- Cost basis, trendline, and profit metrics suggest TRX is in a bullish setup, or so they say.

- Whale activity, address growth, and reset sentiment reinforce the mid-term accumulation thesis—because who doesn’t love a good thesis?

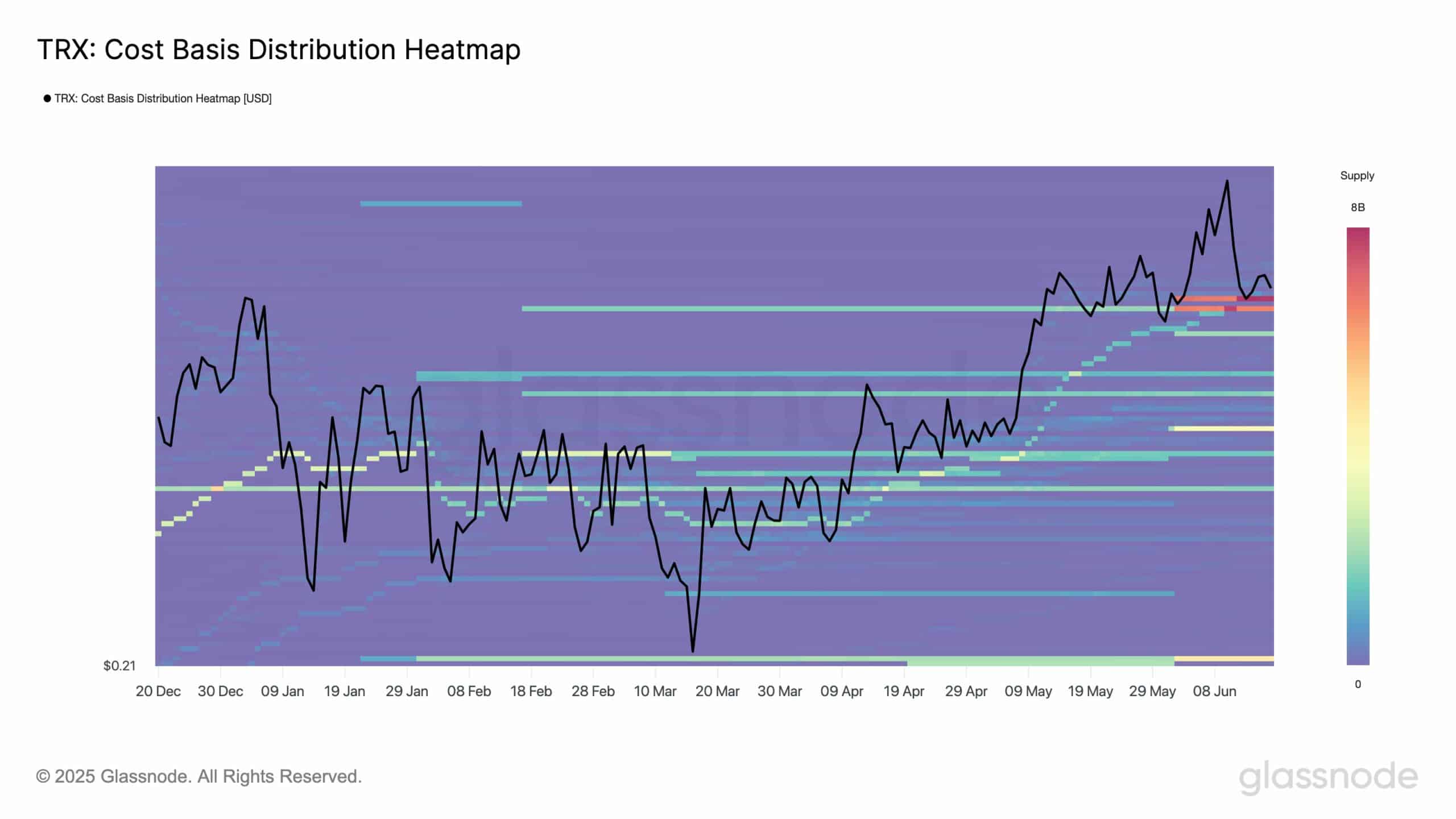

Ah, TRON [TRX], that ever-ambitious little cryptocurrency, continues to consolidate near a key accumulation range, with a staggering 14 billion TRX languishing between $0.26 and $0.27, as reported by the ever-reliable Glassnode on X (formerly known as Twitter, but let’s not dwell on the past).

This zone, dear reader, represents the strongest support cluster on the cost basis heatmap, a veritable fortress of long-term positioning.

Meanwhile, TRX’s price of $0.274 is hovering just above this anchor, like a cat on a hot tin roof, with thin resistance ahead.

As the market tiptoes near this threshold, increasing whale exposure, steady address activity, and a recovering sentiment may shape TRX’s short-term trajectory—if only we could predict the weather with such confidence!

Can TRX maintain its bullish trajectory above the trendline?

TRX has continued to trend above its ascending trendline, which has held since March, maintaining its overall bullish structure—like a well-tailored suit on a Sunday morning.

Despite recent price pullbacks, the trendline and Fibonacci levels between $0.27 and $0.28 remain intact, much like my resolve to avoid dessert.

Moreover, the MACD line has started to cross above its signal, hinting at a possible return of bullish momentum—because who doesn’t love a good comeback story?

This trendline has acted as dynamic support, and holding it would be essential for a move toward the $0.30 resistance zone in the sessions ahead. Fingers crossed!

Most holders remain profitable, reducing sell pressure risk

At press time, IntoTheBlock data revealed that 75.11% of all TRX addresses were “in the money,” totaling a delightful 70.47 billion TRX.

Additionally, 13.66% of wallets were “at the money,” sitting right within the key $0.267–$0.275 range—like a well-placed bet at the races.

Only 11.23% were facing unrealized losses, which is rather fortunate, as this distribution indicates that most holders are not under pressure to exit their positions.

With this structure, sell pressure could remain minimal, especially as TRX stays within or above the cost-basis cluster—let’s hope they don’t get too comfortable!

Whales and investors increase their TRX positions aggressively

The latest historical concentration data revealed a 9.59% increase in whale holdings over recent days. Even more significant is the 38.21% surge among long-term investor addresses—because who doesn’t want to join the party?

Retail wallets grew modestly by 4.10%, showing less aggressive activity compared to institutional participants. This positioning highlights quiet accumulation by large entities, like a secret society of investors.

If this trend persists, it could lay the groundwork for stronger price action once technical and macro conditions align more favorably—if only the stars would cooperate!

New address growth points to expanding TRON network utility

Over the past week, TRON has seen a 32.15% rise in new wallet creation, coupled with a 2.68% uptick in active addresses—because who doesn’t love a new toy?

At the same time, zero-balance addresses fell by 10.52%, implying better retention and actual usage. This trend reflects consistent onboarding of new users and signals improving fundamentals—like a fine wine getting better with age.

Continued expansion of the address base, especially alongside bullish investor behavior, often precedes strong mid-term price appreciation—let’s raise a glass to that!

Was the recent sentiment spike a bullish trap or a signal?

Santiment’s Weighted Sentiment data shows a sharp surge above 7.5 followed by a quick reversal to −0.3—like a rollercoaster ride for the faint of heart.

This indicates that euphoric expectations emerged quickly before correcting, a pattern often seen before consolidations—oh, the drama!

While sentiment spiked due to speculative excitement, its cooling off may have reset the market for a healthier move—let’s hope it’s not just a mirage.

If optimism returns and aligns with technical support, TRX could regain momentum with reduced risk of overheated positioning—fingers crossed for a happy ending!

TRON continues to build strength just above a key support cluster, with over 75% of holders in profit and rising whale exposure. New address creation and declining sell pressure provide further reinforcement—like a well-placed cushion on a hard chair.

If the ascending trendline holds and sentiment recovers gradually, TRX could rally toward $0.29–$0.30 in the coming days—let’s keep our eyes peeled!

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- USD THB PREDICTION

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

- Crypto Chaos: Hackers Make a Killing While CEOs Insist “Nothing’s Changed” 😒

- PLUME: 60% Down?! 😱

- Unleashing the XRP Kraken: Will It Really Reach $15? 🤔🚀

2025-06-20 07:12