In a dramatic flourish befitting a grand theatrical production, Arthur Hayes, the illustrious co-founder of BitMEX, has gracefully bid adieu to over $13 million in digital trinkets this week. His justification? A growing malaise of macroeconomic uncertainty, of course! While the great Bitcoin and Ethereum tumble in somber unison, one cannot help but wonder if a deeper correction is lurking just beyond the wallpaper of this grand ballroom. 🍷🕺

“So $BTC flirts with $100K, while $ETH takes a leisurely dip toward $3K,” Hayes quipped in a most intriguing post on X—not that any Ceres would heed! With tariffs looming thusly and America’s job report resembling a stage play gone wrong, he laments, “No major economy is conjuring enough credit to invigorate nominal GDP.” The tragedy unfolds! 🎭📉

A Gluttonous Breakdown of Hayes’ Multi-Million-Dollar Extravaganza

Our eminent detective, Arkham Intelligence, chronicled Hayes’ extravagant offloading, cataloging the transfer of sizeable volumes of ETH, PEPE, and ENA to various centralized exchanges—those splendid institutions of liquidity, such as Binance and Cumberland DRW, where fortunes are made and lost regularly!

-

ETH: Our dear Hayes unwrapped an impressive 2,373 ETH, a tidy sum of approximately $8.32 million. How delightful! 💰

-

ENA: He let go his entire stash of 7.76 million ENA, worth conversely at about $4.62 million. A true philanthropist, isn’t he?

-

PEPE: The pièce de résistance—a staggering transfer of 38.86 billion PEPE tokens, or a mere $415,000. Truly a benevolent act for the meme enthusiasts! 🐸

These sales signify an audacious shift in portfolio strategy—one that showcases the aristocracy of stablecoins, which now encompass over 80% of his wallet balance, a princely total of $27.9 million! 🎩💼

The Tariff Tango and Jobs Data: Our Dramatic Catalysts

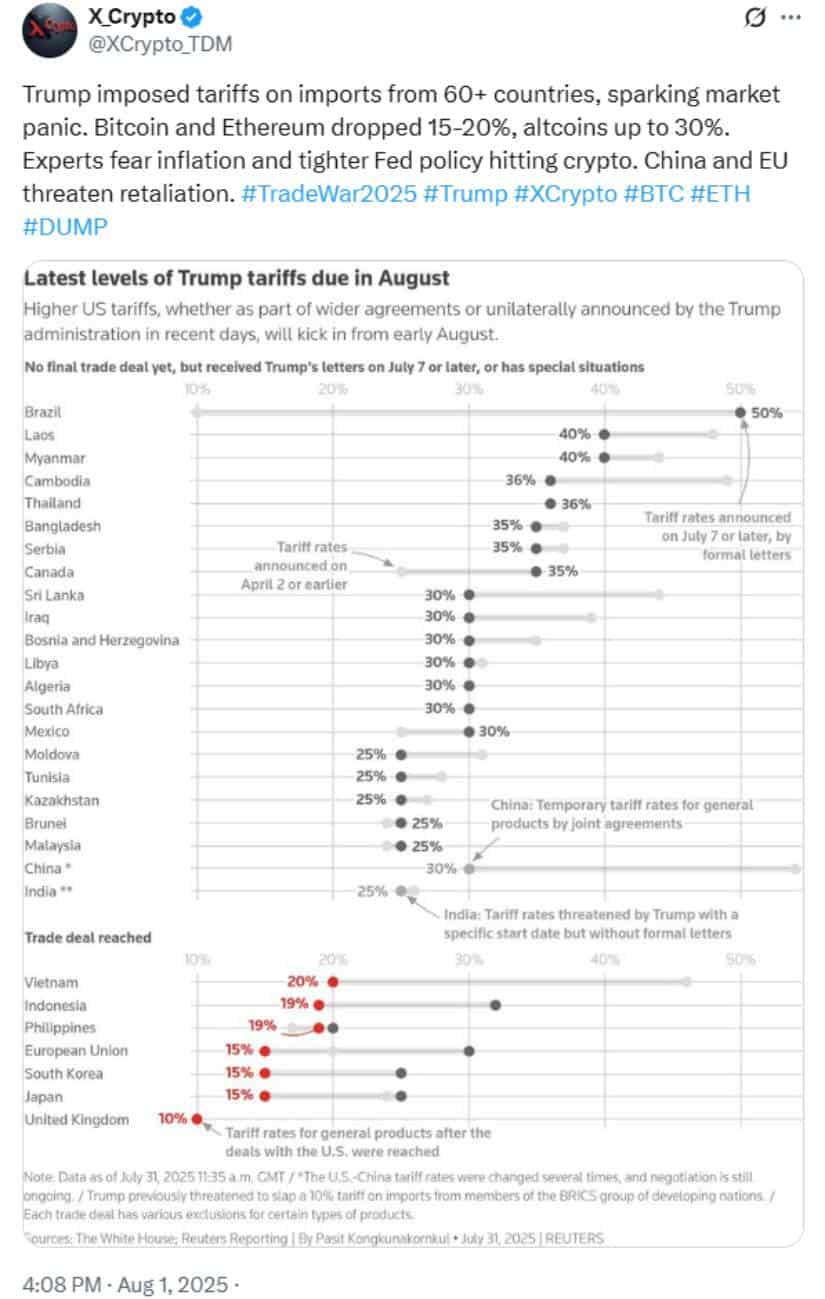

Hayes attributes his adroit maneuvering to two principal characters in this melodrama: the newly minted U.S. tariffs and an utterly disappointing jobs report, akin to a tragedy where no one survives. With tariffs impacting major economies as of August 1, and additional duties set to spring forth by August 7, the stage is set!

In Hayes’ theatrical view, this toxic mélange of tighter trade policy alongside stagnant economic growth could send risk assets tumbling down the proverbial rabbit hole. “Markets sense the tariff bill is a looming specter come Q3,” he forecasts, praying for a Bitcoin resurrection toward $100,000 and an Ethereum descent to a mere $3,000.

Whale Frolics Amidst Rising Trepidation

But fear not, dear readers, for Hayes is not alone upon this tempestuous sea! A bevy of whales frolic about wildly:

-

Wallet 0x3c9E, that generous overseer, deposited a sumptuous 26,182 ETH (~$93.7 million) to various fiefdoms including Binance, OKX, and Kraken in recent hours! 🐳

-

Coinbase and Binance, those trusty titans, routed thousands of ETH to Wintermute, cunningly utilizing its OTC services to mitigate market raucous during these large-scale festivities.

This bustling activity reflects a growing caution amongst the institutional elite, casting a shadow over the market like a heavy velvet curtain just before the grand finale! 🎭

The Daring Divergence: SharpLink Seizes Opportunity

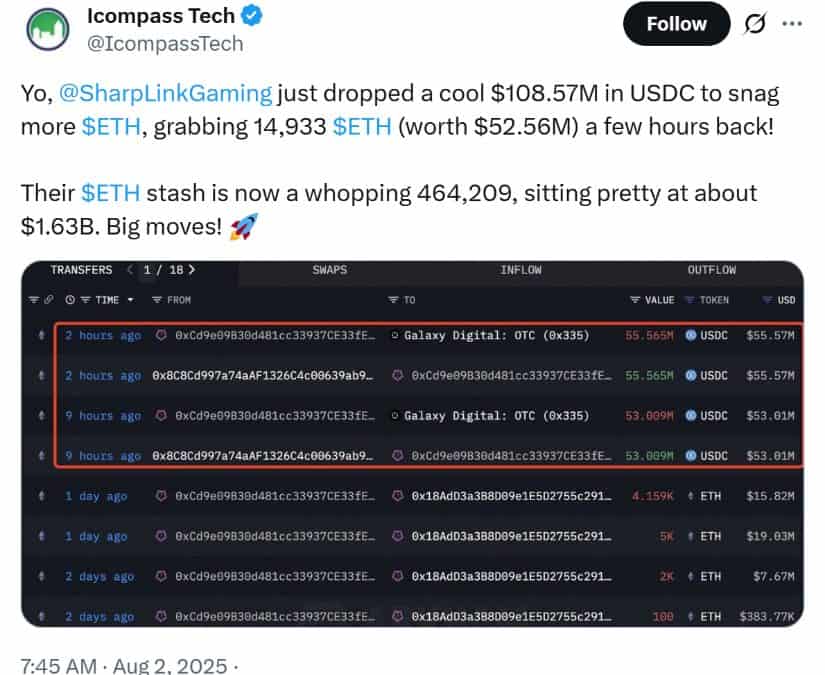

In stark contrast to Hayes’ audacious retreat, the indomitable SharpLink Gaming—the proud second-largest Ethereum treasury behind Bitmine—seized the dip as an opportunity fit for a keen investor’s eye. They procured an additional 14,933 ETH (~$52.5 million), shrewdly deploying USDC theatrically, thus boosting their total holdings to a staggering 464,209 ETH, valued at $1.63 billion. 💸

Analysts, those wise sages, note this divergence among the aquatic giants hints at polarized sentiment within the crypto realm. While some retreat, others boldly accumulate, locked in an eternal waltz of macroeconomic jibes.

Market Melodrama and Future Musings

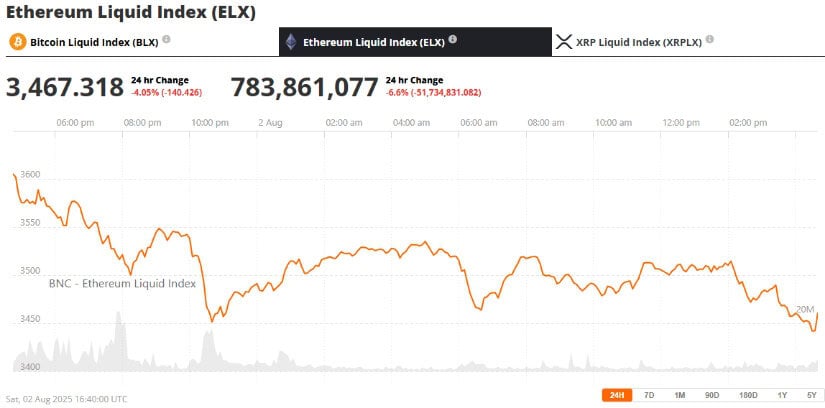

The broader crypto stage has witnessed a dramatic shedding—over 7.5% in value over the past week. Bitcoin stands quaking at $113,500, while Ethereum hovers—a delicate ballet—near $3,500. 🎭🎉

Despite a glimmer of relief sweeping through late Friday as Polymarket traders fancifully elevated the probability of a September rate cut to 70%, the dramatic volatility shall undoubtedly linger, with geopolitical tensions rearing their cultivated heads, like a bad actor in an otherwise fine production.

“This isn’t a meltdown—it’s merely a recalibration!” declared one daring analyst. “While Hayes hedges his extravagance, the overarching narrative of a long-term recovery might yet take center stage!” 🎭

In Summation, Dear Audience

Arthur Hayes’ theatrical crypto sell-off amidst macroeconomic pressures has become a veritable focal point in our ongoing market saga. Will this signal a deeper downturn? Or shall it merely be a passing act, a fleeting intermission before the grand finale? One thing is for certain—whale behavior continues to steal the show, leaving retail investors peering into the wings with bated breath.

As August cascades forth, the crypto market lies at a fateful crossroads: Will the cautious institutional actors provoke a deeper sell-off, or shall the bold buy-the-dip players, such as our beloved SharpLink, script a different end to this tale? 🎭✨

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- Crypto Clash: Bitcoin, Ethereum, or Solana – Who’s the September Superstar? 🌟

- Crypto Chaos: Will the White House’s New Report Save the Day? 🤔💰

- Ethereum’s Fee Fiasco: When Blockchains Play Hard to Get! 🤡

- Doge Doomed?! 😱🐳

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Silver Rate Forecast

- USD GEL PREDICTION

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

2025-08-03 02:21