It is with the most amiable enthusiasm that I convey to you the delightful notion that recent events suggest our dear Bitcoin may soon embark upon a quest for unprecedented attainments in financial heights. The influences of potential ETF approvals and decidedly encouraging signals from the realm of macroeconomics appear to conspire in favor of this digital wonder!

Market Overview: A Peep into the Bullish Expedition 🐂

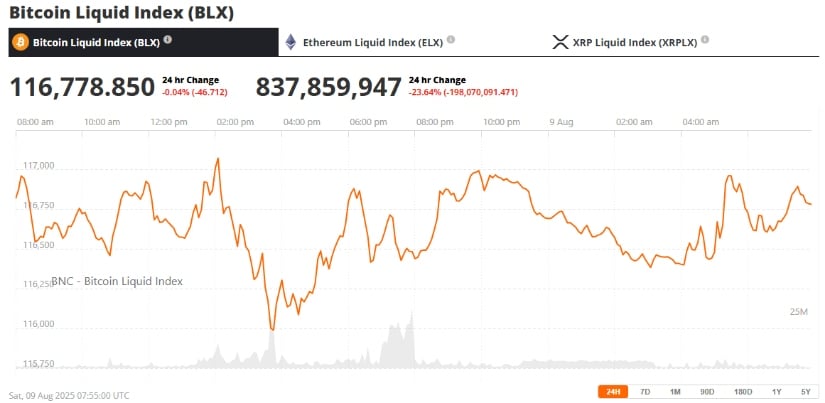

Indeed, the recent exuberance of Bitcoin’s value has shown itself to be underpinned by a splendidly advantageous pattern known as a bullish flag, splendidly illustrated upon the daily chart, just shy of the exalted $117,335 Fibonacci retracement level. This technical marvel follows a rather astonishing leap from the rather humble support zone of $98,000, and it couples delightfully with an ascending trendline, all while embracing the 50-day simple moving average (SMA) that rests amicably near $113,157 – a location of significance that has historically summoned profit-seeking reinforcements.

Ah, the winds of momentum swirl most robustly! The relative strength index (RSI) has jubilantly returned to a stately 54.77 from its previous state of despair, indicating a hearty resurgence of buyer interest, yet cleverly avoiding the clutches of over-exuberance. Moreover, the moving average convergence divergence (MACD) indicator has taken a most agreeable stance, merely hinting at the waning of bearish pressure. One wonders if it has had a touch too much tea! ☕

Traders, those ever-watchful sentinels of fortune, are fixated upon the crucial support levels between $113,635 and $113,157, while a most vital supportive floor at $110,685 beckons. And should our valiant Bitcoin succeed in overcoming the resistance at $117,335, it may gallop forth toward the heights of $123,250 and eventually to the lofty realms between $126,980 and $131,575. Should this bullish formation fulfill its promise, one can only imagine Bitcoin soaring to the low $130,000s and beyond! 🕊️

Trend and the Mystique of News: An Intriguing Narrative Unfolds 📜

Let us not neglect the stirring catalysts that underpin the opulent expectations surrounding Bitcoin’s fortunes today. The impending Bitcoin halving of the year 2025 looms large upon the calendars of investors. History has oft demonstrated that such halving events tend to diminish the influx of new Bitcoins, thus sparking delightful price escalations in the months and years that follow. An intriguing affair, indeed! 🎉

Furthermore, we musn’t overlook the recent executive decree by none other than U.S. President Donald Trump, which permits the inclusion of cryptocurrencies, private equity, and real estate in the sacred 401(k) retirement plans. Such a progressive move brings forth the promise of enticing tens of millions into the cryptic embrace of cryptocurrencies, rendering a delectable demand pool! How quaint! 🤑

To further irk the spirits of institutional interest, Japanese SBI Holdings has splendidly filed for a dual Bitcoin-XRP ETF. This intriguing concoction may well serve to pique the interest of investors wishing to gain dual exposure to these two mammoth crypto assets. Should the SEC bestow their blessing upon this ETF, it shall surely be a monumental occasion, further propelling Bitcoin toward elevated acclaim.

Expert Insights: Bitcoin’s Role as an Inflation Shield and Future Prospects 🔮

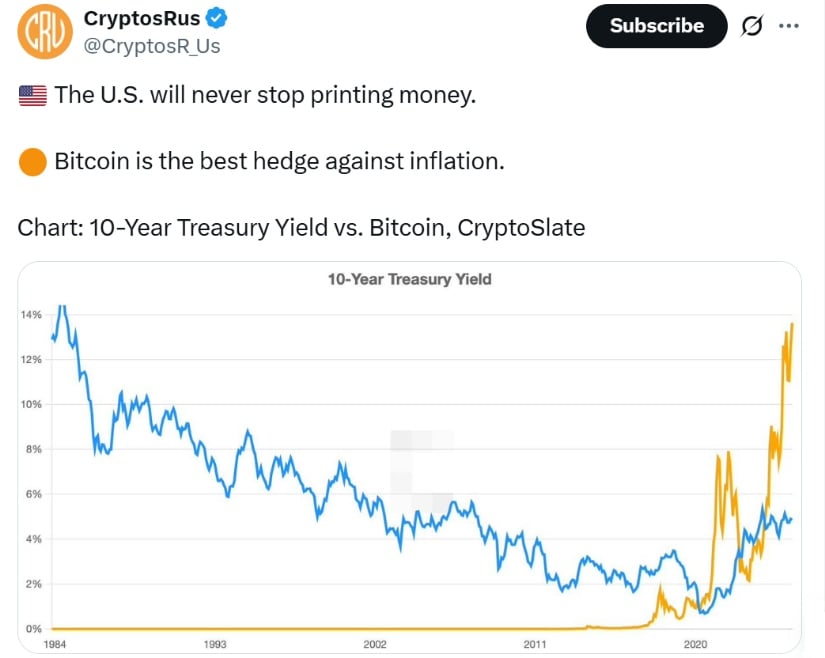

Astute analysts still perceive Bitcoin as a commendable bulwark against inflation, especially amidst the currents of altering economic policies. With the Federal Reserve poised to reduce interest rates in September 2025, it is foretold (or so the CME’s FedWatch Tool suggests with a somewhat audacious 95% probability) that the demand for daring risk assets like our noble Bitcoin may soon flourish.

The swell of adoption in Asia, particularly under China’s noble stablecoin initiative striving to uphold the integrity of the Renminbi while reducing reliance on the dollar, only enhances Bitcoin’s long-term value. Such bold measures highlight the international significance of the Bitcoin Lightning Network, alongside Taproot upgrades that promise to augment transaction efficiency and privacy.

As the witty crypto commentator Francesco remarked, “Bitcoin’s price action resembles a door, poised for an opening. It may wander momentarily to ensnare liquidity, yet the trajectory is distinctly toward a robust breakout above $116K.” Enigmatic, to say the least! 🕵️♂️

A Gaze into the Future: BTC‘s Next Leap and Predictions 🏰

At present, Bitcoin’s technical presentation, combined harmoniously with the propelling forces of fundamental influences and the macroeconomic landscape, indicates a delectably favorable scenario for a price breakout. Those critical support levels lounging about the $113,000 mark are of utmost importance if we hope to witness Bitcoin traversing the dazzling ranges of $130,000 to $150,000 in the forthcoming months.

For those engaged in trading or investing, it shall be most critical to keep an astute eye upon the signals from Bitcoin whales and remain well-informed regarding the esteemed SEC’s stance on Bitcoin ETFs. The whimsical Bitcoin halving of 2025, combined with buoyant narratives of inflation hedges and continual network enhancements, positions our dear BTC for imminent adventures in price discovery.

As the market digests these variable changes – a veritable feast for the intellect! – one ponderously wonders: Shall Bitcoin sustain its jubilant run toward new record heights, or must it take pause, allowing for a grace-filled consolidation? Either way, the distant horizon of Bitcoin appears glitteringly promising for all who are keen to remain abreast of the latest Bitcoin tidings! 🌅

Read More

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- TRX: The Bullish Saga of $0.30 – Will the Whales Save Us? 🐋💰

- The XRP Rollercoaster: Will $2.08 Save or Sink the Altcoin? 🚀💥

- Bitcoin’s Bold $112K Move – Is It A Breakout Or A Breakdown? Find Out! 💥💸

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- SEC’s Jenga Tower: Crenshaw Calls Out Crypto Chaos! 🎲💥

- Ride the Crypto Wave or Wipe Out – $250K Up for Grabs! 🌊💸

- Vitalik Buterin’s Modexp Meltdown: The ZK Drama You Didn’t See Coming 🚀

2025-08-09 19:28