Oh, the drama! The charts are throwing a tantrum, and the market’s like, “What’s the deal, Uniswap? Can’t you make up your mind?” 🧐 With volume and momentum indicators doing the cha-cha, traders are sweating bullets, wondering if support levels will hold or if resistance will slap them back down. Spoiler alert: the daily chart’s like, “Brace yourselves, a pullback is coming!” 🌪️

Weekly Chart: The $10.85 Resistance Strikes Back! ⚔️

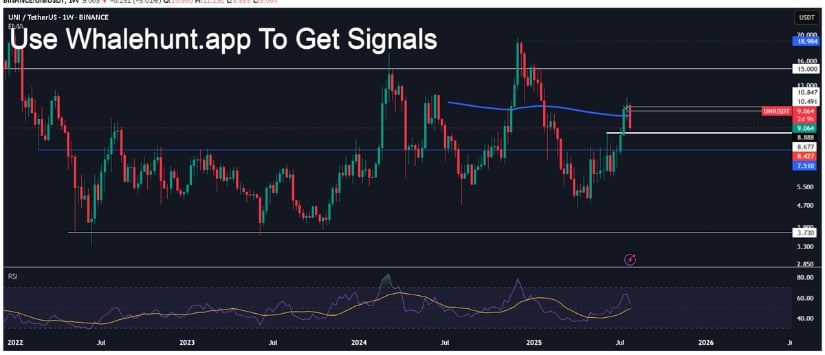

Behold, the weekly Uniswap (UNI/USDT) chart—a tale as old as time! 🕰️ That pesky horizontal resistance band between $10.49 and $10.85 is back, like a bad sequel. It rejected price advances in mid-2022, early 2024, and now it’s like, “Third time’s the charm?” 🤷♂️ UNI’s recent surge brought it back to this cliffhanger, hovering around $9.06. But the latest weekly candle’s like, “Uh-oh, momentum’s fading. Rally, schmalley!” 😓

The RSI’s like, “I’m overbought, but now I’m edging down. Bullish energy? More like bullish exhaustion!” 💤 A dip below $9.00 could trigger a retreat to support zones at $8.42 and $7.51—the old consolidation hangout spots. And the 200-week EMA? It’s acting like a bouncer at the resistance club, keeping bulls in check. 🚷

Analyst Andrew Griffiths is cautiously long, like a tightrope walker with a safety net. 🕸️ He’s eyeing a potential decline in market dominance as a short-term hiccup but thinks UNI could go full bull if it breaks above $10.85. Until then, it’s rejection city, baby! 🚫

Intraday Action: Volatility’s Here, But Confirmation’s on Vacation! 🏖️

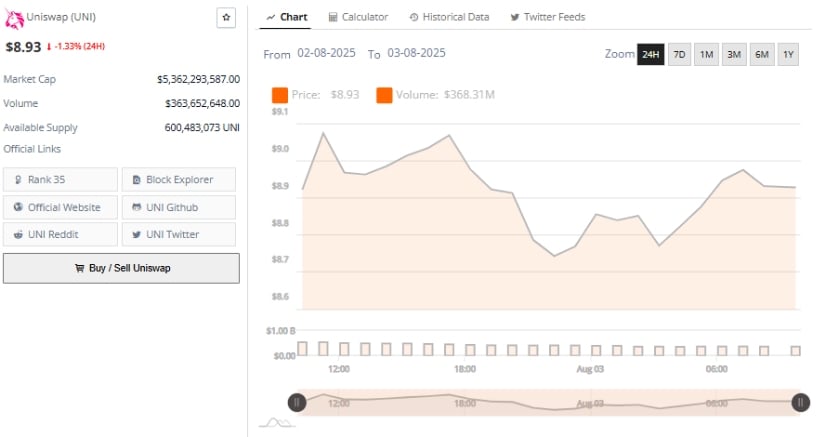

On the 24-hour chart, UNI started with a bullish pep in its step, hitting $9.05. But then resistance was like, “Not today, buddy!” and it slid back to $8.75. No panic selling, just a chill correction. 🧊 Mid-session, UNI entered a sideways siesta between $8.75 and $8.85, with tiny bounces that screamed, “Buyers, where you at?” 🤔 But no dice—it stayed below $9.00, like a kid grounded from dessert. 🍰

Volume was steady but meh, like a party with no snacks. 🥱 Toward the close, UNI bounced to $8.95, ending with a 1.33% decline. Late-stage rebound? Sure, but it’s like putting a band-aid on a bullet wound. 🩹 Stronger momentum needed, STAT!

Momentum Indicators: Consolidation Station, Population: UNI 🚉

The daily chart’s a retracement rollercoaster from July’s $11.68 high, now chilling at $8.94. Red candles? Check. Short-term bearish control? Double-check. But Thursday’s green candle (2.12% gain) whispers, “Hey, $8.60–$8.70 support zone, you’re looking kinda stable.” 🌈

Momentum indicators are like a soap opera. CMF’s at 0.02, slightly above neutral—mild capital inflows, like a tip jar at a coffee shop. ☕ BBP’s negative at -1.530, with sellers in the driver’s seat. But if CMF keeps rising while BBP chills, we might just test resistance again. Stay tuned for the next episode of *Uniswap: The Chart Wars*! 🎬

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- PLUME: 60% Down?! 😱

- USD THB PREDICTION

- When Will the Long Traders Finally Give Up? 🤔

- USD GEL PREDICTION

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- Ethereum’s Fee Fiasco: When Blockchains Play Hard to Get! 🤡

2025-08-04 00:13