The order? 16,299 Antminer U3S21EXPH units, capable of pumping out a combined 14 exahashes per second (EH/s). That’s serious hashpower – enough to tilt the scales in a mining arms race where efficiency is everything. According to TheMinerMag, the purchase came through an option to buy up to 17,280 rigs, but American Bitcoin locked in just over 16K machines for now. 🚀

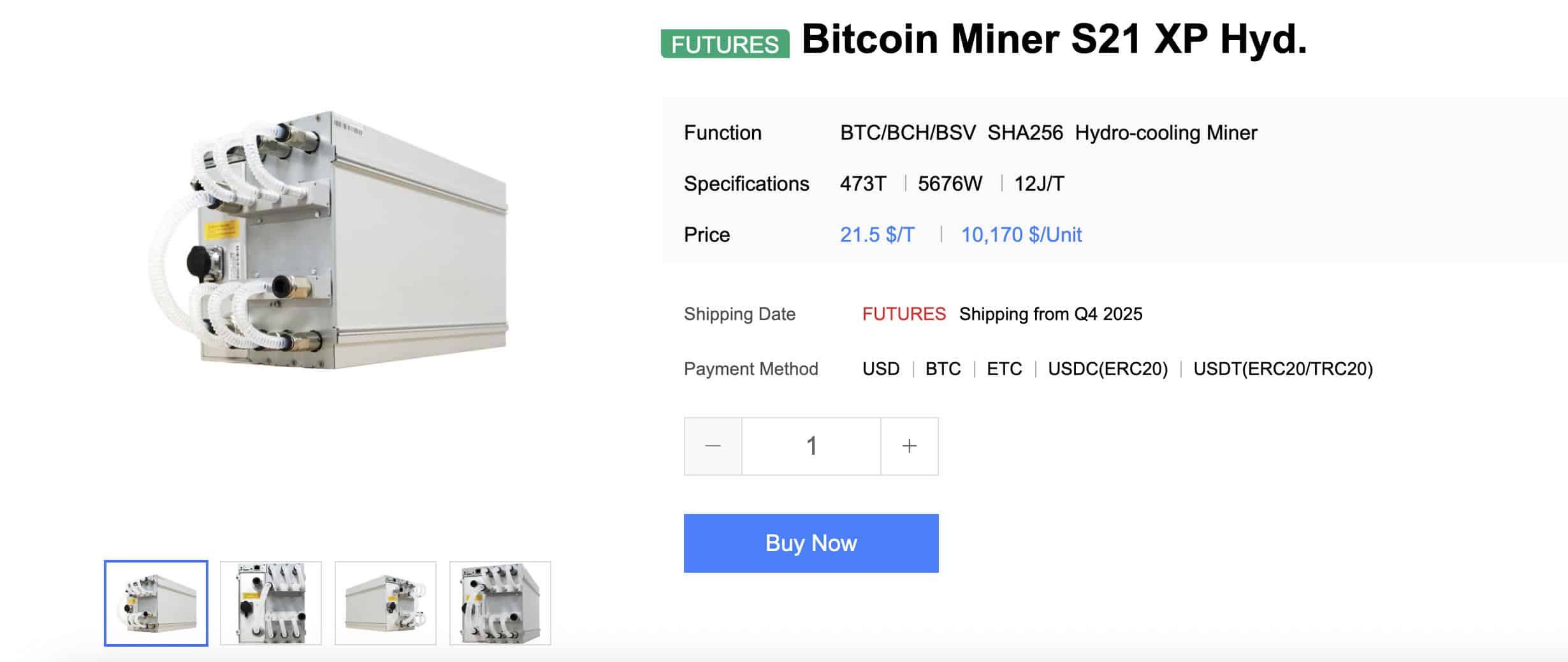

The Bitcoin miner via the Bitmain website

Dodging Tariffs, Courting Trump

The deal explicitly sidesteps Trump’s new wave of tariffs. Bitmain’s rigs, still largely made in China, would normally get hit with punishing duties under the administration’s “bring manufacturing home” strategy. But American Bitcoin’s contract shields it from any sudden price hikes caused by the White House’s trade brinkmanship. Convenient, isn’t it? 😏

The tariffs, though, are already forcing hardware makers to rethink geography. Bitmain just announced plans to open its first US-based ASIC manufacturing plant by the end of 2025, alongside a stateside HQ (likely in Florida or Texas, two states where Trump-world influence runs strong). It’s almost as if they’re trying to curry favor… or maybe just avoid more tariffs. 🤷♂️

A Fragile Supply Chain Under Pressure

Almost all Bitcoin mining gear – more than 99% – comes from just three Chinese giants: Bitmain, MicroBT, and Canaan. Bitmain dominates with ~82% market share, which means US miners are effectively caught between geopolitical chess moves and their own survival. It’s like being stuck in a game of intergalactic ping-pong, where the ball is your profit margin and the paddles are international trade policies. 🏓

By slapping tariffs on imported rigs, Trump’s administration is trying to strong-arm companies like Bitmain into building factories on American soil. Critics argue it’s industrial cosplay that could backfire. Jaran Mellerud, CEO of Hashlabs, warns that higher rig prices will crush demand from US miners. That would leave ASIC makers with unsold inventory they could easily dump overseas at lower prices, strengthening mining hubs in Asia, the Middle East, or South America – the exact opposite of Trump’s “reshoring” dream. It’s a bit like trying to herd cats with a laser pointer. 🐱✨

Why This Deal Matters

The American Bitcoin purchase isn’t just about hardware. It’s about signaling: Trump’s orbit is making a visible bet on Bitcoin mining as part of its economic nationalism narrative. Expect it to be spun as both a jobs story (“mining jobs in America!”) and a sovereignty story (“hashpower made in the USA!”), even if the rigs still ship from Shenzhen. It’s like claiming you’ve built a spaceship because you bought a ticket to the moon. 🚀🌐

But the risks are clear: tariffs, unpredictable energy prices, and the relentless difficulty adjustments of Bitcoin mining itself. If costs rise faster than block rewards, US miners could find themselves uncompetitive, while non-US players scoop up cheap gear and hash away at lower electricity rates abroad. It’s a bit like trying to win a race on a treadmill that keeps speeding up. 🏃♂️💨

For now, American Bitcoin has secured its rigs and dodged the tariff bullet. But the bigger question looms: will Trump’s protectionist policies actually build a US Bitcoin mining powerhouse – or just accelerate the exodus of hashpower to friendlier jurisdictions? Only time will tell, and in the meantime, we can all enjoy the show. 🎉

Read More

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- TRX: The Bullish Saga of $0.30 – Will the Whales Save Us? 🐋💰

- BTC AUD PREDICTION. BTC cryptocurrency

- Ride the Crypto Wave or Wipe Out – $250K Up for Grabs! 🌊💸

- Trump’s Crypto Invasion: Blockchain Meets Bollywood Drama! 🎭💰

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

- Dogecoin’s $2B Volume Spree: Bearish Brouhaha or Bullish Blunder? 🐕💸

- Is XRP Really Trading at $1,000 on a Secret Ledger? The Truth Behind the Rumors Revealed

2025-08-17 03:28