Ah, the grand world of crypto. Uniswap’s price is doing its best impression of a sloth after a double espresso-slow, steady, and entirely disinterested in making a move. With volatility taking a coffee break and traders’ enthusiasm dropping faster than a Wi-Fi signal in the middle of the desert, it looks like UNI is in the midst of an existential crisis, waiting for its next big idea.

Open Interest Plummets-Like That One Friend Who Always Bails Last Minute

Uniswap was hanging out near $6.07, which is a far cry from the glorious $8 range it briefly flirted with earlier this week. But don’t get too comfortable. Open Interest data from TradingView shows a dramatic nosedive, plummeting from over 300 million to a paltry 140 million. It’s like watching the crowd clear out after the concert’s over, only in this case, it’s traders liquidating their positions faster than you can say “Whoops, I sold too early.” This sudden drop hints at a mass exodus, with traders cashing out or frantically closing their leveraged positions. They don’t call it uncertainty for nothing.

Unsurprisingly, this market shift signals reduced participation and a distinct lack of excitement. If Uniswap can’t make a triumphant return to the $6.50 mark (with a little help from increased open interest, of course), it might just drift lazily down toward the $5.80 zone. Let’s face it-unless this token finds a sense of purpose, it’s likely to stay in this cautious, “we’re on a break” phase for the time being.

Market Data: The Crypto Equivalent of a Midlife Crisis

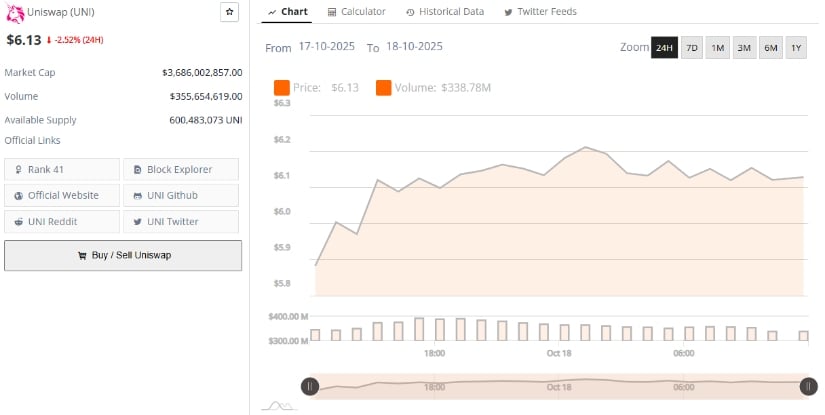

According to BraveNewCoin (the cryptosaurus of data), Uniswap is currently lounging at $6.13, which is a 2.52% decline in the last 24 hours. It holds a market cap of $3.68 billion and a daily trading volume of $355.6 million. Not bad, but not exactly shaking the crypto world either. With an available supply of 600.48 million tokens, liquidity isn’t a problem-yet. Despite the market slowdown, UNI remains comfortably positioned at number 41 in the global crypto rankings. It’s like being the 41st most popular kid in school-still on the list, but don’t expect any invites to the cool parties.

The dip mirrors the general altcoin trend, where several cryptos have been retreating after early October’s “We’re Going to the Moon” rallies. Trading volume is slumping, and sentiment is shifting from neutral to a dash of bearish. The momentum needs a caffeine shot (and maybe a pep talk) to get back to its former glory. For that to happen, both spot and derivative markets need to show up with fresh capital and renewed buyer enthusiasm-something that seems to be as rare as a quiet day on Twitter.

Technical Indicators: The Crypto Version of “Maybe Later”

As of now, Uniswap is hanging out around $6.06, comfortably nestled in a tight range between $6.00 and $6.20. The Bollinger Bands have started contracting, signaling that volatility is shrinking faster than your phone battery when you’re trying to make a 2-hour Zoom call. The token is still hanging below the middle Bollinger band at $7.26, which is a bit like running a race and tripping over the starting line-there’s a definite bearish feel as long as it stays under this level.

The Relative Strength Index (RSI) is sitting at a meager 34.16, teetering on the edge of the “oversold” zone, but not quite jumping off the ledge. It’s like that moment when you realize you’ve stayed up too late watching conspiracy videos, but you’re not sure if you want to actually go to bed. There’s a glimmer of hope in the RSI’s early signs of flattening, though. If it breaks above the RSI moving average at 37.49, we might just get a small uptick in momentum. Or, it could go back to being an unremarkable day. Who knows?

For now, the outlook remains firmly neutral-to-bearish. If UNI can manage to break above the $6.50 resistance, we might see a short-term rebound toward $7.00. But if it fails to keep the current levels intact, brace for another descent toward the $5.50-$5.80 range. Buckle up-it’s going to be a bumpy ride!

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Silver Rate Forecast

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- 🤑 New Hampshire’s Bitcoin Bond: Revolution or Reckless Gamble? 🤑

- Brent Oil Forecast

- 50bps Fed Rate Cut Could Spark Massive Crypto Altseason – Are You Ready to Profit?

2025-10-19 01:50