So, according to Fundstrat’s Tom Lee (the man with the market crystal ball), US equities are still living their best life in a bull cycle after a “normal” price correction. But don’t get too excited. Is it a V-shaped recovery like 2020’s instant glow-up, or will it be a 2011-style “let’s just hang out and wait” scenario? 🧐

In a fresh YouTube update (because who doesn’t love a little investment gossip on video?), Lee says he’s 100% sure the S&P 500 hit rock bottom, but there’s one tiny catch—he doesn’t know if we’re going to soar back up like a rocket, or just vibe in a boring range for a bit. Either way, he’s confident it’s not the end of the world. Yet.

Lee also made sure to remind us that investors’ interpretation of things like tariffs and inflation expectations will basically decide whether the stock market becomes a hot mess or just… well, a mess. 🙃

“I think we’re still in a bull market, but like, I’m not clear if it’s going to be a V-shaped recovery like 2020 or a long-range, meh-market like 2011.”

“Look, it makes sense that we’ve hit the bottom, but there’s always this nagging feeling like there’s another shoe about to drop. Tariffs, China, possibly turning into a cold war… and don’t get me started on global recession fears. Sure, it sounds dramatic, but it’s out there. You know, no biggie.”

“Or maybe we’re gonna freak out about a financial crisis, inflation expectations going wild, and companies just straight-up jacking up prices (hello, greedflation). Which, you know, will force the Fed to panic and hike rates. Oh, and if earnings drop by more than 20%, we’re in trouble. But no pressure. 🙃”

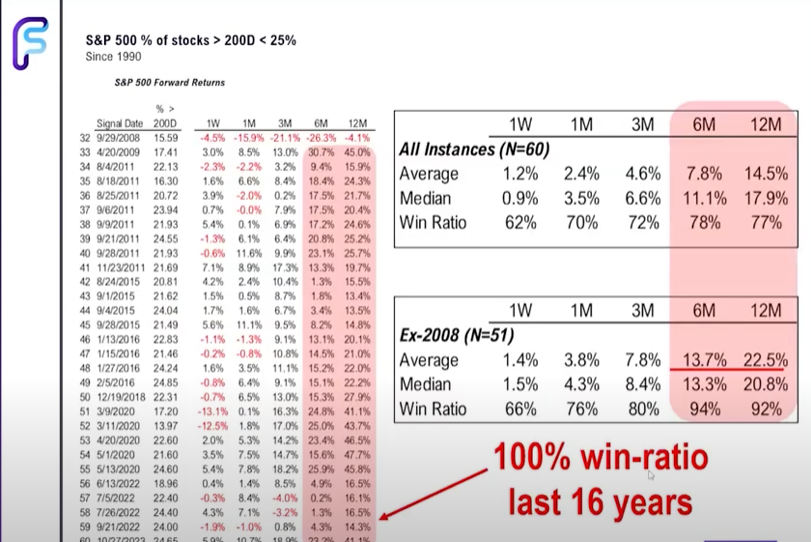

Lee then dropped this spicy chart that shows only 6% of stocks in the S&P 500 are above their 50-day moving average. Ouch. But don’t worry, he says historically, this kind of setup has been prime real estate for bullish success. 📈

“Check out this percentage of stocks above the 50-day moving average at the top and above the 200-day moving average at the bottom. When it’s under 20%, things get interesting. In fact, over the past 16 years, the S&P was up 6 and 12 months later. Seriously, every single time, except 2022 (but, like, we don’t talk about that). So, yeah, I think we hit a solid low.”

As of Friday’s close, the S&P 500 is chilling at 5,282 points. Let’s hope it stays that way… or not. 🤷♀️

Read More

- FIL PREDICTION. FIL cryptocurrency

- USD MXN PREDICTION

- USD PHP PREDICTION

- 🚨 Crypto Exchange Drama: OM Token’s Wild Ride Leaves Everyone Scratching Their Heads 🎢

- GOHOME PREDICTION. GOHOME cryptocurrency

- USD THB PREDICTION

- EUR CNY PREDICTION

- SANTOS/USD

- OMG, ETH is Teetering on the Edge – Could This Be Its Big Bounce? 😱

- XYO PREDICTION. XYO cryptocurrency

2025-04-21 23:06