If there was a medal for underachieving, “Made in USA” coins would be polishing it right now. All five leading US-centric crypto assets have managed to be down at least 20% since January 20—roughly the same rate of descent as a lead duck in a thunderstorm. Not even the glow of a “crypto-friendly” administration and regulatory relief could save the day. 😬

Meanwhile, far from the puritan shores of Uncle Sam, non–USA coins such as Bitcoin and TRON seem to have packed umbrellas and sensible shoes. They mostly shrugged off the storm, even while Ethereum and Dogecoin managed to slide down the stairs with the grace of a sack of potatoes. Clearly, global coins have remembered to read the fine print on the economic weather forecast—“tariffs may cause sudden loss of value.”

America’s Crypto: A Comedy of Errors, Now With 20% More Downturn!

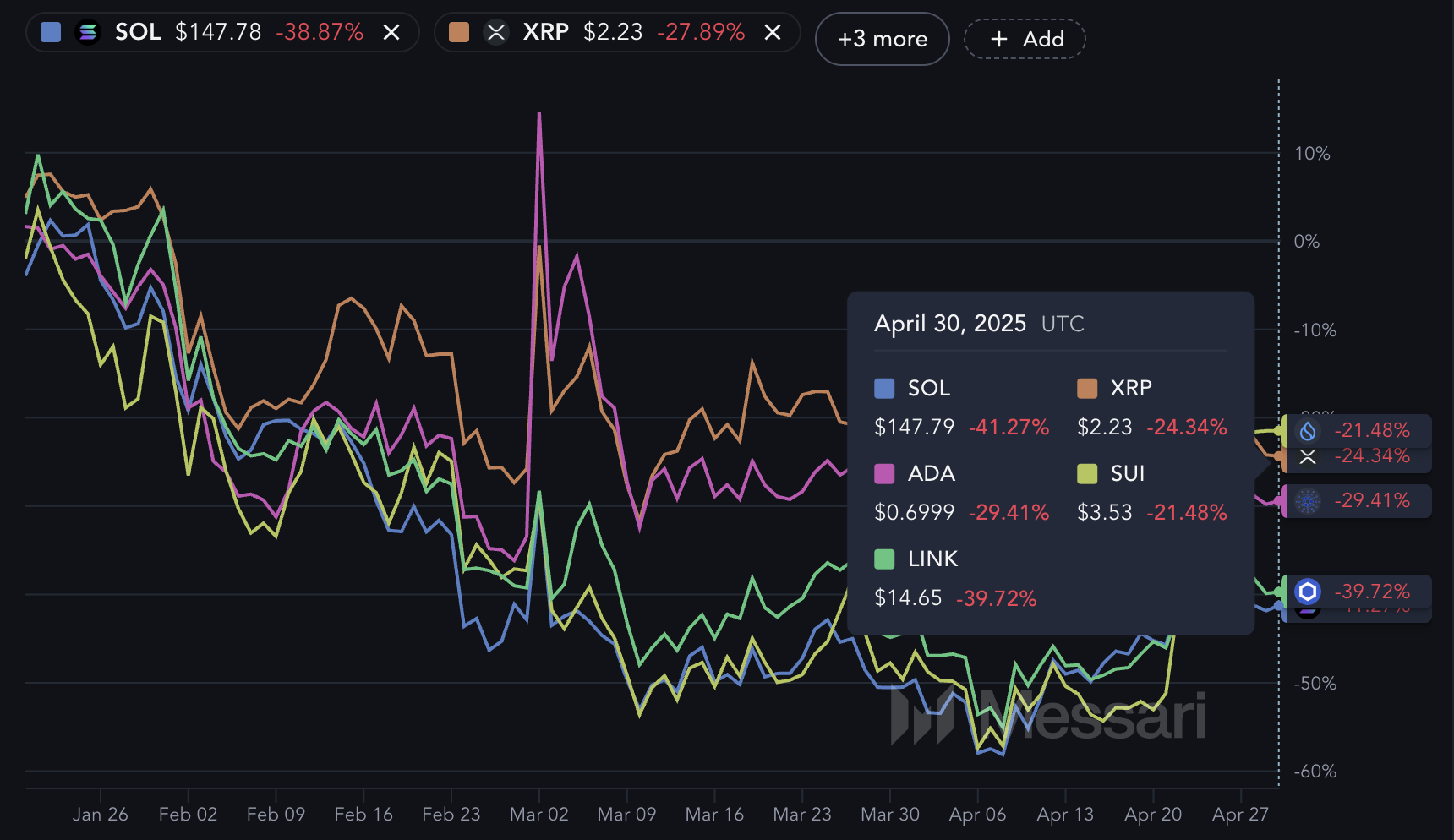

The top five “Made in USA” coins have tumbled a minimum of 20% since the Trump era’s carnival tent went back up on January 20. Sure, there have been flashes of optimism—meaning, less doom and gloom than expected—but the tape measure of history still reads: “downhill, fast.” Expectations of a sunlit, conveniently deregulated crypto paradise? More like British summer: theoretically possible, never spotted in reality. 🌧️

Poor Solana (SOL), for example, has charted a course best described as “spiral-shaped,” dropping over 41% despite bravely rallying more than 18% in the past 30 days. By now, SOL’s recovery efforts resemble the frantic paddling of a duck whose legs have fallen asleep.

SUI, in a rare display of nonchalance and meme-fueled motivation, has actually rallied 58%. Apparently, when people trade meme coins, utility is optional but volume is mandatory. SUI is now the fifth-largest chain by DEX activity, presumably celebrating with cake and an overworked server.

ADA, LINK, and XRP are like students who finally studied in the last week before finals. They gained between 7% and 10% in the past month, perhaps because everyone was too distracted to notice. Still, they’re all down more than 24% since inauguration day. Ouch.

If you thought “Trump’s Return: The Crypto Musical” would have a rousing first act, well, it’s less Broadway smash, more experimental mime. SEC boss Paul Atkins has dropped more cases than a butter-fingered barrister, but tariffs are still lurking, grinning like carnivorous luggage.

Sadly, trade policies continue to blow cold wind through the dessert tent of US-linked crypto optimism. And no, there is no cake. Only spreadsheets. 📉

Non–USA Coins: Fewer Losses, Fewer Family Arguments

Elsewhere, among coins that don’t boast stars, stripes, or a distinct appreciation for lengthy regulatory testimony, life is—if not good—at least less disastrous. ETH has fallen 43%, which is a lot, unless you’re DOGE, which took a nosedive of nearly 51%. That was less “to the moon” and more “to the sub-basement.”

Still, other big names kept their heads. Bitcoin (BTC) managed to lose just 6%. For Bitcoin, this counts as winning the marathon by tripping slightly after the finish line. BNB slipped by a modest 12%. Apparently, Binance is proof that spending enough time on airplanes makes you inflation-proof. ✈️

Zoom in—the last 30 days are less of a slapstick farce. Bitcoin is up 16%, neatly dodging drama. DOGE is also up 7%, which it attributes to memes and possibly divine intervention. BNB and ETH, meanwhile, are doing an impression of a middle manager: mostly flat. TRON (TRX) emerges as the only top coin outside the US crypto sandbox to post actual gains in both the long and short term—up 7.5% over 100 days. Someone give them a gold star, or at least a working wallet.

In short, while US-linked coins keep trying (and failing) to dance in the rain, global coins have mastered the art of wearing galoshes. Even with ETH and DOGE taking nosedives that would impress a Discworld assassin, the group still outperformed Team “Made in USA.”

Apparently, sometimes policy tailwinds are just a nice way of saying, “hold on to your hat.” 🎩

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- XRP: The Calm Before the Storm?

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Brent Oil Forecast

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- Bitcoin’s Dramatic Dive: A Comedy of Errors and Accumulation! 💸😂

- Silver Rate Forecast

2025-04-30 21:32