Welcome to the Asia Pacific Morning Brief-an indispensable digest of overnight crypto absurdities that may or may not shape regional markets. Pour yourself a regrettable green tea and brace for impact. ☕

Vietnam, in a delightful display of economic bravado, launches an international financial center featuring a crypto exchange pilot program-because nothing says “financial stability” like experimental blockchain gambits. Meanwhile, Bakkt, in a stroke of originality, enters Japan by slapping “bitcoin.jp” on an acquisition like a fresh coat of paint on a crumbling façade. Chainlink, ever the show-off, dangles real-time US equities data before DeFi degenerates, while Nomura’s Laser Digital wins Dubai’s “Most Crypto-Friendly License of the Week” award.

Vietnam: Where Crypto Dreams Meet Regulatory Sandcastles 🏖️

In a move that surely won’t end in tears, Vietnam’s Prime Minister Pham Minh Chinh announced the grand unveiling of an International Financial Center by year-end 2025-because if there’s one thing the world needs, it’s another venue for digital asset speculation. Deputy Governor Pham Tien Dung, with the enthusiasm of a man who’s just discovered PowerPoint, revealed Vietnam’s “comprehensive legal foundations” for digital assets-foundations presumably built on hope, blockchain buzzwords, and very forgiving auditing standards.

The Digital Technology Industry Law, passed in June 2025, graciously acknowledges that crypto assets are, indeed, not virtual assets-a distinction as meaningful as arguing whether a croissant is bread or pastry. The Ministry of Finance, meanwhile, submitted a “pilot resolution” for crypto trading floors-a polite way of saying, “Let’s see what happens when we light this fuse.”

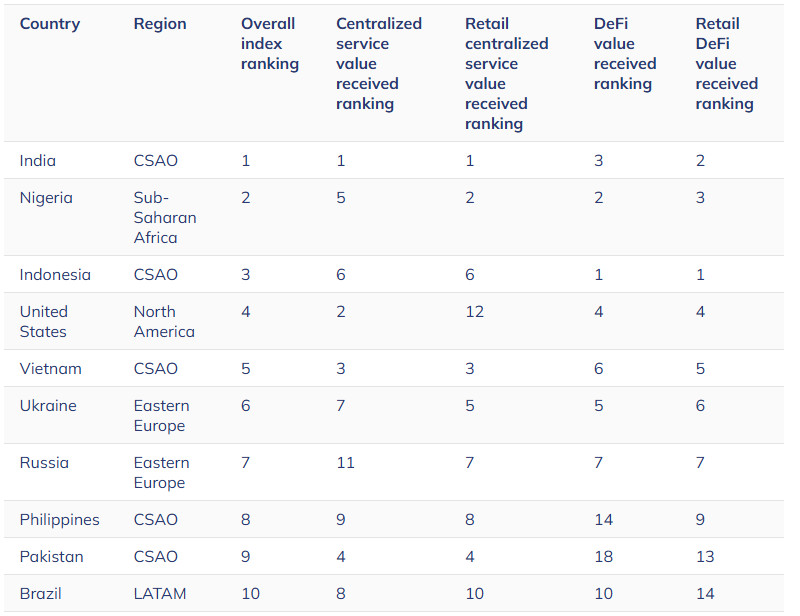

Vietnam boasts a staggering 21.2% crypto ownership rate, meaning roughly 21 million citizens have entrusted their financial futures to digital tokens whose value fluctuates like a caffeinated squirrel. The “regulatory sandbox”-a charming euphemism for “controlled chaos”-will operate in Ho Chi Minh City and Da Nang, presumably because these cities haven’t suffered enough. South Korea’s Upbit is already sniffing around, because nothing attracts venture capital like a hastily assembled regulatory framework.

Bakkt’s Japanese Reinvention: Bitcoin.jp or Bust 🎌

Bakkt Holdings, in a desperate bid for relevance, has acquired a 30% stake in Tokyo-listed Marusho Hotta-a company so obscure even its shareholders had to Google it. The grand plan? Rebranding it as “bitcoin.jp” because originality is so 2024. Phillip Lord, President of Bakkt International, will now serve as CEO-a promotion presumably earned by successfully convincing investors that Bitcoin treasury strategies are anything but glorified gambling.

Bakkt co-CEO Akshay Naheta hailed Japan’s regulatory environment as “ideal,” which roughly translates to “compliant enough not to land us in jail.” The move follows Bakkt’s recent $75 million equity raise and $1 billion shelf offering-financial maneuvers best summarized as “throwing good money after bad.”

Chainlink’s New Toy: Real-Time Data for DeFi’s Gamblers 📉

Chainlink, ever the enabler, has unveiled Data Streams for US equities and ETFs-bringing institutional-grade pricing to blockchain networks where lunatics leverage farm their life savings. The service claims “sub-second latency,” which is impressive, given most DeFi protocols still struggle with basic arithmetic.

The infrastructure includes “market hours enforcement” (because apparently DeFi needed a bedtime) and “staleness detection” (presumably to filter out weekend trading strategies conceived after one too many martinis). Protocols like GMX and Kamino have already integrated the streams-because when you’re already knee-deep in perpetual futures, why not dive headfirst into tokenized NVIDIA?

JUST IN: Chainlink launches Data Streams for U.S. equities & ETFs

Real-time, institutional-grade pricing for tokenized RWA across 37 blockchains.#RWA going full institutional.

– Real World Asset Watchlist (@RWAwatchlist_) August 4, 2025

Chief Business Officer Johann Eid, with the gravitas of a man who’s never lost money in DeFi, declared the launch enables “production-ready tokenized financial products”-a phrase that sounds impressive until you realize “production-ready” in crypto means “hasn’t exploded yet.”

Nomura’s Laser Digital: Dubai’s Latest Crypto Plaything 🎲

Laser Digital, Nomura’s crypto subsidiary-because even stodgy banks need a little danger-secured Dubai’s first regulated OTC crypto options license. This makes them the first VARA-regulated entity to offer client-facing OTC options-a distinction roughly equivalent to “first person to jump into a pool of sharks wearing a meat suit.”

Dubai’s crypto-friendly regulations continue attracting big players like Coinbase-owned Deribit-because when you’ve exhausted all other jurisdictions, why not set up shop in a desert tax haven? Chief Product Officer Johannes Woolard praised VARA’s “flexible execution,” a bureaucratic euphemism for “we’ll look the other way-for a fee.” Laser Digital will focus first on major crypto tokens-because if you’re going to court disaster, you might as well do it with Bitcoin.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Silver Rate Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

2025-08-07 04:17