Ethereum-or as I like to call it, the rollercoaster that never ends-is currently trading below what the experts call “major key levels.” But fear not, because the whales are here, and they’re shopping like it’s Black Friday at a dollar store. ETH is hovering around $2,895, down 9.5% this week, but who’s counting? Certainly not the whale who just dropped $56.13 million on 20,000 ETH like it’s a latte at Starbucks.

According to Lookonchain (yes, that’s a real thing), this same whale has hoarded 70,013 ETH in the past five days, totaling a cool $203.6 million. Because nothing says “I’m confident in the market” like buying enough crypto to buy a small island-or at least a really nice yacht.

As the market dips, whales continue buying $ETH on the drop.

OTC Whale (0xFB7) bought another 20K $ETH($56.13M) 6 hours ago.

Over the past 5 days, this whale has bought 70,013 $ETH($203.6M).

– Lookonchain (@lookonchain) January 26, 2026

Meanwhile, World Liberty Financial-a project backed by the Trump family, because of course-decided to swap Bitcoin for Ether. They traded 93.77 WBTC (worth $8.08 million) for 2,868 ETH. It’s like trading a steak for a salad, but with more zeros.

WLFI(@worldlibertyfi) is rotating from $BTC into $ETH.

About 6 hours ago, @worldlibertyfi swapped 93.77 $WBTC($8.08M) for 2,868 $ETH.

– Lookonchain (@lookonchain) January 26, 2026

Then there’s the “buy high, sell low” whale, who lives up to their name by selling 5,500 ETH for $16.02 million after buying 2,000 ETH just five days ago. It’s like watching someone buy a house at the peak of the market and then sell it for parts. Genius.

The “buy high, sell low” whale 0x3c9E panic-sold 5,500 $ETH($16.02M) at $2,912 over the past 3 days.

Just 5 days ago, he bought 2,000 $ETH($5.97M) at $2,984.

Once again: buy high, sell low.

– Lookonchain (@lookonchain) January 26, 2026

In other news, a wallet linked to Bitfinex woke up after nine years of hibernation to move 50,000 ETH (worth $145.25 million) to Gemini. No one knows why, but it’s probably just someone remembering they had a crypto wallet after cleaning out their junk drawer.

An #Ethereum OG whale wallet, 0xb5Ab (possibly linked to Bitfinex), deposited 50K $ETH($145.25M) into #Gemini today after being dormant for 9 years.

– Lookonchain (@lookonchain) January 26, 2026

Amid all this whale activity, ETH’s trading volume has spiked 250% to $350 billion. Because nothing gets the market going like a few billionaires playing hot potato with their digital assets.

Whales Are Hoarding ETH Like It’s the Last Roll of Toilet Paper

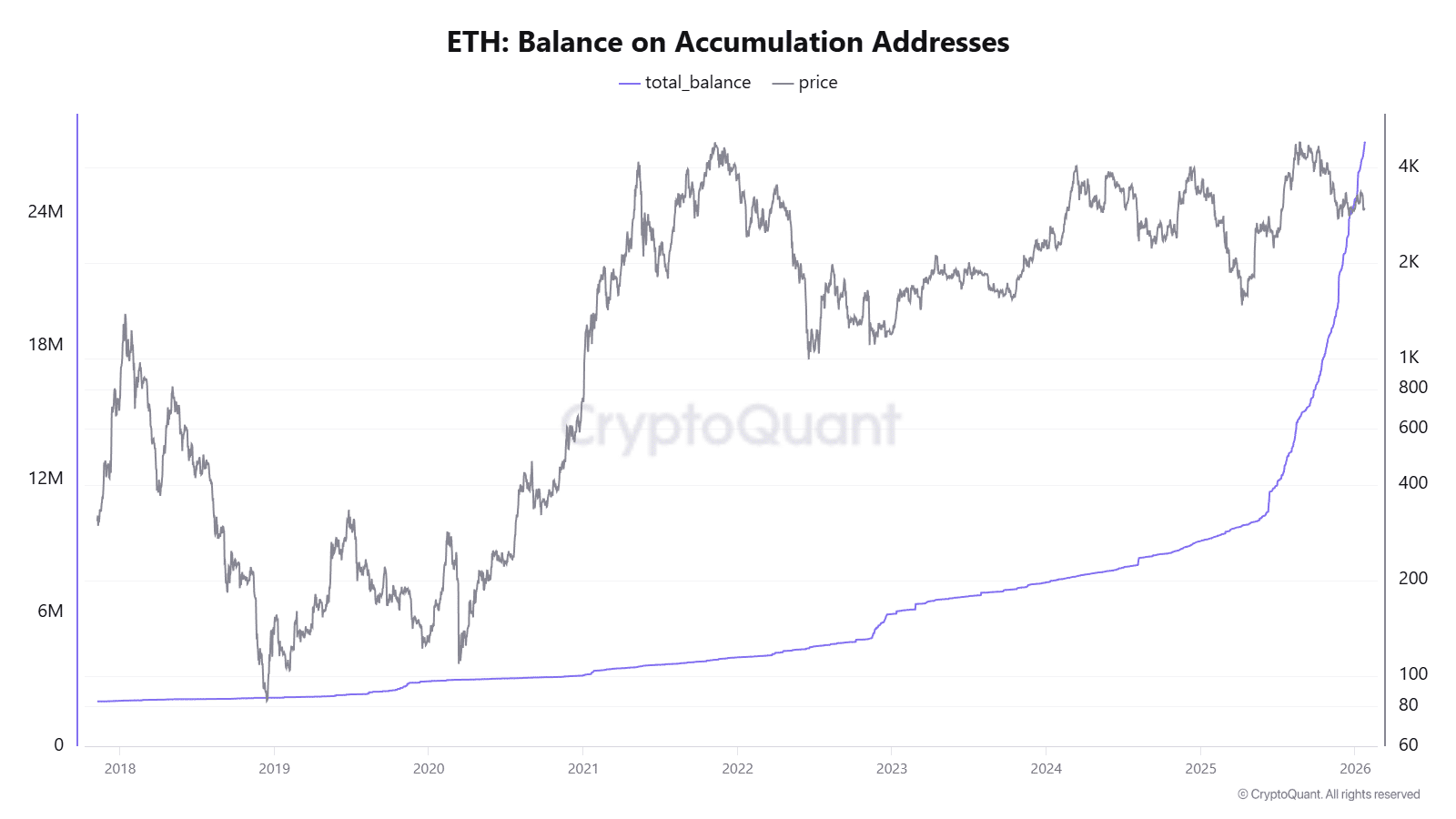

ETH is trading below its moving averages, but whales are stockpiling it like it’s the apocalypse. CryptoQuant data shows they accumulated over 350,000 ETH in a single day last week. Retail investors? Still sipping their coffee and wondering if they should buy more cat memes.

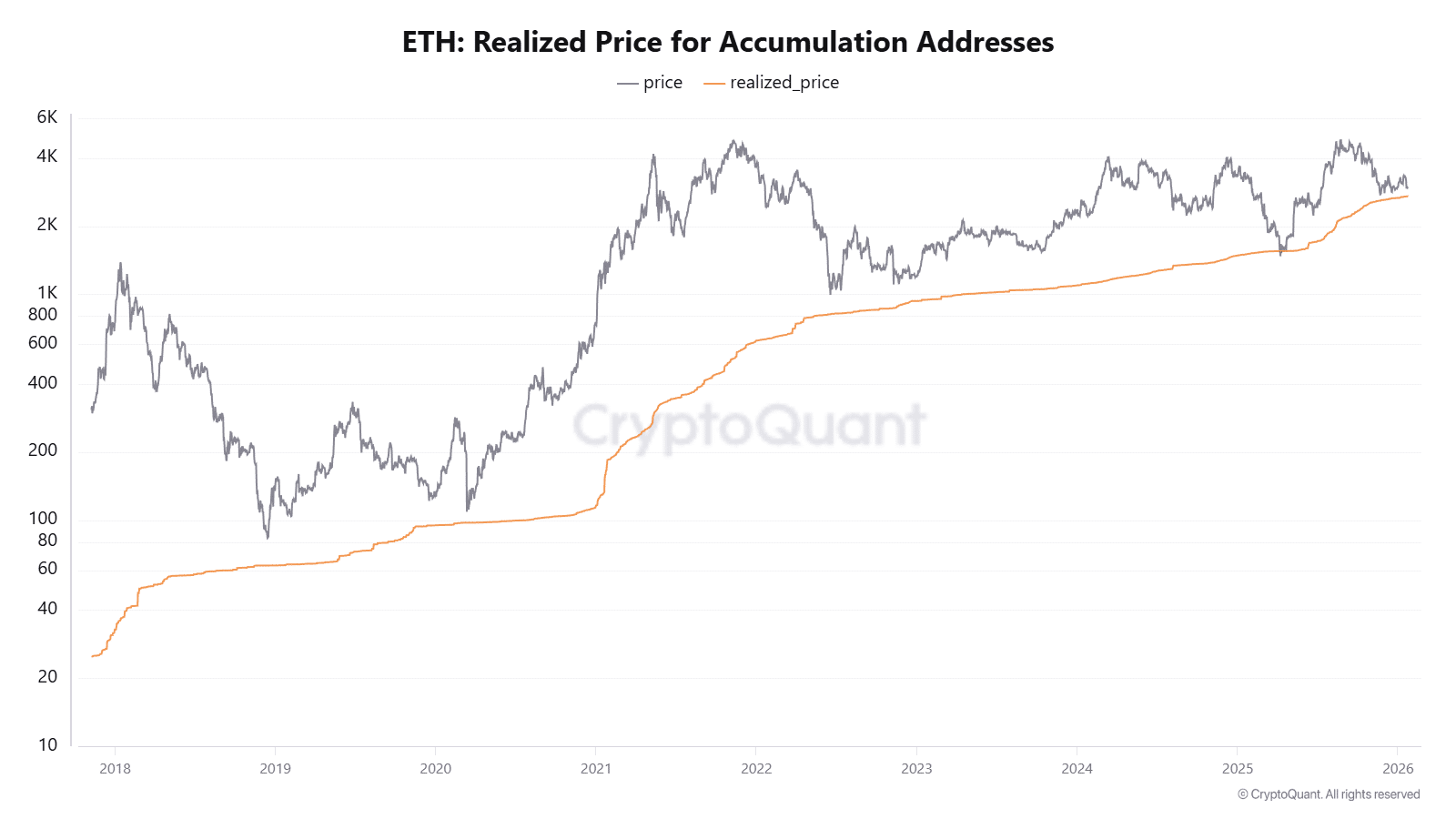

Ethereum’s realized price for accumulation addresses. | Source: CryptoQuant

Ethereum’s balance on accumulation addresses. | Source: CryptoQuant

According to a CryptoQuant analyst, this means whales are gearing up for an ETH rally while the rest of us are still trying to figure out how to pronounce “decentralized finance.”

Bitcoin Hyper: Because Bitcoin Needed a Makeover

In other news, Bitcoin Hyper (HYPER) is raising eyebrows-and $31 million-in its presale. The project aims to fix Bitcoin’s issues like slow transactions and high fees, because apparently Bitcoin needed a spa day.

Tokenomics of Bitcoin Hyper

- Current Price: $0.013635

- Staking APY: 38%

- Funds Raised So Far: $31M

With a Layer 2 network for faster transactions and a staking APY of 38%, Bitcoin Hyper is like Bitcoin’s cooler, younger sibling. If you’re into that sort of thing.

So, while ETH whales are busy playing Monopoly with their digital money, the rest of us are left wondering if we should buy the dip or just stick to our day jobs. Either way, it’s never a dull day in crypto-unless you’re the “buy high, sell low” whale. Then it’s just a day.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- EUR UAH PREDICTION

- USD RUB PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD IDR PREDICTION

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- TRX PREDICTION. TRX cryptocurrency

- Oh, The Places Litecoin Will Go! (Spoiler: To The Moon!)

2026-01-26 14:31