Markets

What to know, in a nutshell (and with a dash of Twainian wit):

- Story Protocol, in a move as bold as a riverboat gambler, has delayed its IP token unlock by six months, pushing it to August 2026. Team and investor tokens are locked tighter than a miser’s purse while they “build more usage.”

- Co-founder SY Lee claims near-zero on-chain revenue is as misleading as a politician’s promise. Why? Because Story’s real game is off-chain licensing of human-generated datasets for AI training, not nickel-and-diming gas fees.

- The project is pivoting from tokenized media to “unscrapable” human data, a shift as dramatic as a Mississippi steamboat changing course mid-river. Visible on-chain income? Slow as molasses in January. But they’re aiming for long-term commitment and less token supply overhang.

In a recent chat with CoinDesk, SY Lee, the co-founder of Story Protocol, defended the delay with the fervor of a man defending his last cigar. “The blockchain needs more time,” he declared, as if time were a commodity one could simply order by the barrel. Near-zero on-chain revenue? “The wrong metric,” he scoffed, dismissing it like a mosquito at a picnic.

The six-month delay keeps team and investor tokens locked up, as Story pivots from a general IP registry to licensing human-generated datasets for AI training. It’s like swapping a canoe for a battleship mid-voyage.

Lee pointed to Worldcoin’s 2024 decision to extend lockups, a move that sent its token soaring like a bald eagle on a thermal. “We’re following the same logic,” he said, though one wonders if they’re also following the same compass.

“If we were all mercenary, we would have wanted a shorter lockup,” Lee remarked, painting the extension as a noble gesture rather than a desperate Hail Mary. One can almost hear the ghost of Twain chuckling in the background.

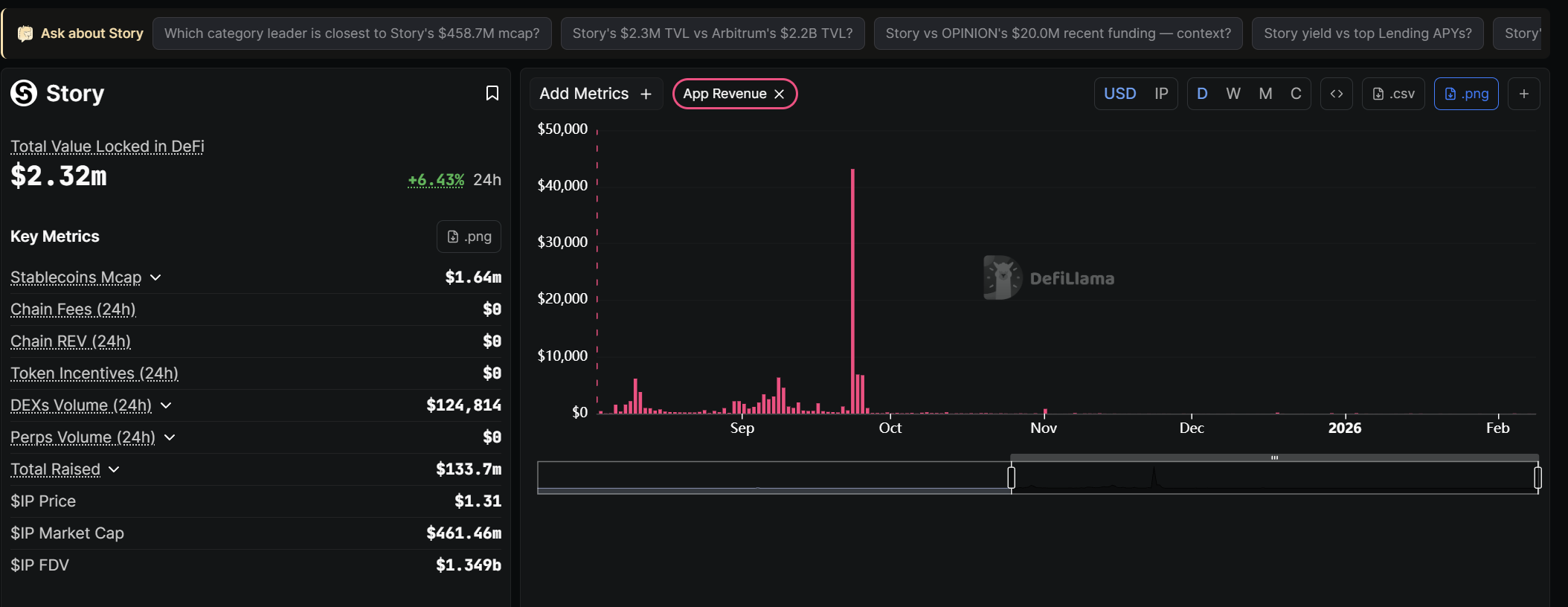

Story’s daily revenue, which peaked at $43,000 in September 2025 and now sits at $0 (according to DeFiLlama), has investors more nervous than a cat in a room full of rocking chairs.

Lee, however, insists these numbers are as misleading as a con man’s smile. Much of the monetization, he argues, happens off-chain through licensing agreements, not in transaction tolls. “Gas revenue is a lagging indicator,” he said, as if it were a slow mule in a horse race.

“We intentionally put our chain gas fee pretty low. We’re more of an IP chain,” he explained, though one suspects he’d say the same if the fees were as high as a giraffe’s eyebrow. “You may not see the type of revenue stream you’re looking for, like a DeFi chain.”

Instead, Story’s focus is on recording ownership terms and usage rights for datasets and models used to train AI systems. Payments and royalty splits are embedded in smart contracts, a move as clever as a fox in a henhouse.

This shift moves the project away from tokenizing media content or collectibles and toward “unscrapable” human-contributed data, such as multilingual voice samples and first-person video. Lee argues these assets are harder for AI developers to obtain legally than a straight answer from a lawyer.

The transition, however, delays the visibility of on-chain income, as much of the expected value is tied to enterprise licensing deals. Lee compared the timeline to his Web2 startup experience, which landed him a $440 million exit in 2021. “It took years for meaningful revenue to materialize,” he noted, as if years were just a minor inconvenience.

For token holders, the practical implication is that supply expansion is being slowed while the team attempts to demonstrate traction in AI data partnerships. Whether this strategy will ultimately pay off is as uncertain as the weather in Missouri.

“The best founders, the best teams, the best companies usually do it for a decade plus,” Lee declared, with the confidence of a man who’s already cashed in his chips. “We’re in it for the long term and longer innings.”

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- Crypto Cowboy Fights Back: CZ Tells WSJ to Take a Hike! 🚀😏

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Binance’s CZ Predicts Bitcoin Will Go So High Even Molière Would Write a Satire

- Bitcoin’s Bouncy Castle? 🚀

- Traders Weep as Bitcoin Dances Near $95K—ETH Shoots, DOGE Slumbers, LAYER Moonwalks!

2026-02-09 10:50