Last week, with all the pomp and digital circumstance, bitcoin soared to a new peak—an all-time high. It was the kind of rally that makes you feel like you’ve accidentally walked onto a rollercoaster designed by intoxicated physicists. Online, the euphoria was palpable, a swirling miasma of emojis and exuberant exclamations, yet beneath that glittering veneer, some sober eyes pointed to metrics that whisper—perhaps—or maybe just mock—there’s more to this than mere hype.

This little editorial—an epistle from last week’s Week in Review (subscribe now, or FOMO’s going to eat you)—offers a chilly look into the madcap cosmos of crypto euphoria. Take a sip, my friend, and ponder the paradox.

Pizza and Parabolas: A Love Story with Leverage

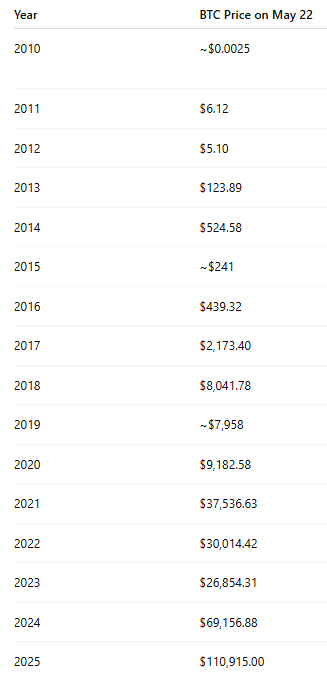

On the fateful Thursday, maggio 22, 2025, bitcoin not only brunched but *massed*—punching through a staggering $111,000 per shimmering, digitized coin. Yes, you read that right—more digits than your average number of zeros in a banker’s nightmare. The date, dear reader, marked Bitcoin Pizza Day—an ironic homage to Laszlo Hanyecz, who in the ancient era of 2010 spent 10,000 bitcoin on pizza. A cautionary tale wrapped in cheesy optimism—and perhaps a veiled sarcasm about our current valuation bubble.

From a minuscule fraction of a cent to this digital Everest, bitcoin’s ascent is an odyssey that rivals Icarus’ flight—only with fewer feathers and more blockchain. Check out the chart below for a visual cocktail of upward and downward possibilities, like the dance of a caffeinated squirrel:

The X timeline, that digital firework display of excitement, blazed with hopes of new highs faster than you can say “HODL.” Yet, amid the fireworks, a sage reminder: when “everyone you know” starts pumping their fists and declarations of imminent riches, a schist of skepticism is wise. What makes your bullish heart flutter? Could it all be just smoke signals?

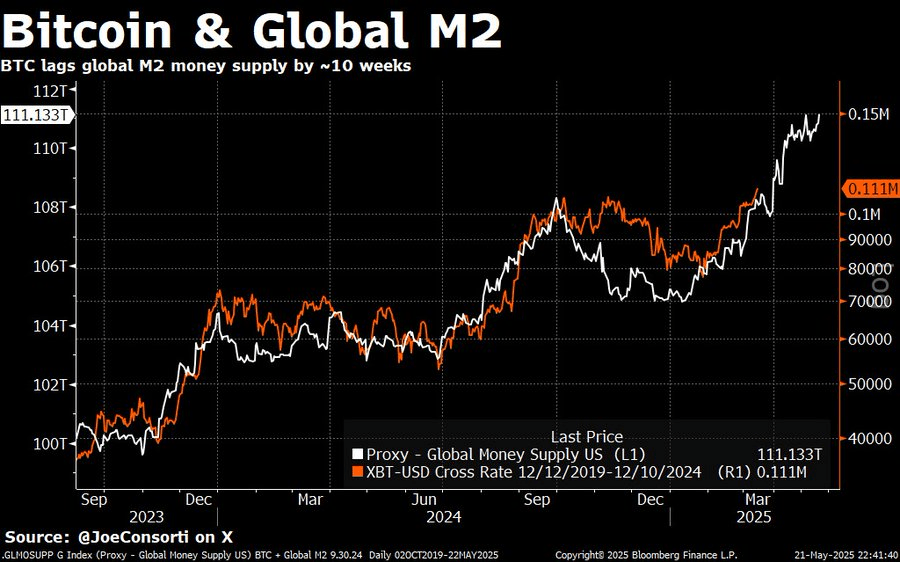

Enter macroeconomic indicators—think of them as your sober aunts at the crypto family reunion. Global liquidity, for example, is an overachiever: rising liquidity often pulls bitcoin along on its merry, volatile journey. Currently, we stand in this rising phase—sipping champagne and praying it lasts.

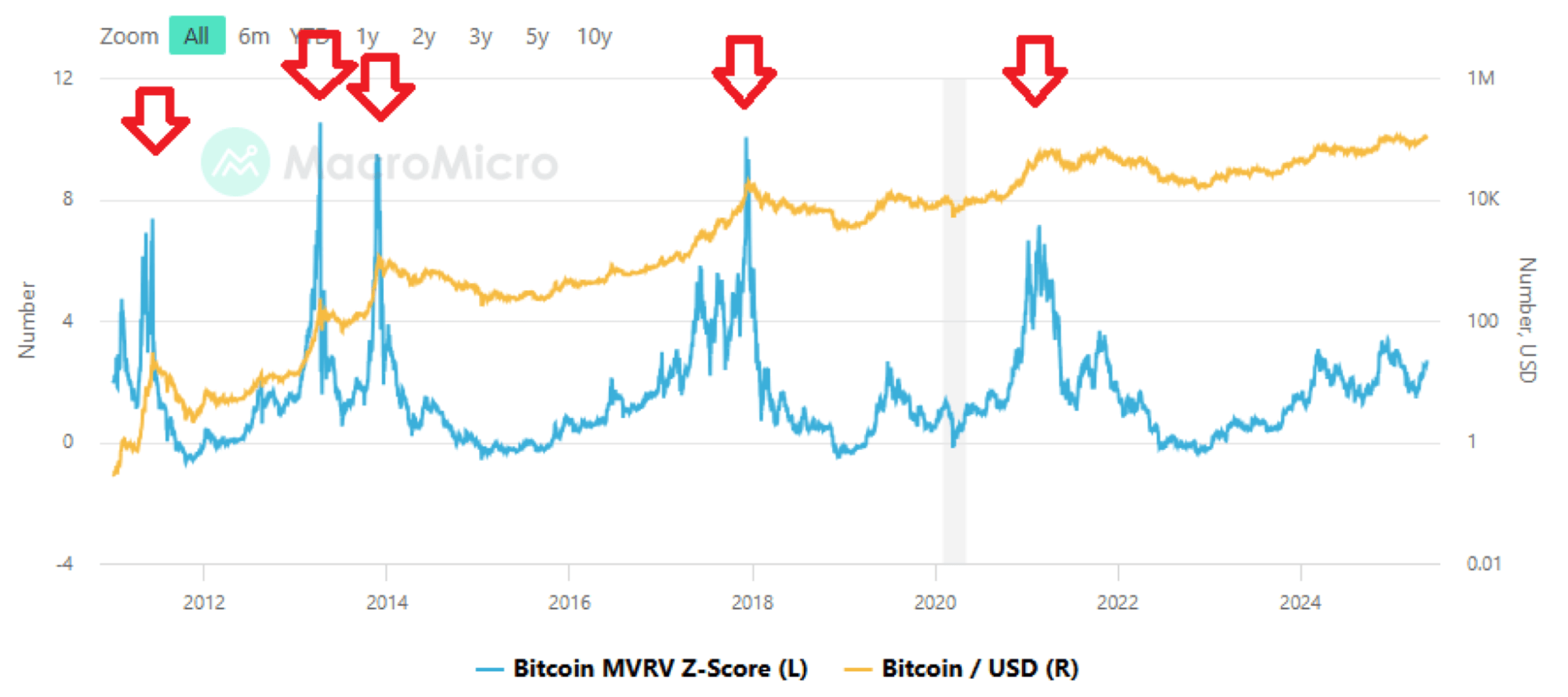

The MVRV Z-Score is like that judicious friend who always knows when to wave a finger—telling us when bitcoin’s valuation has gone bonkers or remains modest. Currently, the signal is, shall we say, not quite in meltdown territory.

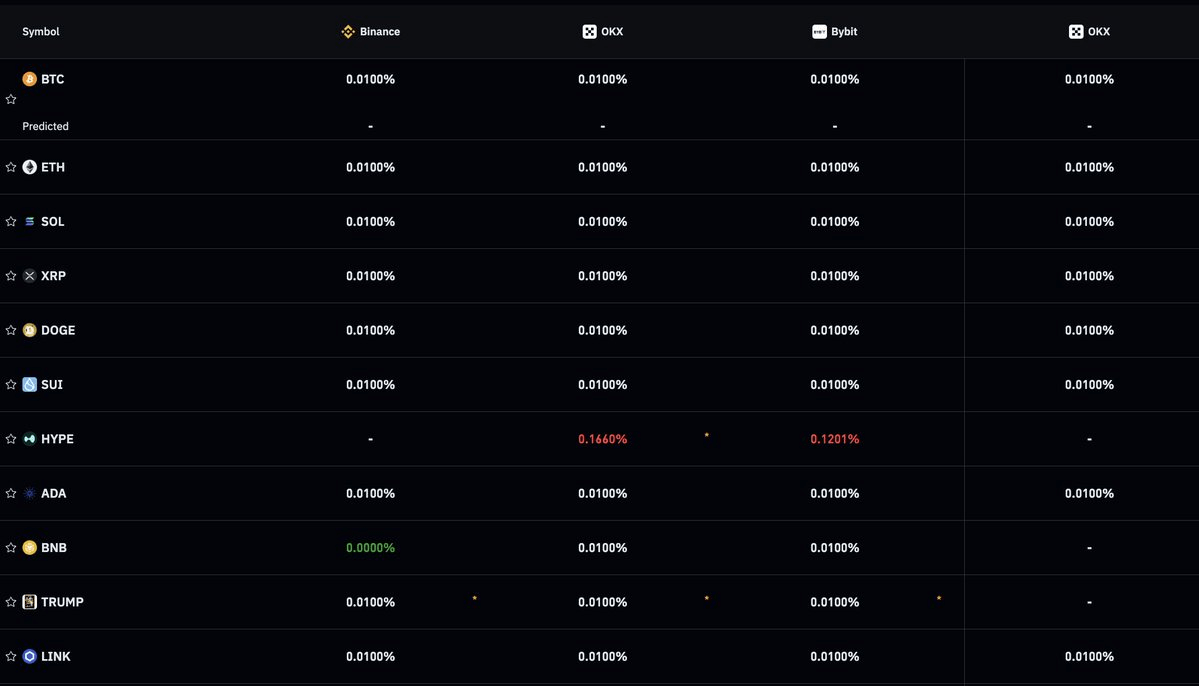

Funding rates—conceptually, the price of borrowing money to buy more bitcoin—are currently as tame as a housecat in a hammock (a mere 0.0100%). No wild speculative binges, no frantic leaping on the bandwagon. For now, the ride’s smooth and almost suspiciously serene.

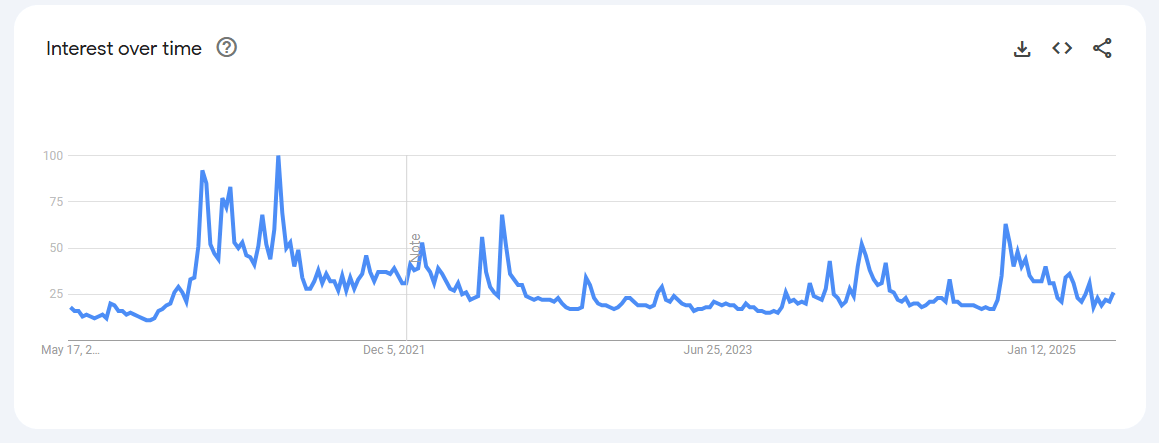

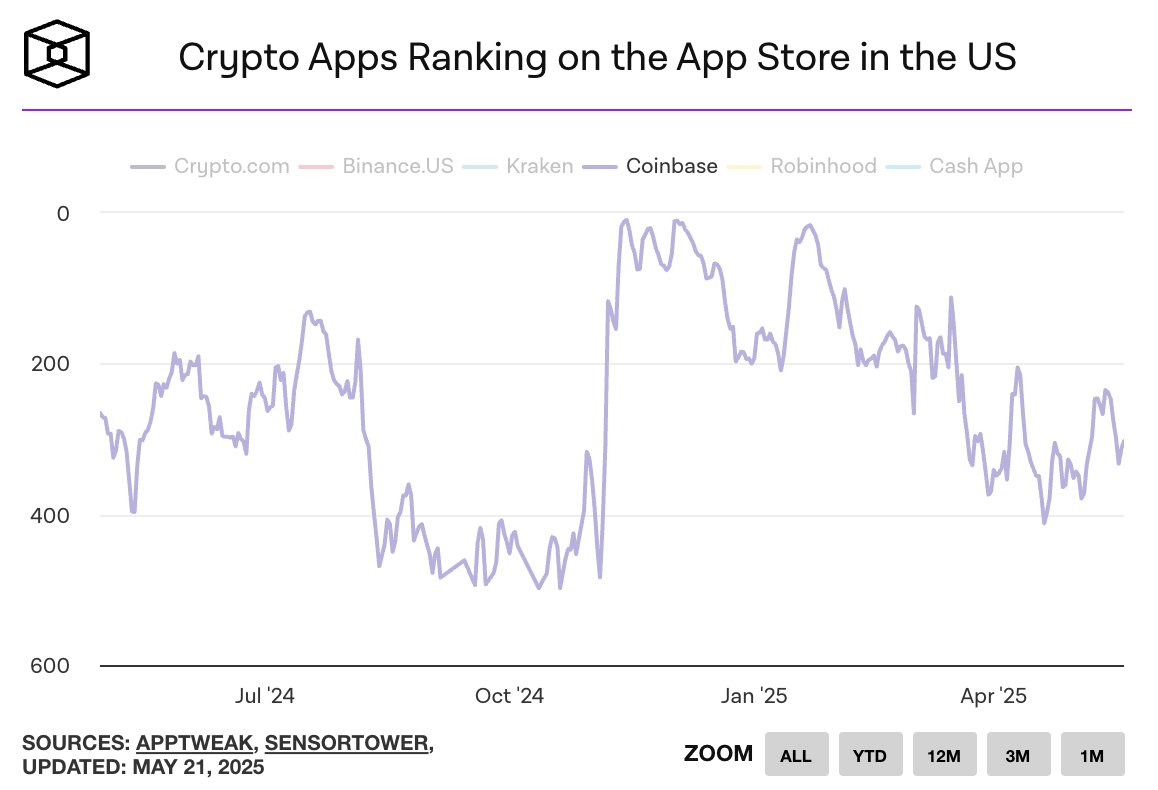

And what about the mood of the masses? As the last bubble bloomed, Google searches for “bitcoin” spiked to heights as lofty as Elon Musk’s Twitter ambitions. Today, the search volume? More like a gentle, well-behaved kitten—calm, collected, and a tad boring. App store rankings reflect the same: interest has politely retreated, perhaps to nap in the sun and dream of future riches.

All this jazz points to one truth, wrapped in irony and smirking like a Cheshire cat: we are more likely in the throes of a curious phase of price discovery—an elaborate dance perhaps—rather than the wilting of a bubble. Remember, tools and metrics are but mischievous minstrels, guiding us with hints and whispers; their prognostications are as reliable as a fortune cookie at best. So ask yourself—does this look like a bubble to you, or just another chapter in the soap opera of crypto? 🤔

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Fantasy.top’s Desperate Dash to Base: A Crypto Comedy 🎭

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- New ETF: Bitcoin and Gold Tango to Save Your Wallet from Currency Woes!

- USD TRY PREDICTION

- Buffett’s $334B Stash: Still Hatin’ Bitcoin?!

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

2025-06-02 00:57