In a world where fortunes are made and lost in the blink of an eye, XRP futures on the CME Group have burst forth with a staggering $25.6 million in notional volume within just two days of their launch. A strong debut, indeed, for this altcoin as it tiptoes into the regulated derivatives markets, like a cat on a hot tin roof. Meanwhile, our dear XRP languishes below the $2.50 mark, having taken a 7% tumble in the past week. Oh, the irony! 😂

XRP Futures Make a Strong Entry on CME

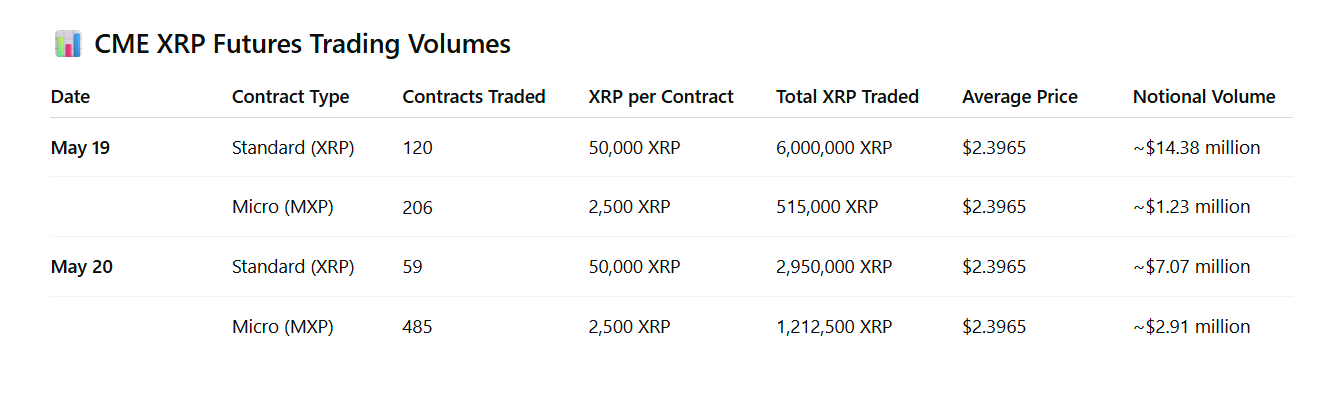

On the fateful day of May 19, CME began trading XRP futures, offering both standard (50,000 XRP) and micro (2,500 XRP) contracts. A buffet of options for the hungry traders!

According to the official CME data, which is as reliable as your neighbor’s gossip, 120 standard and 206 micro contracts were traded on that day, totaling approximately 6.5 million XRP. Not too shabby!

Then, on May 20, the exchange logged 59 standard and 485 micro contracts, adding another 4.1 million XRP to the tally. It’s like watching a slow-motion train wreck, but with more numbers!

So, with XRP’s current market price of $2.39, the total trading volume across both days equals approximately $25.6 million. Who knew numbers could be so thrilling?

This volume catapults XRP’s debut ahead of other altcoin launches on CME. Solana (SOL) futures, which made their entrance in March 2025, could only muster $12.3 million in first-day notional volume. Talk about a dramatic entrance!

In contrast, Bitcoin and Ethereum had more modest beginnings. BTC futures launched in 2017, and ETH followed in 2021—though both have since become the darlings of institutional investors. Ah, the sweet taste of success!

Futures Mirror XRP Spot Price, Hint at Stable Outlook

CME’s XRP futures are cash-settled and based on the CME CF XRP-Dollar Reference Rate, updated daily at 11 am Eastern Time. Because who doesn’t love a good update?

This structure means the futures are closely tied to the spot market. With XRP currently trading at $2.39, the futures contracts are not reflecting a premium or discount. Traders seem to expect price stability in the short term. Or perhaps they’re just too tired to care? 😴

So far, there’s no sign of strong bullish or bearish sentiment among futures participants. This could reflect broader market indecision or simply the fact that participants are using the contracts for hedging rather than speculation. A classic case of “let’s play it safe!”

The success of this debut highlights a growing institutional interest in XRP, especially after the regulatory fog around Ripple’s operations has begun to clear. It’s like watching a flower bloom in the spring!

Overall, this sets the stage for future growth as traders explore more nuanced ways to gain exposure to XRP in a regulated environment. Who knows what the future holds? Perhaps a rollercoaster ride of emotions and profits! 🎢💸

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Silver Rate Forecast

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- When Lawsuits Throw Everything but the Kitchen Sink at Crypto 🎭💸

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Satoshi Nakamoto Statue Invades NYSE: Wall Street’s New Boy Toy 🏛️💻

2025-05-22 00:41