In a most unexpected turn of events, the illustrious SBI Holdings, a titan of Japanese finance, has unveiled a new on-chain bond, a contraption so peculiar it might make a monk weep with confusion. Behold, the product grants mere mortals access to XRP, all while remaining ensnared in Japan’s labyrinthine regulations-a feat as remarkable as a goose learning to recite Pushkin.

Reports whisper that this venture, a mere 10 billion yen in size, is etched into a blockchain, that modern-day scribe of secrets, rather than the traditional securities parchment. One might say it is a marriage of the ancient and the absurd, where digital tokens waltz with paper money.

The SBI Start Bonds: A New Dawn?

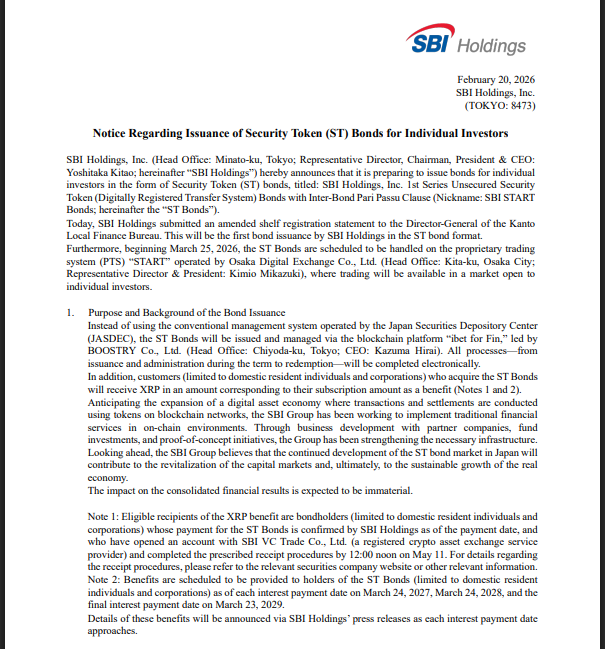

According to the hushed murmurs of the press, these bonds-nicknamed “SBI Start Bonds” by the overly enthusiastic-are tokenized upon the hallowed platform of ibet for Fin, a system so arcane it could only have been devised by a committee of sleep-deprived engineers. Investors, if they manage to navigate the bureaucratic gauntlet, shall receive XRP promptly, as if summoned by a wizard’s spell.

Moreover, the firm has promised additional XRP benefits, like a benevolent tsar bestowing gifts upon his subjects, stretching through 2029. A fixed-income payout, yes, but laced with crypto rewards-a true connoisseur’s delight.

The Trading Rituals

Trading these security tokens shall occur on the Osaka Digital Exchange, a realm where digital tokens are traded with the solemnity of a religious rite. Secondary market activity, it is said, shall commence on March 25, 2026-a date as significant as the day the Tsar abolished serfdom.

The yield, though modest, is described as “low single digits,” a fact that would make even a miser blush. Yet, it is this very blend of fixed-income and crypto whimsy that has pundits scratching their heads in bewilderment.

In a twist as surprising as a bear in a ballet, Japan’s SBI Holdings has launched a ¥10 billion ($64.5M) on-chain bond issuance that rewards investors with XRP.

– 𝗕𝗮𝗻𝗸XRP (@BankXRP) February 21, 2026

Who May Partake?

Eligibility, dear reader, is as restrictive as a nun’s diet. Only those who have resided in Japan since the dawn of time and hold an account with SBI VC Trade may partake in this grand XRP feast. A procedural deadline looms, a specter that shall haunt all who delay their steps until mid-May.

In short, this is no global giveaway, but a carefully curated affair for Japan’s domestic denizens, whose wallets are as tightly clasped as a bureaucrat’s purse.

According to the whispers of the market, this structure may nudge demand for XRP, as the issuer must procure the token for distribution. A curious notion, akin to a baker needing flour to bake bread, yet it is this very act that has some pondering.

Some market watchers, ever the optimists, suggest that this modest sum, though but a drop in the ocean of crypto, may inspire other Japanese firms to follow suit, lest they be left behind in the digital age. A prophecy as likely as a frog becoming a prince.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- XRP: The Calm Before the Storm?

- Bitcoin’s Wild Ride: Is It a Rally or Just a Bunch of Greedy Investors? 🤔💰

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Crypto Riches or Fool’s Gold? 🤑

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

2026-02-22 19:26