What to know:

- The Senate has passed the GENIUS Act to regulate stablecoins, while a similar bill, the STABLE Act, is progressing in the House.

- The proposed legislation faces criticism for potential redundancy and the involvement of multiple regulators, which could lead to inefficiencies.

- Congress is urged to designate the Federal Reserve as the sole regulator for stablecoins to streamline oversight and address systemic risks.

Ah, the GENIUS Act! A bipartisan triumph, or perhaps a bipartisan tragedy? The Senate, in its infinite wisdom, has decided to grace us with a regulatory framework for stablecoins. Meanwhile, the STABLE Act is making its slow crawl through the House, like a tortoise in a race against a hare that’s already asleep. President Trump, bless his heart, is eager to sign this bill into law, as if it were the Holy Grail of financial regulation. 🏆

But hold your horses! 🐴 We mustn’t count our chickens before they hatch, lest we find ourselves in a henhouse of confusion. The proposed legislation is riddled with flaws, like a Swiss cheese of bureaucracy, and it desperately needs fixing to avoid unnecessary costs for both the industry and the beleaguered taxpayer.

Fear not, dear reader! The legislation can be salvaged. The House and Senate bills, while sharing a familial resemblance, have their quirks. Will we end up with the STABLE GENIUS Act? One can only hope! There’s still time to sidestep the chaos of 55 different regulators and the exclusion of interest-bearing stablecoins from the regulatory embrace.

Our regulatory framework is as outdated as a rotary phone in a smartphone world. We have a veritable army of regulatory agencies, each more eager than the last to extend their dominion, while critical issues languish in the shadows. FTX was under the watchful eye of state money transmitter regulators—who thought that was a good idea? 🤔

This fragmentation is a recipe for disaster, as evidenced by the financial crisis of 2008. Congress, in its infinite wisdom, responded by creating the Financial Stability Oversight Council (FSOC), a committee of dukes and earls who would surely cooperate better than before. Spoiler alert: they didn’t. And now, Congress is poised to repeat this blunder with joint rulemaking from the alphabet soup of agencies.

Ah, the joys of bureaucracy! The battle over whether a digital asset is a Security under the infamous Howey test is akin to a game of chess played by blindfolded players. The SEC, with its whims, or the Something Else Regulators (CFTC? CFPB? State banking regulators?)—who knows? 🤷♂️

Issuers of digital assets have contorted themselves like circus performers to avoid the Kafka-esque experience of SEC oversight. Even traditional finance folks are dodging SEC registration like it’s a game of dodgeball. The SEC has been spectacularly unsuccessful in scaling its requirements to fit the size of newer enterprises. It’s like trying to fit a square peg in a round hole—frustrating and messy!

The proposed bills allow issuers to choose from a staggering 55 regulators. What could possibly go wrong? Oh, just about everything! The temptation to pick the laxest regulator is a siren song that could lead to disaster. And if the Secretary of the Treasury certifies that a state’s regulation is “substantially similar” to federal regulation, why bother with the redundancy? Talk about a waste of resources! 💸

But wait, there’s more! The House bill requires the OCC, FDIC, and Fed to engage in joint rulemaking. Anyone who has witnessed this process knows it’s akin to herding cats—slow, painful, and often contentious. One can only imagine the shouting matches that ensue! 😤

And let’s not forget the turf wars! Stablecoins that pay interest? Not covered! A stablecoin that is a “security”? Also not covered! Expect endless wrangling over which of the 55 regulators gets to claim jurisdiction. It’s a bureaucratic free-for-all! 🎪

In a time when the DOGE administration is trying to trim the fat from government agencies, creating a regulatory regime with overlapping regulators is a contradiction of epic proportions. Congress must choose a single regulator and eliminate the joint rulemakings and state loopholes. It’s time to cut the nonsense!

Before we dive into the who and how of regulating stablecoins, let’s clarify why we’re doing it in the first place. Financial regulation should aim to ensure:

- The economy won’t collapse when disaster strikes.

- Customers are protected when intermediaries fail.

- The economy can grow and remain stable.

- Market participants have the information they need to make informed decisions.

- Fraudsters aren’t peddling bogus instruments.

- Intermediaries who hold customer assets can be trusted.

- Prices are fair and not manipulated.

Stablecoins are a vital innovation in the global payment system, solidifying the dollar’s role in the economy. They’re poised for substantial growth and could become systemically important. A failure of a large stablecoin could send shockwaves through the economy, leading to defaults and distress in the Treasury market. This is the very definition of systemic risk, and it must be monitored by our de facto systemic risk regulator, the Fed.

Congress can and should rectify the flaws in the STABLE GENIUS bills. The Fed should be the single regulator for stablecoins, and interest-bearing stablecoins must be included in the regulatory framework. These fixes can be made swiftly and simply. It’s time to rethink our dysfunctional regulatory structure!

A more agile regulatory framework would have embraced the benefits of blockchain technology and fostered innovation while ensuring American leadership. We must begin this crucial discussion before our outdated regulatory structure stifles progress. The clock is ticking! ⏰

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

Crypto Lenders Hold Nearly $60B of Assets as New Wave of DeFi Adoption Sweeps In: Report

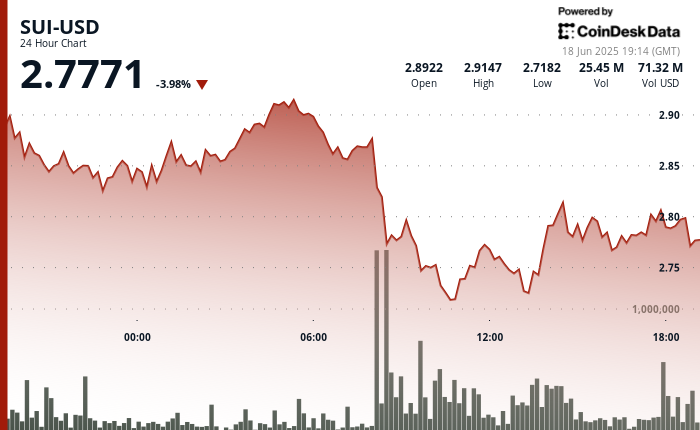

SUI Reverses After Wild Swings; Trading Volume Spikes 11% Above 30-Day Average

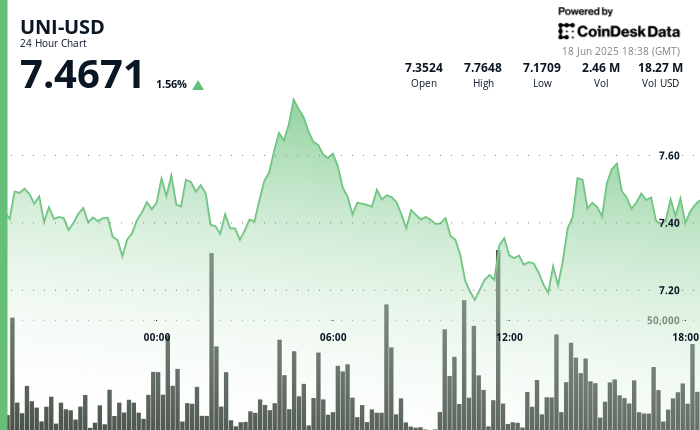

UNI Rallies 70% From April Lows With Bullish Pattern Taking Shape, Up 24% in Past 30 Days

Fed Leaves Rates Steady, Expects Weaker Growth, Sticky Inflation

Coinbase Debuts Stablecoin Payment Stack Following Shopify Partnership

UK to Propose Restrictions on How Banks Can Deal With Crypto Next Year

Bitcoin ‘Accumulator’ Better Fit for Corporates Than Dollar-Cost Averaging Strategy, Research Suggests

Another XRP ETF Comes to Canada as 3iQ Launches XRPQ on Toronto Stock Exchange

Compliant Stablecoins Will Become the ‘Money Layer of the Internet:’ Canaccord

Bitcoin Retests 50-Day Average Support; XRP Risks Dogecoin-Like Bearish Shift in Momentum

Token That’s Literally USELESS Is Crypto’s Latest Meme Cult

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Silver Rate Forecast

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

2025-06-18 23:25