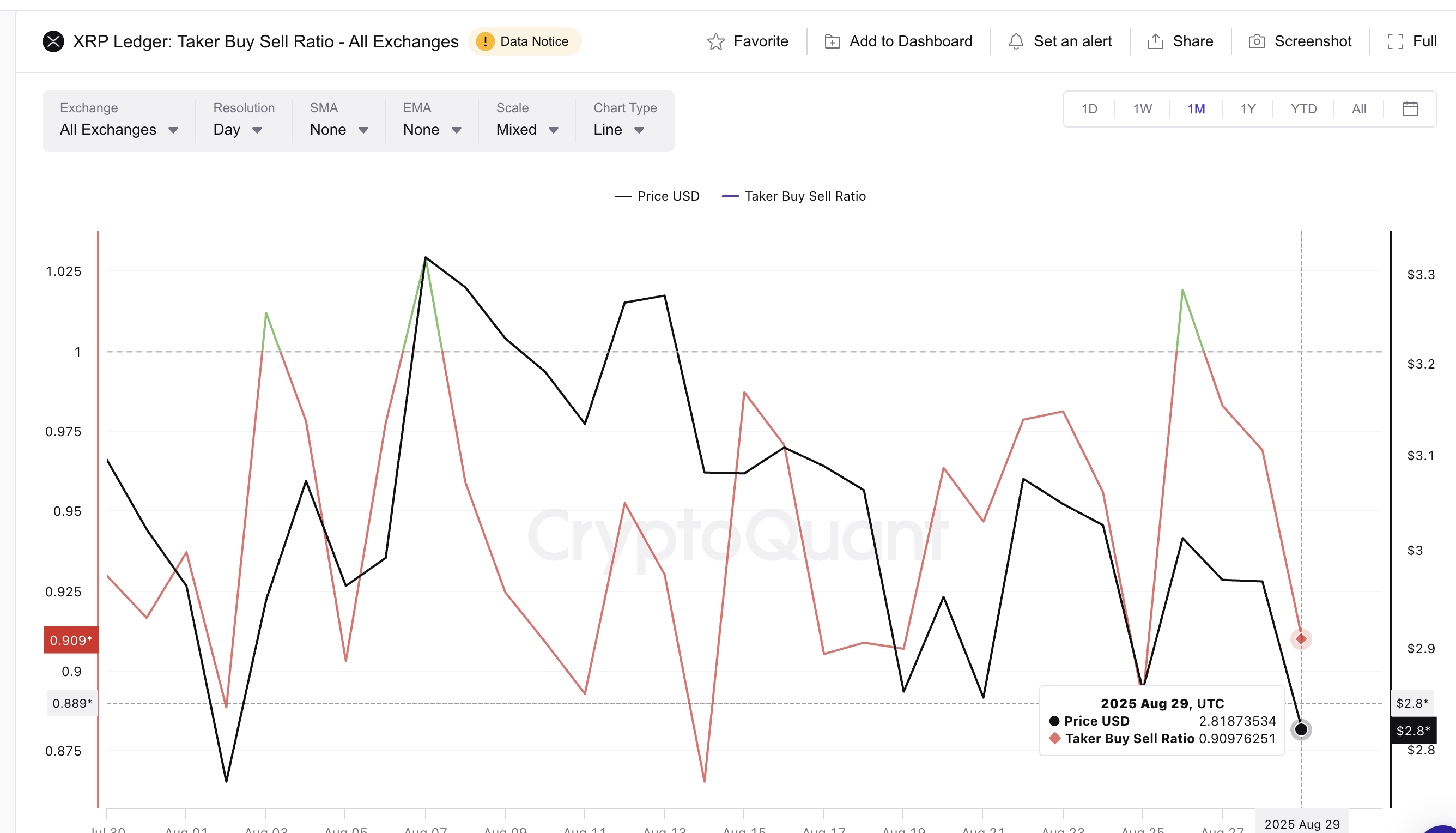

Now, gaze upon the Taker buy-sell ratio-a curious measure that chronicles whether the market’s handful of bold souls are buyers or sellers in this grand pantomime. A value above one heralds buyers as the aggressive heroes; below one, sellers steal the stage.

At this moment, the ratio rests at 0.90, whispering tales of selling pressure-unsettling at first glance, as the retail crowd, ever impatient, tend to flood the exits at signs of trouble, abandoning their posts without negotiation or ceremony. With the great whales in their rare silence, this imbalance seems a retail-led retreat.

Yet, history has a sly way of teasing us. Almost every dip below one in August marked the market’s breath before a rally-a local bottom before the crescendo. On the second of August, a dip to 0.88 preceded a near 20% ascent. August 19 bore the same tale: a short fall before the rise. And now, this ratio lingers near those storied levels once again.

So what seems bearish retail despair may secretly pen the prelude to another rebound. When joined by the patient whales’ halted inflows, this ratio weaves a tale of divergence: the crowds flee as titans hold, and historically, this dance has often choreographed bullish outcomes.

XRP’s Price Destiny and the RSI’s Cryptic Wisdom

The charts add their voice, with the Relative Strength Index (RSI) telling a tale at odds with price’s moody sways. While XRP shuffled lower lows between the nineteenth and twenty-ninth of August, the RSI saluted us with a higher low-a subtle, bullish defiance hinting that the downward momentum weakens, perhaps exhausted from its grim march.

For the uninitiated, RSI measures momentum by capturing the speed and extent of recent price gyrations-a barometer of market’s inner fever.

As to price targets: eyes should watch the $2.84 mark, standing like a sentinel. Should the daily candle close beyond this threshold, a path might open to $2.95, then the psychological bastion at $3.00. Should a heroic breakout shatter the $3.33 rampart, the entire trend might bow to bullish rule, rewriting XRP’s future with more ample upside.

But beware! Should XRP falter and close below $2.72 on the day’s canvas, it would sound a somber note-signaling that retail panic has overwhelmed whale stoicism, and the bears may once more take the throne, sending hopes for a rebound into the snowy wastes of despair.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- Bitcoin’s on Fire! Institutions Hoarding Like It’s Toilet Paper 2020 🚀💰

- Bitcoin’s Rollercoaster Ride: Hold Onto Your Hats, Crypto Fans! 🎢💸

- Crypto Chaos: Powell Holds the Keys! 🔑

2025-08-30 13:27