Ah, the world of cryptocurrency-a place where fortunes are made, lost, and occasionally found again under the couch cushions. Enter Sharps Technology, a company that has decided to jump headfirst into the Solana pool, cannonball-style. Their stock surged 70% after raising $400 million to build what they modestly describe as “the largest corporate digital asset treasury of Solana.” Modesty is clearly not their strong suit. 😏

- Sharps Technology’s stock went on a joyride, climbing 70% after announcing their grand plan to hoard SOL like it’s toilet paper during a zombie apocalypse.

- Alice Zhang, co-founder of Jambo, joined as CIO. Because nothing says “financial wizardry” like adding another acronym to your name. The Solana Foundation even chipped in, agreeing to sell $50 million worth of SOL tokens at a discount. Generosity or desperation? You decide. 🤔

- Digital asset treasuries (DATs) are popping up faster than mushrooms after rain, all hoping to replicate Michael Saylor’s bitcoin bonanza. Spoiler alert: most won’t. But hey, dreams are free! ✨

SOLSOL$196.75◢4.35%

BTCBTC$112,330.66◢1.80%

Nasdaq-listed Sharps Technology (STSS) saw its stock leapfrog through the atmosphere like an overcaffeinated kangaroo, hitting highs of $13 before settling down for a nap at 53% above Friday’s close. Not bad for a Monday morning! The funds will mostly go toward buying SOL, because apparently, there’s no such thing as too much Solana. Or coffee, for that matter. ☕

The Solana Foundation, ever the supportive parent, promised to sell $50 million worth of SOL tokens at a 15% discount. It’s almost like they’re running a Black Friday sale but forgot to tell anyone about the returns policy. 🛒

And let’s not forget the other players in this crypto circus. Galaxy Digital, Multicoin Capital, and Jump Crypto are reportedly trying to raise $1 billion for yet another Solana-focused treasury. Meanwhile, DeFi Development (DFDV), led by ex-Kraken execs, announced plans to raise $125 million. Unsurprisingly, their stock responded by tumbling 19%. Maybe someone should’ve warned them that “Monday” and “market-moving announcements” don’t always mix well. 📉

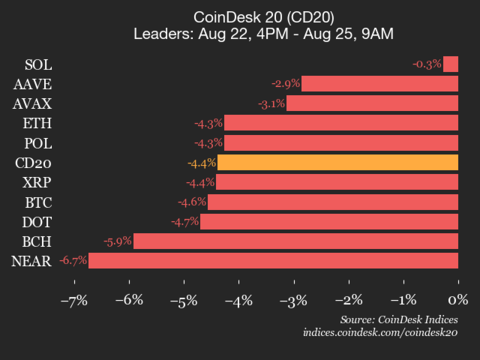

Aptos’ APT Falls 4% as Crypto Markets Retreat

Coinbase, Circle, Strategy, MARA Lead Crypto Stock Post-Rally SellOff

Crypto-Friendly Xapo Bank Hires Former FalconX Executive as Head of Relationship Management

BNB-Focused Treasury Firm B Strategy Looks to Raise $1B With Backing From CZ’s YZi Labs

CoinDesk 20 Performance Update: Uniswap Drops 11.3%, Leading Index Lower from Friday

Coinbase, Circle, Strategy, MARA Lead Crypto Stock Post-Rally SellOff

BitMine’s ETH Holdings Top 1.7M Tokens, With $562M of Buying Power Remaining

Michael Saylor’s Strategy Added 3,081 Bitcoin, Bringing Stack to Nearly 632.5K

Grayscale Moves to Convert Avalanche Trust Into Spot ETF

SOLSOL$196.75◢4.35%

BTCBTC$112,330.66◢1.80%

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

- You Won’t Believe What Binance Coin Did Next! 🤯💰

- USD GEL PREDICTION

- Doge Doomed?! 😱🐳

- Ethereum’s Fee Fiasco: When Blockchains Play Hard to Get! 🤡

- When Will the Long Traders Finally Give Up? 🤔

2025-08-25 19:14