Ah, the sweet symphony of the US Dollar plummeting—nothing like a good political storm to shake things up. The US Dollar Index (DXY) has dropped to a three-year low, all thanks to President Donald Trump considering a little “housecleaning” at the Federal Reserve by removing Jerome Powell. Oh, the drama! 🤡

But, wait for it—there’s a silver lining, folks! Bitcoin (BTC) is taking full advantage of the chaos, skyrocketing to its highest point since Trump’s “Liberation Day” victory. Is this a sign of the times, or just another market anomaly? You decide. 🍿

Trump vs. Powell: The Dollar’s Descent Continues

The latest numbers are in, and the DXY is in freefall—dropping below 99, now sitting at 98.2. That’s the lowest it’s been since March 2022. What a glorious sight for the dollar haters among us. 👏

Peter Schiff, the economist who always seems to have something dramatic to say, weighed in on the situation via his X (formerly Twitter) account. His words? Not exactly comforting for the greenback:

“Gold is up over $50, hitting a record high of $3,380. The euro is above $1.15. The dollar has also fallen below 141 Japanese yen and .81 Swiss francs (a new 14-year low, just 3% above a record low). The Dollar Index is below 98.5, a new three-year low. This is getting serious,” Schiff posted.

All this chaos comes after Kevin Hassett, the National Economic Council Director, revealed that Trump’s team is seriously considering kicking Powell to the curb. What a show! 😱

“The president and his team will continue to study that matter,” Hassett replied. Sounds like a dramatic reality show, doesn’t it? 😏

Of course, it didn’t stop there. Hassett made sure to throw some shade at Powell for allegedly using the Federal Reserve as a political tool. Apparently, Powell’s interest rate moves, right after Trump’s election and just before the next one, were designed with the Democrats in mind. Classic political chess. 🎭

Trump, not one to hold back, also joined in on the fun. In a recent social media post, he called Powell “always too late and wrong” for not cutting rates sooner. Ah, the perfect soundbite for a Twitter war. 🔥

“Powell’s termination cannot come fast enough!” the President wrote. Seriously, is this a tweet or a plea for help? 🤔

If Powell does get the boot, it raises some serious questions about the Fed’s independence, and the impact it could have on global markets. Powell’s term runs through May 2026, but who needs a pesky “term” when you’ve got a political power play on the table? 🙄

Can Bitcoin Ride the Dollar’s Downward Spiral?

Now here’s where the real fun begins. If Powell’s out and Trump convinces the Fed to cut interest rates, we could be looking at a crypto market rally. And we all know that when the Fed gets cozy with lowering interest rates, the dollar gets weaker, and investors flock to the safer, shinier shores of cryptocurrency. 🎉

Bitcoin, ever the rebellious asset, thrives when fiat currencies stumble. The inverse relationship between the DXY and BTC means a collapsing dollar might just push Bitcoin to even greater heights. A match made in financial chaos heaven. 😎

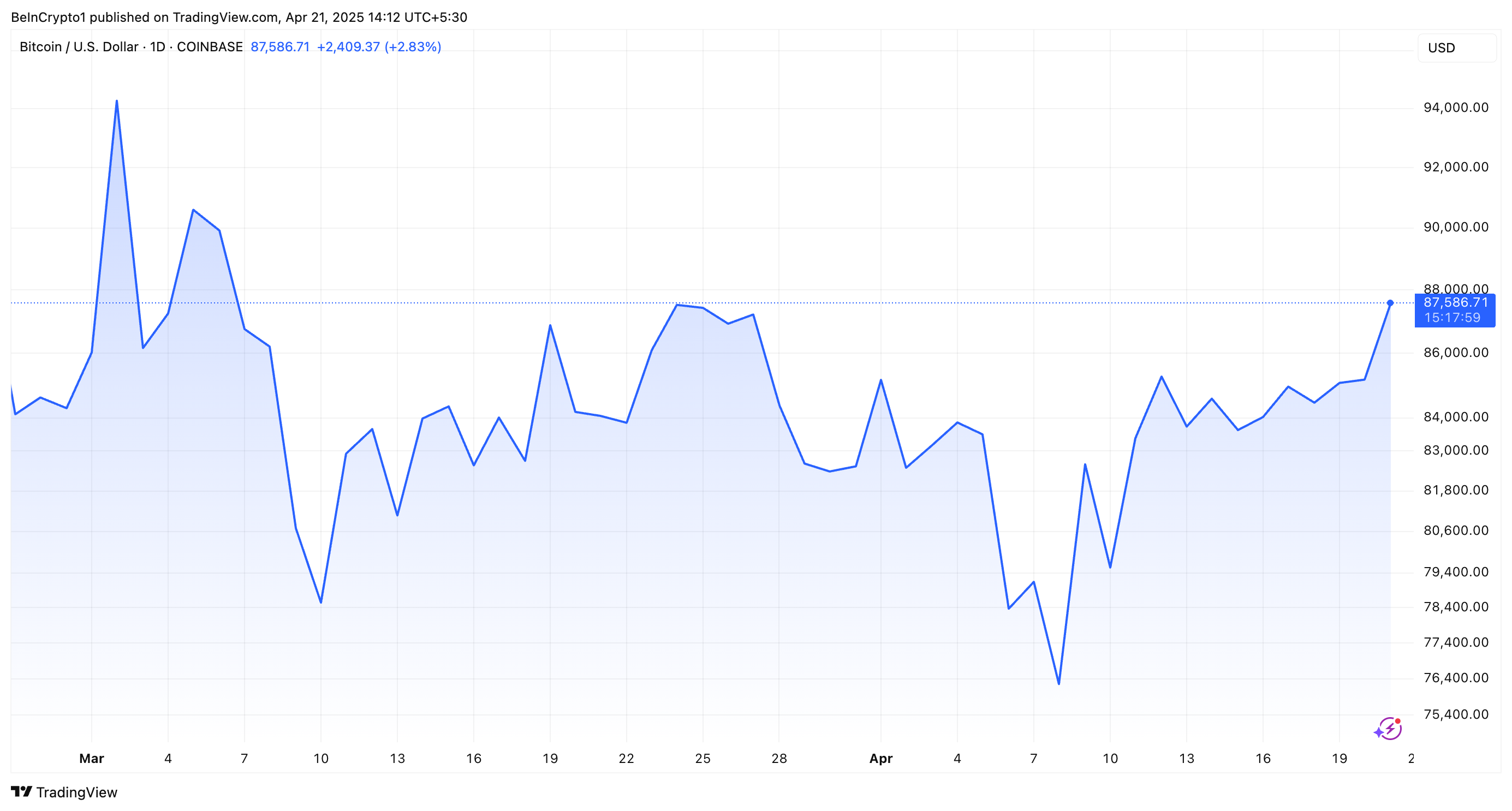

And guess what? The DXY’s miserable fall has already given Bitcoin a big push, sending it to over $87,000—its highest price since April 2. Oh, how the mighty have fallen, and the mighty crypto has risen. 🙌

“USD weakness is driving the rally in crypto,” said Sean McNulty, Derivatives Trading Lead at FalconX. Translation: The dollar’s loss is crypto’s gain. 💸

At the time of writing, Bitcoin is sitting pretty at $87,586—an impressive 3.5% jump in just one day. Markets are cheering, but the real question is: how long will this victory lap last before the next twist in this wild political soap opera? 🍿

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- USD THB PREDICTION

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

- Crypto Chaos: Hackers Make a Killing While CEOs Insist “Nothing’s Changed” 😒

- PLUME: 60% Down?! 😱

- Unleashing the XRP Kraken: Will It Really Reach $15? 🤔🚀

2025-04-21 12:41