Ah, the United States—a land of innovation, ambition, and now, apparently, Bitcoin hoarding. The nation’s crypto enthusiasts are pacing like expectant fathers as a pivotal policy report looms on the horizon. This document, set to emerge before the month’s end, may well determine whether digital assets become America’s new gold—or just another footnote in history.

The Working Group: Masters of Delay (and Deadlines)

According to an X post by Bo Hines, the President’s Digital Asset Working Group has wrapped up its 180-day study—a task so monumental it required nearly half a year of deep thought, coffee breaks, and possibly even heated debates over lunch menus. Their findings will grace us with their presence on July 30. Yes, dear reader, mark your calendars. The wait is almost over.

Rumors had initially placed this grand unveiling around July 22, following an executive order issued by none other than US President Donald Trump himself. His decree tasked the group with crafting a blueprint for something called a “Strategic Bitcoin Reserve.” Sounds impressive, doesn’t it? Like a vault from a James Bond movie, but filled with cryptocurrency instead of gold bars.

This mysterious report promises to reveal how much Bitcoin Uncle Sam currently owns. Spoiler alert: these coins were not purchased at a Black Friday sale but rather confiscated through various law enforcement operations. One wonders if there’s a government spreadsheet somewhere titled “Ill-Gotten Gains Turned National Treasure.”

A Reserve or Just a Pile of Coins? 🤔

Will this stash remain a mere curiosity, or will it evolve into a full-blown reserve worthy of international awe (or ridicule)? Policy experts and investors alike are chewing their nails down to the quick awaiting answers. Early whispers suggest the document will delve into the practicalities of establishing such a fund. Apparently, they’ll start by using seized coins because why not put those ill-gotten treasures to good use?

And then comes the fun part: budget-neutral methods for acquiring more Bitcoin. Imagine bureaucrats shuffling funds between accounts like magicians performing sleight-of-hand tricks—all in pursuit of additional BTC. There’s talk of tapping into nearly 200,000 BTC already captured by authorities. Security, storage, and audits will also take center stage since guarding a national treasure requires more than just a padlock and crossed fingers.

The executive order hints that only legally obtained coins will make the cut—which begs the question, what exactly qualifies as “legally obtained” when dealing with cryptocurrency? Furthermore, drafts mention a potential 20-year holding period for stability. A noble idea, though one can’t help but wonder if anyone considered the volatility of Bitcoin during that timeframe. Perhaps they assume it will behave itself after two decades of captivity.

Congress Joins the Circus 🎪

Meanwhile, Congress refuses to sit idly by while the executive branch hogs all the attention. President Trump recently signed the GENIUS Act, which sets guidelines for banks, credit unions, and trusted non-banks to issue stablecoins. Yes, you read that correctly—stablecoins. Those boring cousins of Bitcoin might finally get their moment in the spotlight.

Not to be outdone, the Senate Banking Committee introduced a bill aimed at clarifying who’s boss in the crypto world—the SEC or the CFTC. Ah, regulatory turf wars—the stuff of legends. Meanwhile, Senator Cynthia Lummis reintroduced the BITCOIN Act, which proposes directing the Treasury to purchase 1 million BTC over five years. Clearly, she believes in going big or going home.

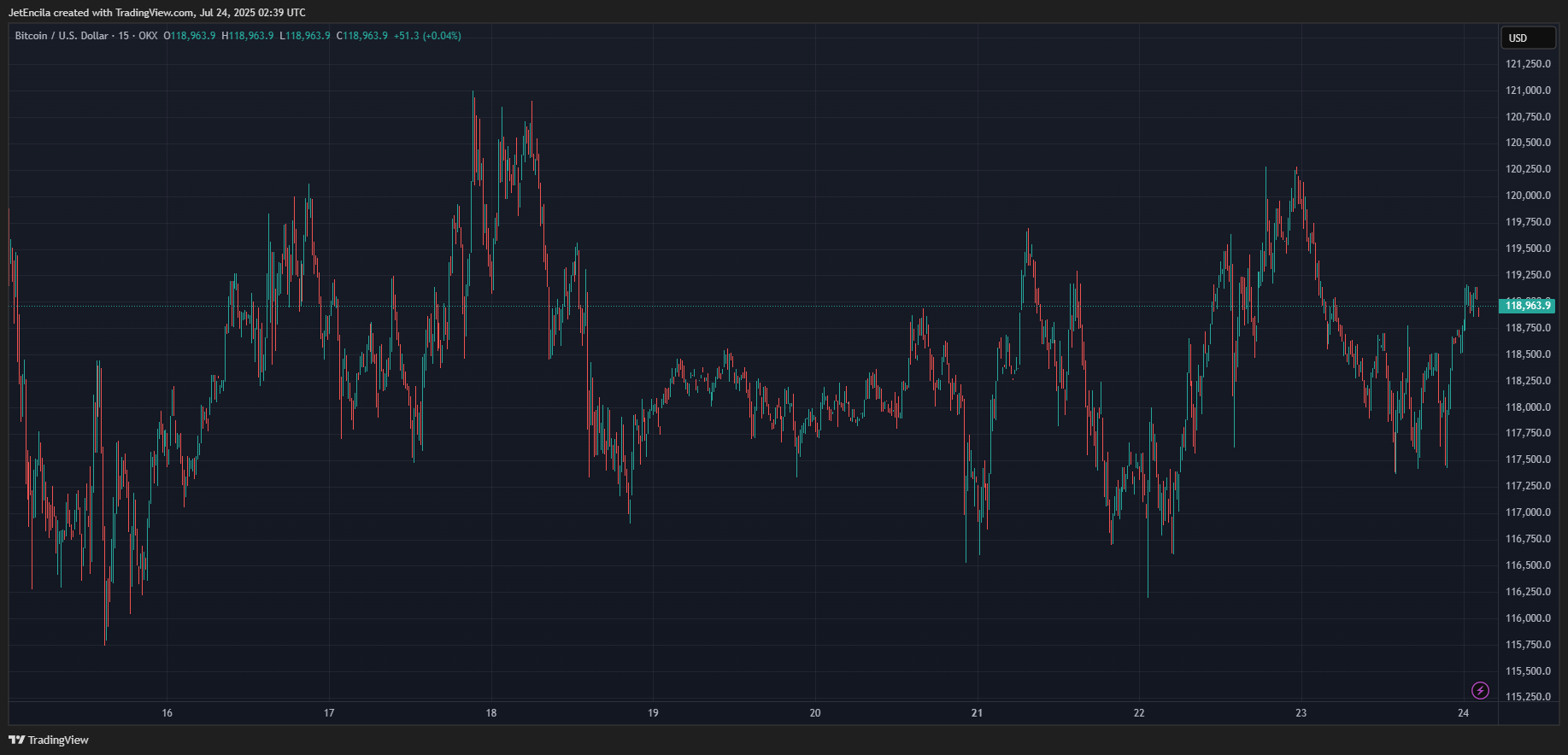

Investors see dollar signs (or should we say Bitcoin symbols?) dancing before their eyes if both branches align in favor of digital assets. Increased government buying could send demand soaring—but let’s not forget the risks. Volatility remains Bitcoin’s middle name, and securing such a volatile asset carries costs that could make even the most frugal accountant cringe.

So, dear reader, prepare yourself for the spectacle ahead. Will Bitcoin rise to glory under governmental stewardship, or will this experiment collapse under its own weight? Only time—and perhaps a few congressional hearings—will tell.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Bitcoin Billionaire’s Bizarre Stock Scheme: Will It Collapse or Conquer? 🤔

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- 🚨 Senate Drops Crypto Bill: CFTC to the Rescue? 🚨

2025-07-24 06:25