Well, well, well-Bitcoin‘s comfortably lounging around the $111,000 mark, just waiting for the weekend to arrive. But don’t get too comfortable, darling, because with liquidity on the verge of disappearing faster than a good bottle of champagne at a party, volatility is about to take the stage. 🍾📉

Hold onto your hats, darlings!

Let’s dive straight into the five price zones that are more dramatic than a West End play.

-

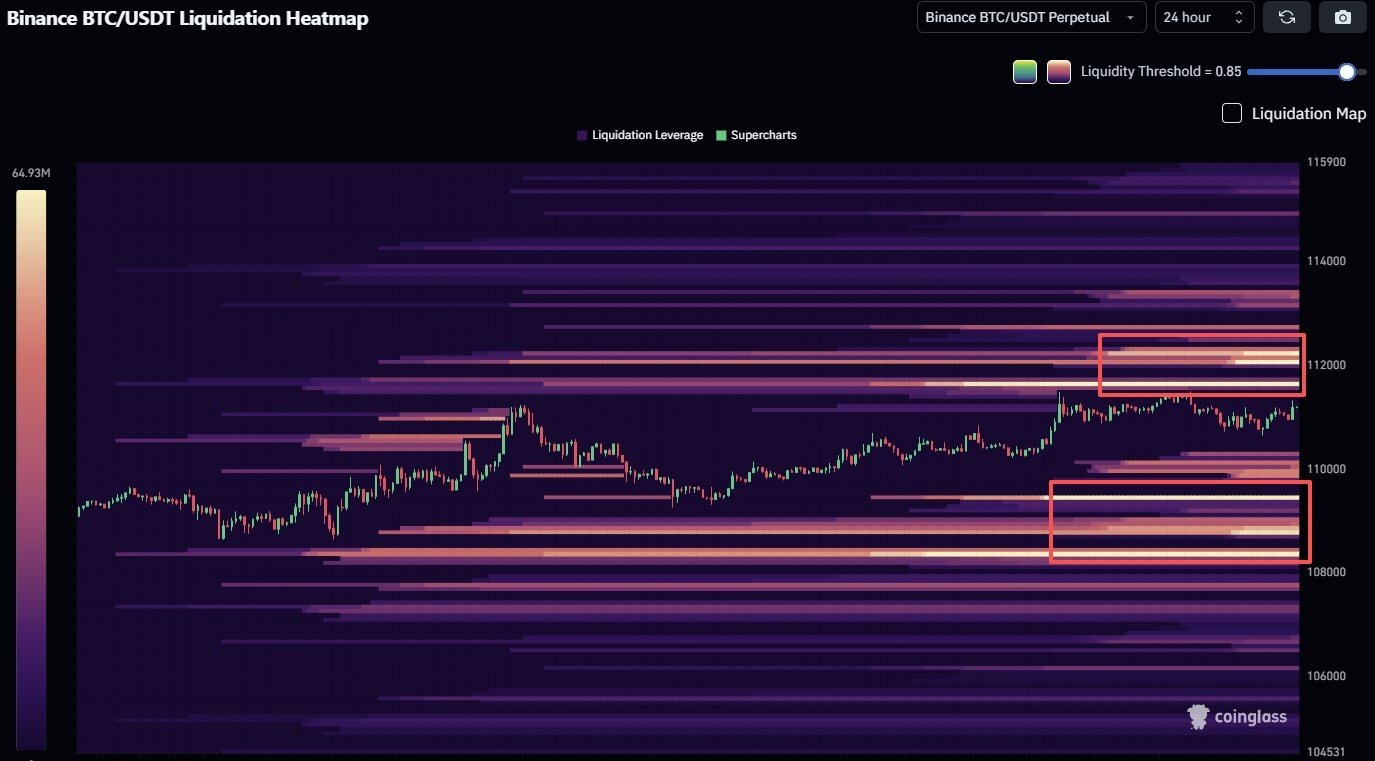

The Major Downside Liquidity Pool: Ah, the $108,000 to $108,500 range. This is where Bitcoin’s greatest hits of long liquidations come to play. Should Bitcoin take a tumble below this mark, expect a delightful rush toward $108,000. A level that has, quite frankly, saved Bitcoin’s behind a few times. But if it’s breached? Brace yourself for a bit of a crisis-nothing too serious, just a bit of fun, you know?

-

$110,000 (The Weekend Pivot/Neutral Zone): Here we are, at the crossroads of liquidity. Stay above this, and Bitcoin’s as calm as a Sunday afternoon. Fall below it, however, and you’ll see a liquidity sweep into the $108,000 zone-good luck with that one, darling.

-

The Short Liquidation Zone: Between $111,500 and $112,000, there’s a bit of short-selling drama. This is where short positions tend to congregate, like a group of theatre critics waiting for the curtain to rise. Should Bitcoin breach $112,000 again, expect fireworks-liquidations galore, darling!

-

$113,000 to $113,500 (Resistance Area): Oh, the suspense! This is where the next battle will unfold. Watch for possible profit-taking or a surge in short pressure if the weekend decides to throw a curveball. Hold onto your monocle.

-

$114,500-$115,000 (Short Cluster at High Risk): The grand finale of this weekend’s performance. This zone is positively dripping with short liquidations. If Bitcoin breaks through, we could see prices soar faster than a champagne cork popping at a New Year’s Eve party-towards the tantalizing $118,000 to $120,000 range.

So, what’s the takeaway, darlings? Bitcoin’s stuck in the middle of moving averages, and the market is being rather cautious-probably because it knows what’s coming. Over the weekend, expect sharp, liquidity-driven wicks. And with those precious Saturday and Sunday sessions often seeing thin order books, these zones could turn into flashpoints for short squeezes and liquidation cascades. In other words, expect the unexpected-and hold onto your hats, my dears. 🎩

Read More

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Crypto Cowboy Fights Back: CZ Tells WSJ to Take a Hike! 🚀😏

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Crypto Investors Laughing All the Way to the Bank, But They’re Not Selling Yet!

- Gold Rate Forecast

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Whale of a Time! BTC Bags Billions!

2025-10-24 17:02