Well, Monday arrived on schedule and with all the grace of a drunk uncle at a wedding. Bitcoin did its usual impression of a nervous squirrel—up, down, sideways—while Wall Street’s finest turned pink and wilted on the vine. Meanwhile, President Donald Trump kicked the tariff deadline further down the road (because “why make a decision today you can put off until August?”), and Elon Musk, who apparently can’t resist pushing any and every red button, introduced a political party. Yes, really. 😮

Stocks Throw a Tantrum, Bitcoin Puts on a Little Show

Monday was not a day for the faint of heart or weak of portfolio. U.S. President Donald Trump announced tariffs would remain on simmer just a little longer—from July 9 to August 1, giving everyone extra time to argue about them on cable news. The S&P 500, Nasdaq, and Dow all responded by breaking out in hives, dropping 0.85%, 0.91%, and 1.02% respectively. Woe betide the investor with optimism! Meanwhile, in the magical fairyland of digital currencies, bitcoin leapt up to $109,000, then promptly remembered gravity and plopped itself back down to $108,000. Flatlined, but with style. 🪁

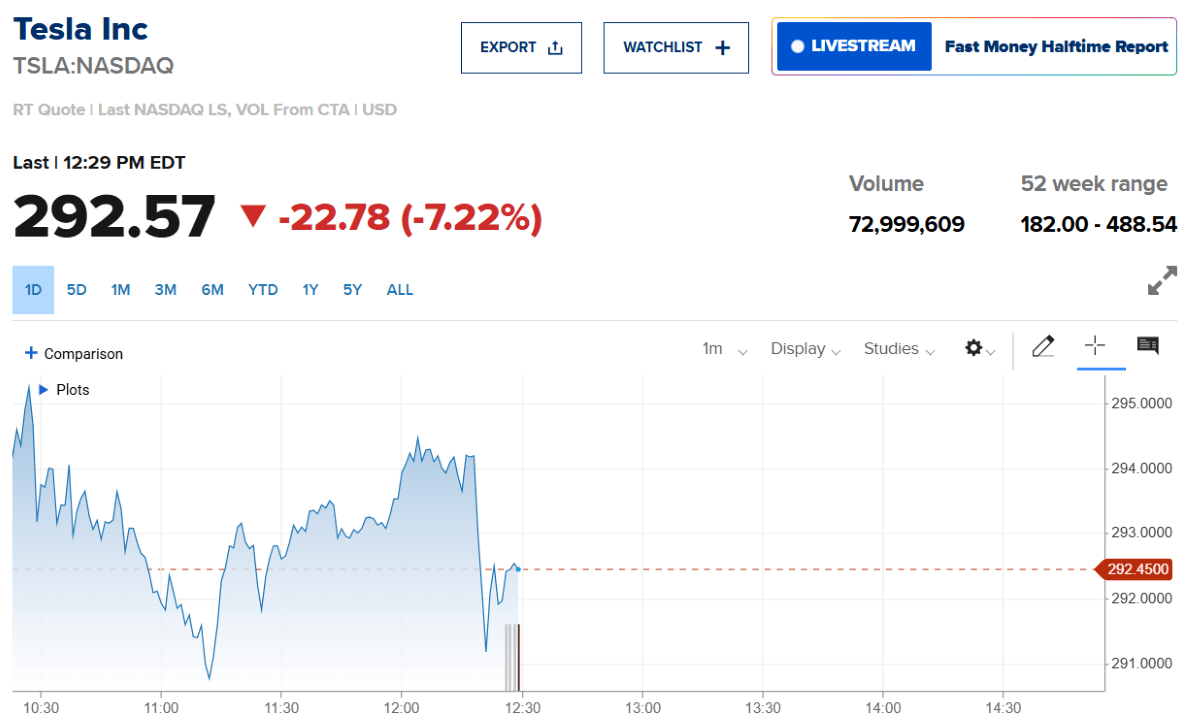

Tesla (Nasdaq: TSLA) won the grand prize for Most Dramatic Decline, down over 7%, thanks to CEO Elon Musk launching what we all needed: another American political party. One wonders if cars will be allowed to vote. Ever since Musk decided “running a car company bores me, let’s try politics,” Tesla’s stock has taken up bungee jumping as a hobby.

“The board’s going to have to take some sort of action,” sighed Dan Ives of Wedbush Securities on CNBC, doubtless wishing he’d chosen basket weaving as a career instead. “It’s a matter of when not if.” Possibly referring to either Tesla’s future or civilization in general.

As for the ongoing bromance-turned-row between Trump and Musk, it’s taken on the grace and dignity of a pie fight in a retirement home. Trump called Musk “a train wreck” right after the great party announcement. To be fair, this is possibly the only accurate market analogy we’ll get this month. 🚂💥

Amid the tumbleweed, crypto true believers claim bitcoin’s about to leave the old guard eating its blockchain dust. At least, that’s what London’s Standard Chartered Bank is whispering into clients’ ears between sips of warm gin and a resigned laugh.

“We continue to see BTC rising to around USD 135,000 by end-Q3 and to USD 200,000 by end-Q4,” declared their man Geoffrey Kendrick, suggesting either peak optimism or the finest British humor at work. The driving force? ETFs, corporate treasuries, and U.S. policy—which in this context is basically a magic eight ball with commitment issues.

Markets in Numbers (For People Who Prefer Pain in Chart Form)

//static.news.bitcoin.com/wp-content/uploads/2025/07/btcusd_2025-07-07_13-53-31.png”/>

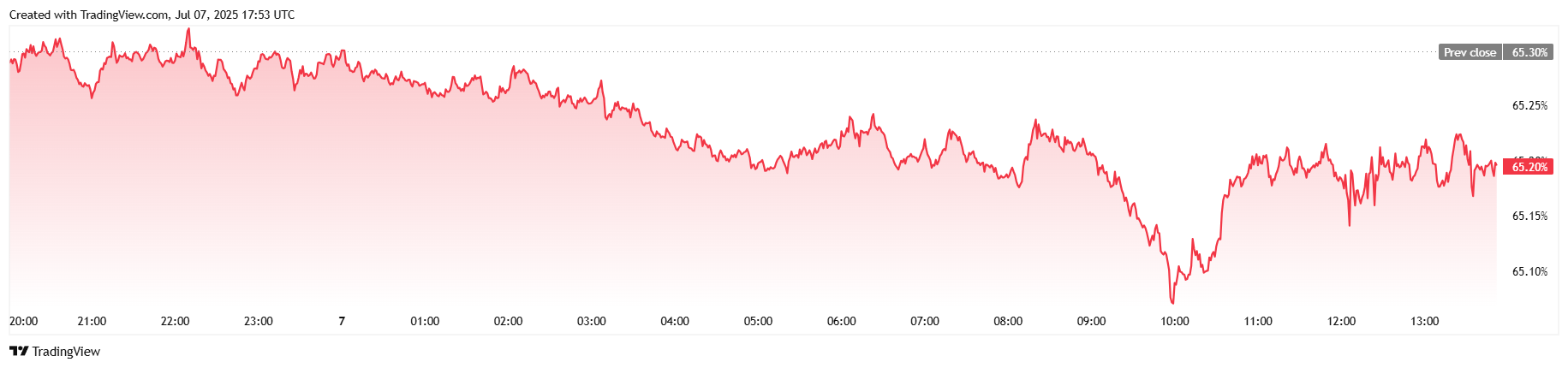

Volume’s up 30% to $43.6 billion, perhaps because all the institutional types came crawling back from the July 4th barbecue and realized the screens still work. Market cap slid to $2.15 trillion, dominance inched down to 65.21%. Even bitcoin has dominance issues, apparently.

Open BTC futures contracts crept up by 0.24%—that’s to $74.06 billion for anyone keeping score with a magnifying glass. Liquidations reached $38.29 million, roughly split between over-caffeinated bulls and newly bald bears. The shorts and the longs went out together, like star-crossed lovers. Or perhaps just unsuspecting tourists.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Drama: A16Z’s $55M Bet on LayerZero – Will It Pay Off? 💰😱

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- SHIB PREDICTION. SHIB cryptocurrency

- Crypto’s Dandy Escape: Band-Aids and Banter for the Currency Conundrum 😏

- ETC PREDICTION. ETC cryptocurrency

2025-07-07 22:13