Imagine this: the venerable Western Union, that old relic of sending money in painstakingly slow ways, now declares with the flair of a carnival barker that it will launch a shiny new US Dollar Payment Token-dubbed USDPT-on the mystical blockchain of Solana by the bright mid-2026. Ah, progress! Or perhaps just another fancy toy for the tech jugglers to pretend they’re changing the world. 🎪💰

They say they will launch this marvel in the first half of 2026, as if predicting the future is a simple matter, much like forecasting the weather in a storm of cryptocurrencies. The stablecoin will be issued by Anchorage Digital Bank, which sounds like a bank for digital creatures-probably some sort of binary beast. It’s federally regulated, because of course it is, the government loves a little digital thrill now and then. The plan? Users will be able to access USDPT via partner exchanges-because nothing says trust like a bit of corporate dance amid the blockchain chaos. 🔗

Western Union claims this clever initiative will merge its worldwide digital footprint with Solana’s ever-enthusiastic blockchain tech, plus Anchorage Digital’s supposedly secure custody solutions. Think of it as a digital salad-fresh, mixed, and served with a side of skepticism. 🥗🤨

Global Cash Access Through Digital Assets (Or How to Turn Crypto into Store-Bought Fear)

In a move that surely will warm the heart of every money-hungry libertarian, Western Union unveiled a “Digital Asset Network”-a fancy way of saying they’ll help you turn your crypto into good old fiat money at their retail locations worldwide. Because what good is digital wealth if you can’t spend it at the corner store while buying a questionable hot dog? 🌭💸

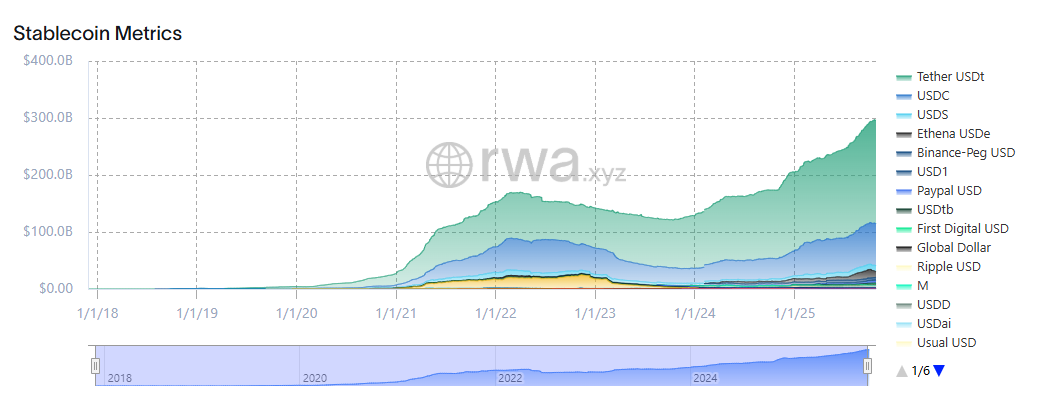

Stablecoin metrics | Source: RWA.xyz

Meanwhile, the stablecoin universe is booming, hitting a staggering $4.30 trillion in monthly transfer volume-probably enough to buy a small country-up 35.68% in just a month. Monthly active addresses? Up 20.89%, reaching nearly 33 million-because everyone wants a piece of this digital pie. Pie, or perhaps just crumbs? 🍰

Tether, still king of the hill (or perhaps throneless in this chaotic realm), proudly holds a market cap of $179 billion-controlling just over 60% of the sector. Circle trails behind with a modest $73 billion and roughly a quarter of the market. The old guard keeps marching forward, unbothered by flashier newcomers. 👑

Big Boss Says Regulation Is the Secret Sauce

Devin McGranahan, the CEO of Western Union, waxes poetic about their brand new stablecoin plans, claiming the move is a stroke of genius sparked by “regulatory shifts.” Or maybe just the need to keep their heads above water as they suffer a 6% revenue dip in the first quarter. Blame it on the bad karma of traditional finance, or maybe just viral TikTok dances. Anyway, the new plan is apparently to own the economics of stablecoins-whatever that means-while the world watches skeptically from the sidelines.

Coincidentally, as Western Union plans to get its crypto paws wet, the NYSE launched Bitwise’s $BSOL, the first US spot Solana ETF-because why not add a touch of stock market glamor to the blockchain circus? And so the saga continues, promising both hope and chaos, all wrapped in a shiny digital package.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- Brent Oil Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- Will Bitcoin’s “Uptober” Bewitch Us with Crypto Sorcery? 📈🔮

- You Won’t Believe What Bitcoin Whales Are Doing—And How It Could Wreck the Market 🚨

2025-10-29 01:40