If you blinked, you missed it: the grand parade of America’s largest companies went clattering past the previous record, with investors clinging on like children atop a runaway, golden goose.

S&P 500 Soars While Bitcoin Nibbles Its Nails

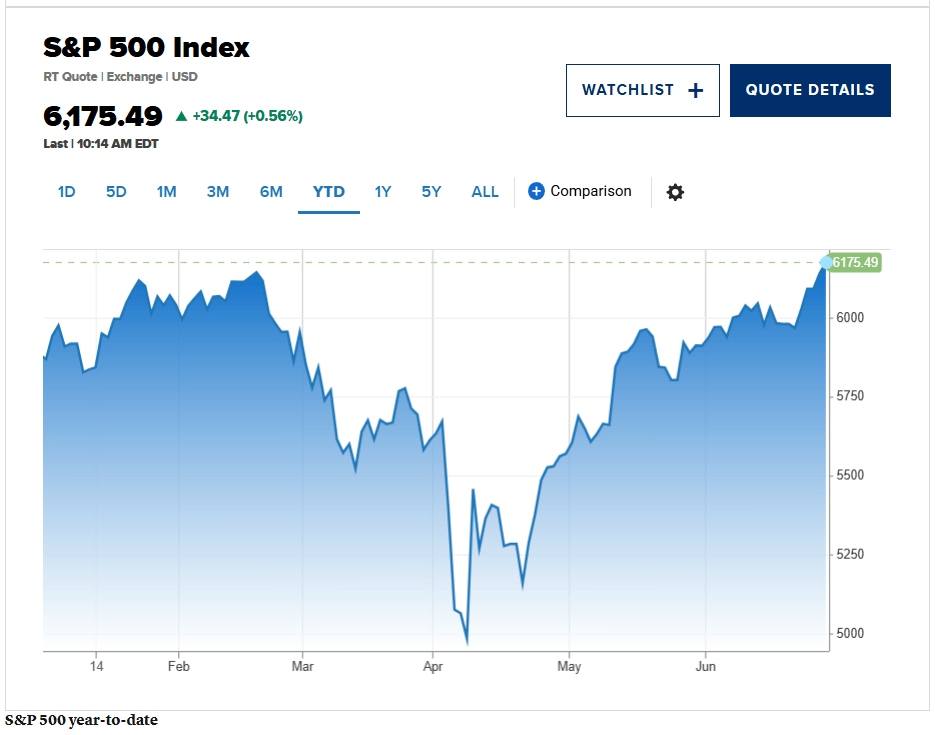

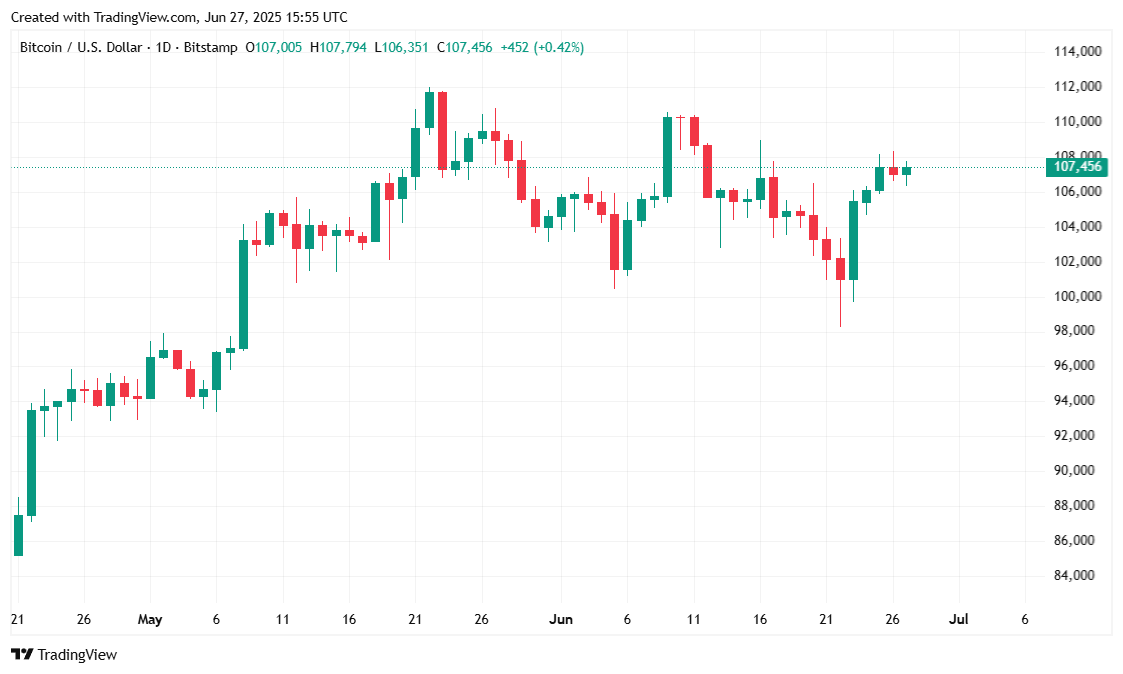

Tick-tock-tick went the S&P 500, shimmying up to 6,178 like a circus acrobat who’s had one cup too many of espresso. Forget the last record of 6,147.43 set four months ago—that’s yesterday’s stale cabbage. Meanwhile, poor old bitcoin—our digital daredevil—sat glumly in the corner, peeking shyly from behind $107,000 like a child who’s just seen the school headmaster. Turns out, even crypto prefers to stay in bed when wars are afoot. 💤💰

Wall Street’s bash didn’t stop: the Nasdaq spun up a new high, not wanting to be a wallflower, and even Dow joined in. Up half a percent here, nearly a percent there—investors were clearly sipping something fizzy. 📈✨

Economists, poor things, scrambled about like startled hens trying to justify why the market’s so perky when the world looks like a Tim Burton sequel. Inflation? Tariffs? Wars? Trump wagging his finger about interest rates? Pah! None of it stopped the party, though apparently the crypto crowd got the wrong invitation—they were already down 0.78% according to Coinmarketcap, probably still looking for the dance floor.

Experts wagged their fingers at a big, shiny trade deal between the U.S. and China, plus the tantalizing promise of even more “top ten deals,” as though Wall Street were at a fast food counter ordering up another tray of profits.

U.S. Secretary of Commerce Howard Lutnick, in an interview that would make Willy Wonka proud, spilled the beans: “We’re going to announce a whole bunch of deals over the next week or so.” So many deals! Like multicolored gobstoppers—one for everyone!

Willy Wonka’s Market Metrics—Snap Quiz!

Bitcoin muddled about between $106,449.99 and $107,973.65, finally sitting on $107,012.78. Up a mere sprinkle—0.06% since yesterday, but 2.51% up for the week. Not exactly chocolate river stuff, but respectable. Even so, trading volume plopped down by 2.81% to $43.5 billion, possibly because traders finally decided they needed a nap.

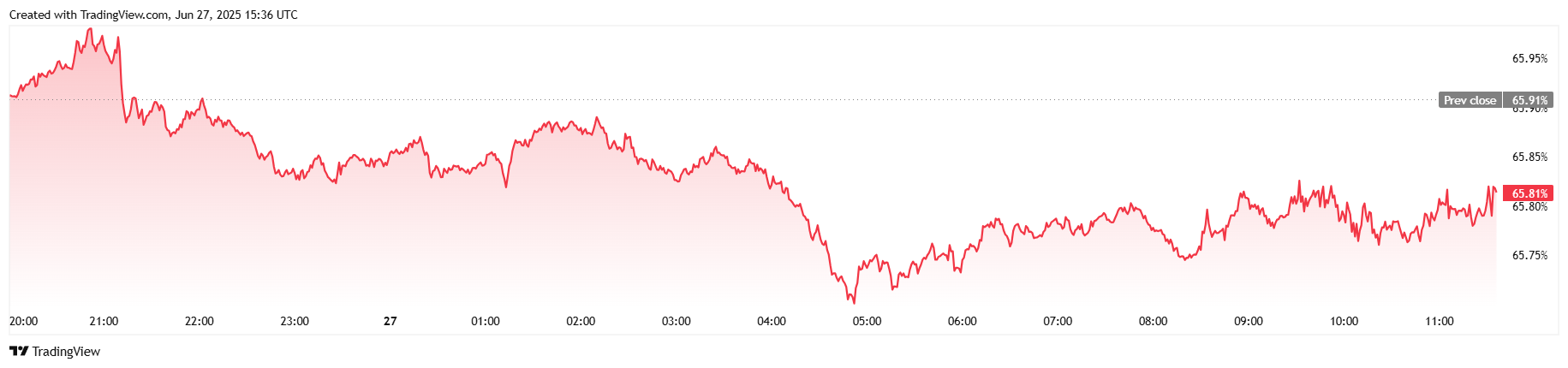

Bitcoin’s market cap puffed itself up to $2.12 trillion, inching 0.09% higher. Dominance, however, shrank a smidge to 65.81%—it’s tough being top banana all the time.

As for the futures market? Interest fizzled by 3.39%, sliding to just $71.04 billion, as traders hedged their bets (and perhaps their bedsheets). Liquidations in the last 24 hours hit $23.01 million—half the rooms betting bullish, the other half betting bearish, neither side willing to clean up the mess. It’s a seesaw worthy of the Twits. 🎢🐍💸

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Gold Rate Forecast

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin’s Bouncy Castle? 🚀

- Dogecoin’s Wild Ride: Will It Bark or Bite? 🐶💰

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

2025-06-27 19:58