On the 12th of April—only a mere fortnight ago—the financial world was buzzing with speculation about a potential cut to the federal funds rate. The markets were playing their usual game of uncertainty, with a 39.8% chance that the U.S. Federal Reserve might lower the rate by a modest 25 basis points. Fast forward to a mere seven days before the next Federal Open Market Committee (FOMC) meeting, and that probability has shrunk like a sweater in the wash, now standing at a mere 7.8%. Talk about a change of heart!

The Fedwatch Tool, Kalshi, and Polymarket—A May 7 Rate Cut? Not So Fast…

In the midst of endless trade negotiations and rising unease over President Donald Trump’s tariff drama, U.S. equity markets stumbled last Wednesday, reeling from fresh economic data that suggested a shrinking GDP. Meanwhile, the Federal Reserve’s Board of Governors is set to meet on May 7, just one week from now, to decide whether to make any changes to the all-important benchmark interest rate.

Trump’s relationship with Federal Reserve Chair Jerome Powell has been nothing short of a roller coaster. At first, Trump blasted Powell for being a slowpoke and even suggested the man’s days were numbered. But as is often the case, Trump took a u-turn, stating that he had no plans to fire Powell. Speaking at a rally in Michigan, Trump boasted about his supposed mastery of monetary policy. “I have a Fed person who is not really doing a good job,” he remarked.

But don’t worry, he added:

“I want to be very nice and respectful to the Fed.”

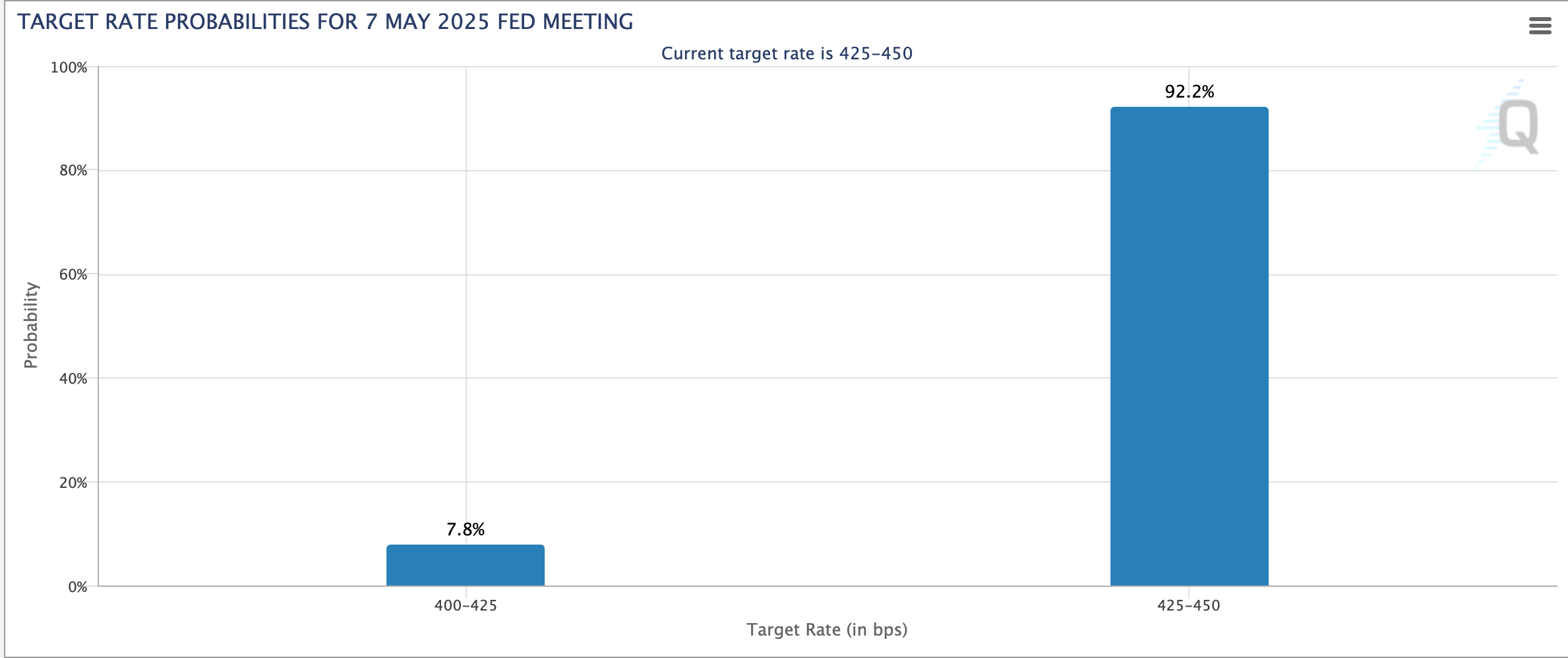

According to the projections from the CME Fedwatch tool, the likelihood of a rate cut looks slim, with markets favoring a status quo outcome. While a tiny 7.8% chance remains for a 25 basis point reduction, the dominant sentiment—at 92.2%—expects no change at all. The Fedwatch tool does its magic by interpreting fed funds futures prices, offering a real-time view of market expectations.

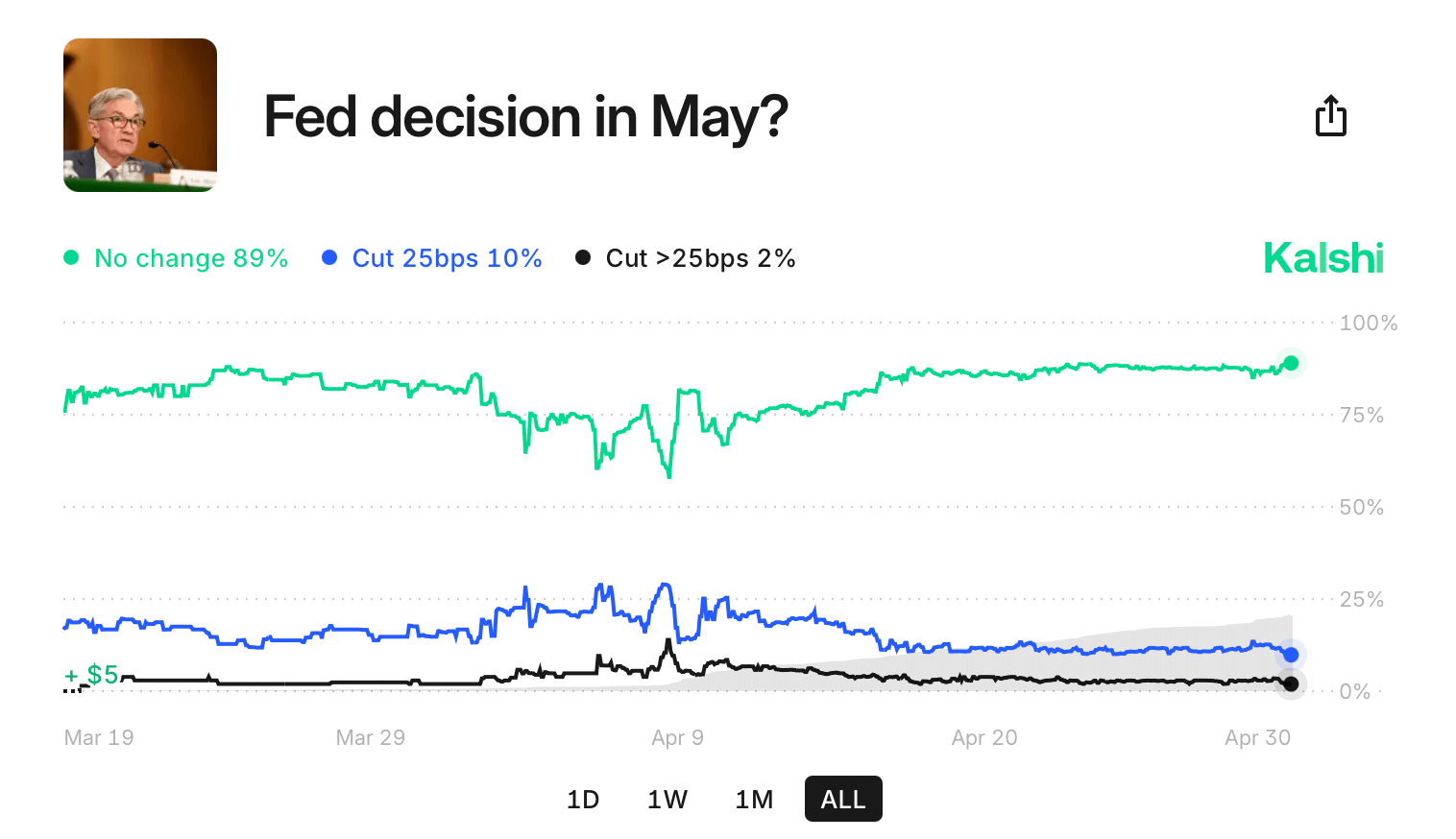

A 2025 study published on SSRN credits the Fedwatch tool with an 88% accuracy rate in predicting Federal Reserve decisions. Meanwhile, Polymarket’s prediction market, with $32 million wagered, places the odds of no rate change at 93%, and a cut at a measly 7%, as of 2:30 p.m. Eastern on April 30. Meanwhile, Kalshi, another forecasting platform, has raised the probability of a quarter-point cut ever so slightly to 10%.

As traders continue to bet on no changes, market sentiment seems to suggest that the Fed is likely to remain calm and collected at the May FOMC meeting, despite the political pressure from Trump and the economic anxiety about tariffs. The gap between sentiment and speculation shows just how firmly the market’s expectations have been set in stone.

Whether the Federal Reserve sticks to data-driven decisions or sways with the wind of broader political narratives could soon be a pivotal moment for its credibility. But with a week left until the meeting, there’s still plenty of time for the FOMC members to flip-flop twice. Who needs stability, right?

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Brent Oil Forecast

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- XRP: The Calm Before the Storm?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- Will XRP ETF Approval Change Everything? Traders Can’t Wait! 😲

- Ethereum’s ETH: The New Global GDP? 🌍💰

2025-04-30 23:02