In the dusty corridors of the daily charts, a W-pattern has emerged, catching the weary eyes of analysts who—like old farmers scanning the horizon for rain—hope for a harvest of financial gain. The momentum metrics, favorable in their nature, have beckoned not just the astute buyers, but also the ever-hopeful souls chasing the next big profit. 🌱

With volume dancing like a lively jig and structural support levels standing firm, SEI has decided it’s a fine time to position itself for an ascendance, perhaps a great leap towards that tantalizing figure of $0.50. The market’s sentiment, like a wild beast, appears supportive, as SEI trades with the kind of confidence usually reserved for a cat walking atop a fence, just above the key moving averages.

The Golden Cross: A Blessing or Just Glitter? ✨

Our friend SEI/USDT has displayed a sight that resembles the arrival of a golden nugget in a stream—a Golden Cross, where the 50-day average coolly cross-dresses over the 200-day average, signaling a bullish wave and a possible long-term shift in the winds favoring buyers. Shared by the ever-watchful @goldencrossertw, this formation speaks of things to come, or at least we hope it does! 🙏

As we gaze upon the numbers, the 50-day MA rests comfortably at $0.2515 while its older counterpart lounges at $0.2475. The crossover is a trumpet call of renewed interest, and lo and behold, SEI is trading in the neighborhood of $0.3538, reveling in the warmth of both averages, a pretty sight indeed!

The daily chart also flaunts a well-formed W-pattern, like a fancy dress at a modest gathering, suggesting a potential bullish reversal. Defined by its two low points ensconced around $0.28, and that neck-breaking resistance near $0.35, SEI has taken a leap over the latter as if it were a fence on a moonlit night.

The volume on this breakout has been as hearty as a Thanksgiving feast, with over 184 million turning hands. The targets? Oh, a splendid $0.45—perhaps even $0.50 should the momentum keep its boots polished. The Relative Strength Index (RSI), chiming in at 66.71, still leaves ample room for frolicking before it finds itself in the overbought pasture.

A Fortified Defense: All’s Well on $0.345 🛡️

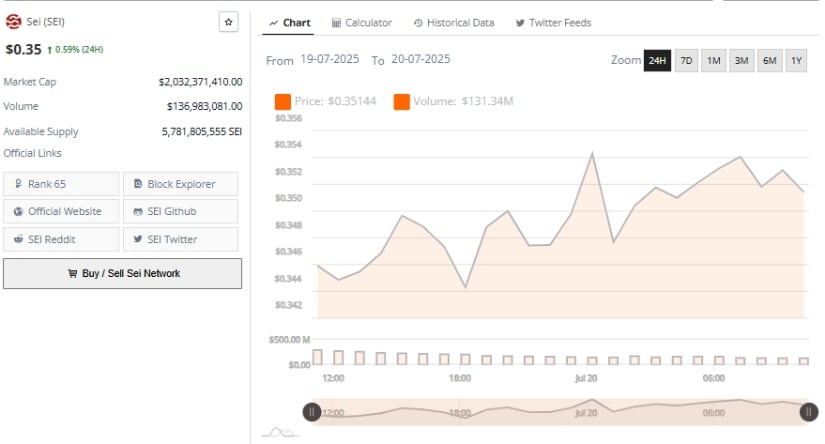

The 24-hour chart chronicles SEI’s careful navigation above the pivotal support at $0.345, steadfast like a dad at a barbecue. It peeked into higher altitudes of $0.356 before settling down around $0.35, garnering a modest gain of 0.59% on the day. The buyers, vigilant as hawks, have successfully defended the $0.345–$0.348 range—swinging that price like a baseball bat on a summer’s eve, seemingly without weariness.

Each test of that price zone has been followed by a rush of bullish momentum, hinting strongly at gathering forces among short-term denizens of the market.

Like a well-structured staircase, the price action reveals higher highs and higher lows, leading us skyward. Trading volume, a robust $136.98 million, has secured SEI’s position above $2.03 billion in market capitalization, marking its rank at a proud 65 among crypto aficionados. The circulating supply—over a staggering 5.78 billion tokens—supports this steady ascendancy, a cha-cha of controlled accumulation. So long as the $0.345 fortress holds, SEI appears positioned to challenge the looming resistance of $0.370, perhaps bursting forth toward the coveted $0.40. 🥳

As We Scribble: The MACD Tells All and the CMF? Well, It Might Just Be Shy! 📈

As the ink dries on this tale, SEI stands at $0.3533, a champion rising from its sub-$0.30 lows, once marking a remarkable high at $0.3903. It consolidates just below that lofty peak, while the trend hangs on, much like that last piece of pie at a family gathering—delightfully tempting.

Should it revisit and close above that local high, we might just catch a ride toward that $0.50 destination promised by the W-pattern with spirits flying high.

The Moving Average Convergence Divergence (MACD), in its clever whispers, reveals a bullish alignment, with the MACD line at 0.0297 and the signal line just a hair under at 0.0271. The histogram begins to flatten, like an old accordion, yet it gives a positive reading of 0.0027, issuing a silent promise of continued upward momentum.

And then we have the Chaikin Money Flow (CMF) who seems just a tad negative at -0.04, possibly hinting at a temporary divergence between price action and capital inflows. A recovery back above zero would be a hearty handshake, reinforcing the plea for a continued accumulation, building the case for a bullish tale yet to unfold. 🤞

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- The Shocking Tale of Werewolf Hackers Stealing Crypto in Russia

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

2025-07-20 22:25