The capture of Nicolás Maduro has ignited a fervor of speculation, as the world watches with bated breath, wondering if the United States might follow suit in other corners of the globe. Capital, ever the opportunist, has flocked to prediction markets, where bettors, with a mix of trepidation and curiosity, wager on the likelihood of such interventions. 🤝💥

Markets of Speculation: How Nicolás Maduro’s Capture Sparked a Global Betting Frenzy

Just recently, President Trump announced that the U.S. would “run” Venezuela until a “safe, proper, and judicious transition” could occur, casting the move as part of a broader effort to curb alleged drug trafficking and safeguard oil resources. The decision has ignited widespread debate over whether comparable interventions or regime shifts could unfold in other nations viewed as U.S. adversaries or strategic priorities. 🧠

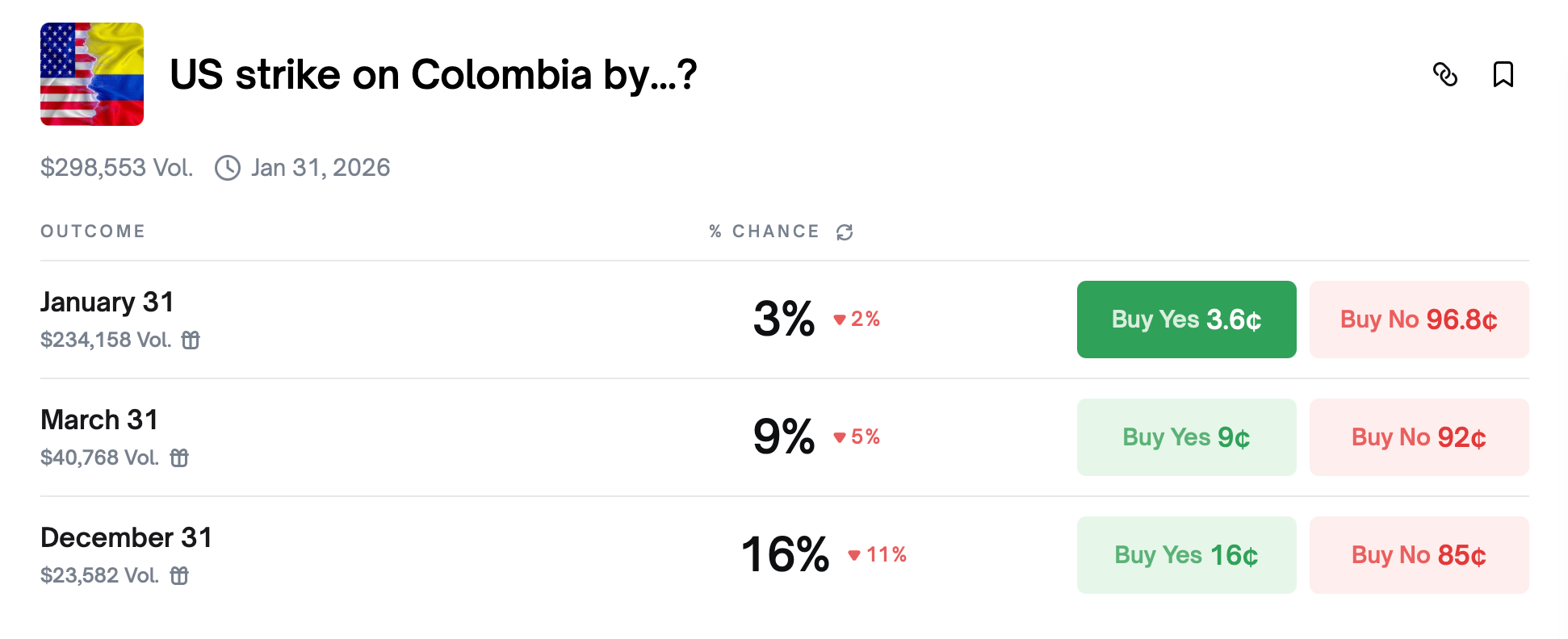

These debates have also spilled into the realm of prediction markets, where a sizable volume of bets is now drawing capital tied to the likelihood of such events. For example, one wager centers on whether the U.S. strikes Colombia, with Polymarket bettors assigning a 16% probability that it occurs by Dec. 31, 2026, or before the year’s end. 🤔

Speculation surrounding Colombia centers on its left-wing President Gustavo Petro, whom Trump has labeled a “sick man” tied to cocaine production, while warning of direct action akin to the Venezuela operation. Petro has responded with defiance, issuing a “come get me” challenge, mobilizing troops along the border amid concerns over refugee flows, and condemning the Maduro raid as a violation of national sovereignty. 🇨🇴

Polymarket bettors assign a 3% probability that a strike occurs by the end of this month and a 9% likelihood by March. Another Polymarket wager places the odds of a U.S. invasion of Colombia at 11%. Then there are the more unusual bets tied to Greenland. These exist because of Trump’s long-standing interest in bringing the Danish autonomous territory under U.S. control on national security grounds. 🧊

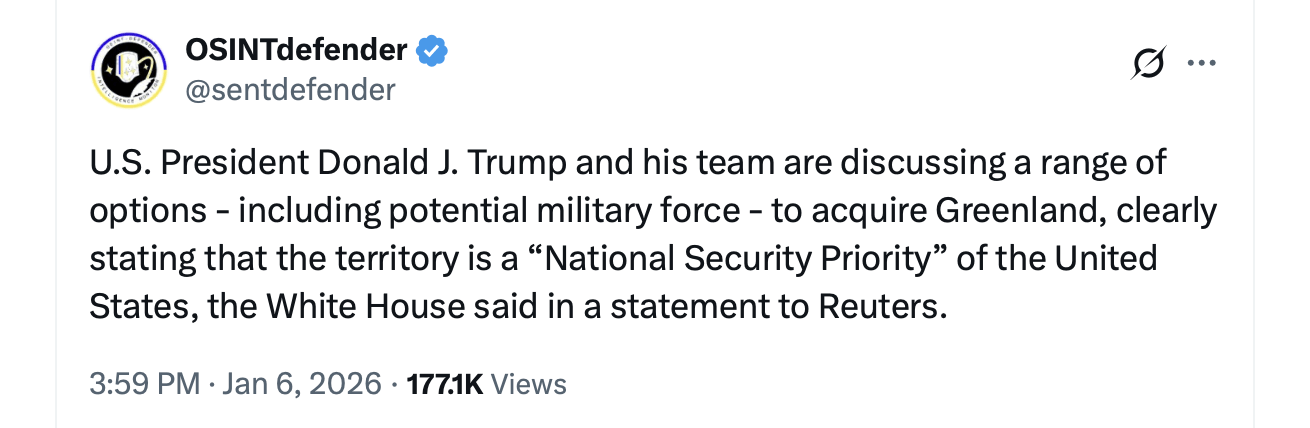

At its core, such a move would be aimed at Arctic dominance and access to mineral resources seen as essential to reducing reliance on China. Following the Maduro operation, Trump said “we need Greenland” for defense, explicitly linking the issue to Venezuela. Polymarket bettors assign a 13% probability that Trump acquires Greenland before 2027, while a separate wager puts the odds of a U.S. invasion of the region at 11% on Jan. 6, 2026. 🇬🇷

Then there’s Mexico, where intervention talk stems from U.S. concerns over drug cartels, migration pressures, and left-leaning policies under President Claudia Sheinbaum. The Mexican president condemned the Venezuela operation as “state terrorism” and called for Maduro to receive a fair trial. Polymarket bettors assign a 13% probability that the U.S. strikes Mexico by Dec. 31, with a 2% chance it happens by the end of the month. 🇲🇽

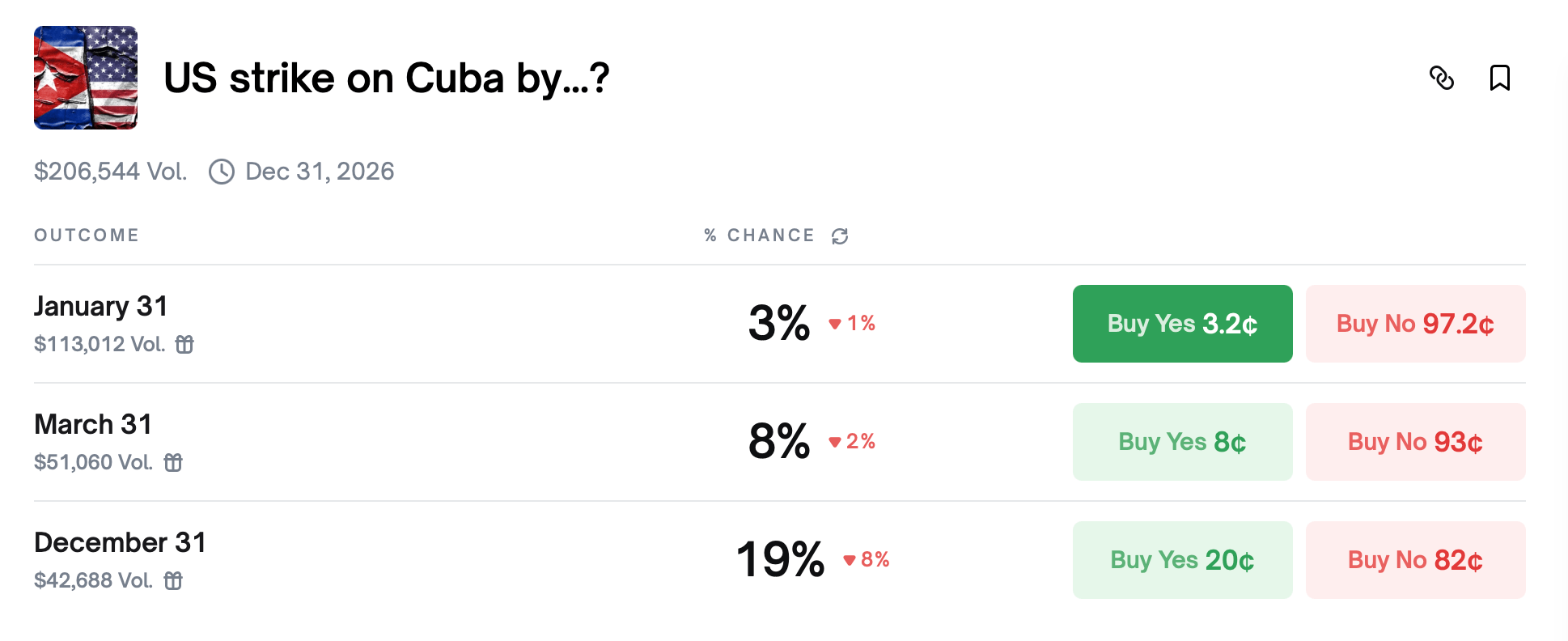

In a separate wager, a full-scale invasion of Mexico is given a 7% likelihood of materializing. Media attention has also turned toward Cuba, which maintains deep economic and political ties with Venezuela. Trump has said Cuba is “ready to fall” and does not require U.S. action, while Secretary of State Marco Rubio warned the country is “in a lot of trouble” due to its support for Maduro. Polymarket bettors place a 19% chance on Cuba being struck by U.S. forces by Dec. 31. 🇨🇺

A U.S. invasion into Cuba has a 10% chance today, at least, according to Polymarket bettors. While it’s further away like Greenland, Iran is also included in the conversation. Iran’s connection also comes from its alliance with Maduro, involving oil deals, military cooperation, and shared anti-U.S. stance, including Hezbollah’s presence in Venezuela. Iran carries the highest implied odds of a U.S. strike, with Polymarket assigning a 35% probability. 🇮🇷

Bettors place a 15% chance on action occurring by the end of the month and a 25% likelihood by March. In a separate Polymarket wager, the odds of a full-scale U.S. invasion of Iran by 2027 stand at a far lower 12%. Bets of this nature continue to draw attention, with some attracting only thin liquidity while others see far heavier participation depending on the region. 💸

Prediction Markets: A Barometer of Sentiment in an Increasingly Fragile World

Viewed as a whole-peculiar wagers notwithstanding-the bets offer a live barometer of how the public is weighing geopolitical risk after the Venezuela operation, converting President Trump’s rhetoric and the latest Maduro development into probabilities the market can actually price. 🧭

Whether these bets ultimately prove prescient or misplaced, prediction markets have emerged as an alternative barometer of sentiment-capturing not official policy, but the collective judgment of participants reacting to headlines, signals, and shifting global fault lines. 🤯

The post-Venezuela moment has exposed how quickly rhetoric, military action, and strategic ambition can blur into one another, leaving markets, governments, and the public searching for clearer lines of intent. In that vacuum, prediction markets have become a proxy for collective unease. 🤕

While some hone in on forecasting precision it may be more about reflecting an era in which global stability feels increasingly fragile and decisions at the highest levels reverberate far beyond their immediate targets. 🌍

FAQ ❓

- What are prediction markets saying after Maduro’s capture?

Bettors are assigning measurable odds to potential U.S. action in countries such as Colombia, Mexico, Cuba, Greenland, and Iran. 🤝 - Which country has the highest implied probability of U.S. action?

Iran currently carries the highest implied odds on Polymarket, reflecting heightened geopolitical focus tied to its alliance with Venezuela. 🇮🇷 - Why is Greenland included in these wagers?

Bets reference President Trump’s repeated statements linking Greenland to U.S. defense needs and Arctic resource access. 🧊 - Do these bets reflect official U.S. policy?

No, they capture market sentiment reacting to headlines and rhetoric rather than confirmed government plans. 🧠

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Brent Oil Forecast

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- XRP: The Calm Before the Storm?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- You Won’t Believe What Bitcoin Whales Are Doing—And How It Could Wreck the Market 🚨

- This Will Break the Internet: Is Bitcoin About to Explode Past Its All-Time High?

2026-01-07 02:28