Brothers and sisters, the specter of the FOMC approaches—not with the solemnity of a czar’s decree, but rather with the cold poker-face of Jerome Powell, whose words have the power to rattle empires… and push trembling hands to both buy and sell bitcoin at a swipe. Once, the ruble could tumble in a single morning and we’d all line up for bread. Now it’s Bitcoin that shrugs off a trillion in value while traders scream silently at their screens, calculating hope and fear with each tick. Ah, progress! 😏

The world, that trembling mosaic of devices and exchanges, now holds its breath for Wednesday, June 18. Bitcoin—the digital ‘king’ of this new, headless monarchy—hobbles at $105,273, a mere bagatelle of a $2.1 trillion market cap, but even titans can get vertigo standing atop such a mountain. Skepticism oozes from the pores of every would-be speculator. Will the bull charge, scattering the shorts like autumn leaves, or will Federal Reserve policy flick the lever and send us all clattering down the staircase of correction? Place your bets—fortune favors only the truly exhausted! 🎲

The sages predict: rates unchanged, squatting stubbornly at 4.25% to 4.50%—because when you can do nothing, why not do nothing, but make it sound wise? You know the game: inflation gnaws quietly, war and rumors of war dance their endless pirouette from the Middle East to Washington. Meanwhile, traders squint into the abyss waiting for Powell to slip, to mutter some accidental prophecy that sends Bitcoin soaring or plunging—a monarch both feared and thoroughly mocked.

Curious, is it not, that no matter how benign the data appears—lower CPI, lower PPI, the sort of numbers accountants dream about—unease persists. Bulls and bears alike watch the chairman’s lips, parsing each syllable for their deliverance or their doom. Swissblock, that remote oracle of wisdom (posting from the safety of X, where truly all major global decisions are made now), warns of two levers left: peace in the world or Powell’s voice an octave lighter. Either offers a swift ride—bulls fantasize about $BTC tearing up bear stops, while the bears are left praying for the mercy of negative funding. Yes, yes, finance is war with more spreadsheets, less mud. 📉🦍

A Glance to the Chart—The Chronicle of a Triangle

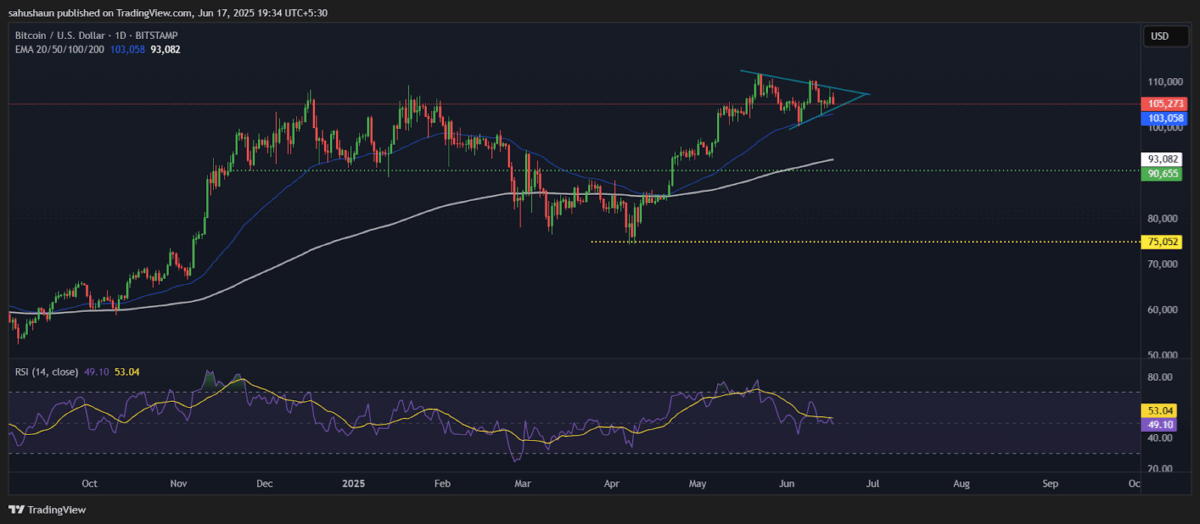

Old habits die hard—even Bitcoin clings to tradition, whittling itself into a perfect symmetrical triangle around $105,277, stuck in a pattern since the May peak at $112,000. Each low is slightly higher, each high more unimpressive—the very picture of existential malaise. As any prisoner knows, you can walk around your cell a thousand times and still end up where you started, but the breakout looms. The only question: which wall collapses?

The boundaries are clear. On the upper end, the $112,000 resistance lurks—psychological as much as mathematical, tethered to recent glories. Below, trenches are dug at $100,000, with fallback to $93,082 and $90,655, the citadel of the 200-day EMA. Once people hid gold under the floorboards; now, it’s just numbers hiding within other numbers… but don’t get sentimental, the charts are watching. 🤖

The RSI, that trusty barometer of the crowd’s emotional temperature, reads 53.04—neither euphoric nor despondent, but as bored as a commissar at a poetry recital. Should it leap above 70, expect delirium, yet for now we persist in limbo. Should Bitcoin break the triangle, $115,000-$120,000 beckons like a promised land populated only by Instagram traders and Lambos. On failure, we descend to $90,000—a place of darkness, broken only by the light of another ‘Buy the Dip’ tweet from your least favorite influencer.

And So, the Prologue to the Next Act…

The gods (or Powell) will decide which door swings open—bullish euphoria or bearish despair—while the rest of us play our minor roles, clutching hardware wallets or clutching at straws. The next 48 hours? The entire fate of Bitcoin in the balance. At least when it was bread lines, you could meet your neighbors. Here, you’ll just refresh TradingView, alone.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- AVAX Soars Again! Is the Crypto World Turning Tides? 🚀

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

2025-06-17 18:18